- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global automotive aftermarket size accounted for revenue of USD 378.4 billion in the year 2019 and is projected to grow with a 4.0% CAGR over the forecast period, from 2020 to 2027. The increasing focus of consumers to improve their vehicle performance in terms of speed, exhaust sound, and other aspects is majorly driving the automotive aftermarket growth.

In U.S. and Japan, the motor vehicle regulatory authorities have built up to standards due to growing environmental concerns of harmful gas emission by vehicles. Digitalization of automotive repair components sales & services coupled with the emergence of online portals that are distributing automotive parts across the globe is expected to influence the market players to invest in this industry. Due to the afore-mentioned trade gateways, the market is projected to have significant growth through e-commerce portals during the forecast period.

The automotive aftermarket value chain includes two major segments including service enablers and suppliers. These segments exchange value at various intermittent stages through the automotive sector. Thus, access to a large number of automotive components through e-commerce portals is anticipated to reduce the availability issues, this is expected to drive the market growth during the projected period. Growing digitalization and increasing application of IoT are expected to drive the growth of the automotive industry as well as the aftermarket. For instance, IoT technology is used for real-time monitoring and data sharing, cognitive insights allow the manufacturers to inform drivers of any problem, as well as external sensors are used to detect blind spots and assist for parking. In addition, sensors in operational components monitor temperature, speed, navigation, and electrical systems.

Technological advancement has opened new avenues for market growth. However, high investment for R&D is expected to hamper the market growth during the forecast period to some extent. Automobile industry players are facing several challenges such as high production costs of automobile components.

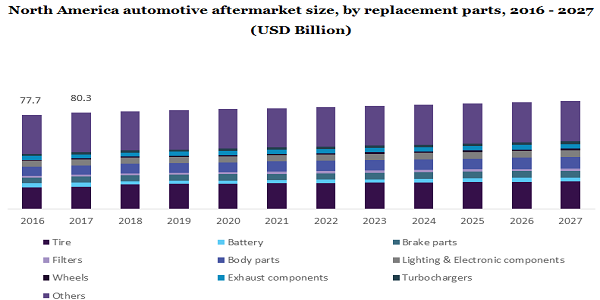

Based on replacement parts, the market is fragmented into tires, wheels, batteries, filters, lighting & electronic components, body parts, exhaust components, and brake parts. The tire segment is projected to hold the largest market share and is expected to retain its position throughout the forecast period. This is due to the low replacement of tires than other counterparts. Moreover, the automotive replacement part supplier comprises several accessories, tires, lubricants, and other components. The automobile industry is witnessing growth due to the growing demand for hybrid vehicles; electronic vehicles, as prices for petrol as well as petrol engine-based vehicles are increasing.

Growing purchasing power in developing nations is expected to witness a positive impact on market growth. In addition, the growth of the automotive industry is expected to trigger the sales of automotive components sales during the forecast period. Moreover, strict regulatory norms and standards for vehicle safety worldwide are projected to fuel market growth. In recent years, market players are adopting new technologies like 3D printing of automotive parts that help to reduce harmful gas emissions as well as enable efficient fabrication.

In the automotive aftermarket, the distribution channel is segmented into wholesalers & distributors, and retailers. The retailer segment is projected to dominate the market in terms of revenue. On the other hand, the wholesale & distribution segment is expected to emerge as the fastest-growing over the forecast period, from 2020 to 2027. Aftermarket plays an important role in the automotive industry in terms of maintenance and manufacturing, as automobile components have to be changed on time to improve vehicle performance.

The advent of technology is shifting towards digitalization, leading to the sale of automotive parts components, and services through online channels. Every player included in the value chain such as Original Equipment Suppliers (OES), wholesalers, workshops, Original Equipment Manufacturers (OEMs) is striving to grow online sales of automotive parts. Technological advancement in automotive fabrication, growth in automobile manufacturing, the emergence of digitalization in automotive repair & maintenance services are some key factors surging the market growth.

Based on the service channel, the market is segmented into DIFM (Do it for Me), DIY (Do it Yourself), and OE (Delegating to OEMs). The OE segment is projected to hold the largest market share by 2027 in terms of revenue, wherein the DIY segment is estimated to be the fastest-growing segment during the forecast period. Moreover, DIY customers are tech-savvy and interested to upgrade, repair, and maintain their vehicles on their own while DIFM customers purchase parts through online channels but install them by professionals.

In the aftermarket, the service channel involves tier 1 distributors, raw material suppliers, aftermarket units, and exhaust hubs/manufacturing units, comprising repair shops and jobbers. The industry is observing strategic collaborations and strategic alliances between insurance companies and collision repair centers to sustain in the competitive market and gain maximum share.

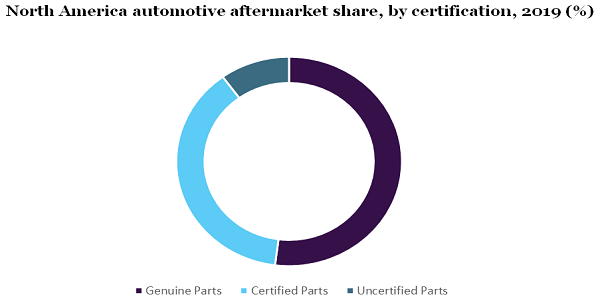

Based on certification, the market is classified into certified, genuine, and uncertified. The genuine segment is projected to hold the largest market share during the forecast period. Genuine parts are produced by OEMs and car manufacturers. Genuine automotive replacement parts have better quality and warranty assurance and are easy to find. However, these are very expensive and they are only available from OEM workshops and authorized dealers.

The Certified Automotive Parts Association (CAPA) was founded in 1987 that ensures the quality of automotive replacement parts sales by collision repair retailers. Certified automotive parts are inspected and tested by certified organizations. CAPA organized test programs to guarantee and verify the sustainability of automotive replacement components. Certified automotive parts are a cost-effective solution for expensive genuine parts, however, uncertified parts are used as a substitute for original automotive parts. In addition, uncertified parts are not approved by car manufacturers. However, the low cost of uncertified parts is projected to create new opportunities for segment growth.

In 2019, Asia Pacific held the largest market share and was estimated to witness substantial growth over the forecast period. Factors such as increasing usage of new technologies for manufacturing auto parts and digitalization of automotive components distribution are projected to surge the regional market growth over the forecast period. R&D institutes and universities are striving to increase the operational efficiencies of critical automotive parts. The new design invented by researchers at Imperial College, London, from the department of chemical engineering uses 80% less metal, reduces the manufacturing and vehicle cost which is expected to witness better results than existing automobiles.

Strict government regulations for vehicle emission across the globe are enforcing the suppliers to produce highly efficient and eco-friendly automotive components. In the past few years, developing nations such as India, Brazil, and China have witnessed significant growth in the automotive industry, this is anticipated to boost the aftermarket growth over the forecast period.

Due to the outbreak of COVID-19, the automotive industry, as well as the automotive aftermarket, is in a crises situation. Most of the manufacturers import automotive parts from China. When the outbreak of coronavirus was reported in China in December 2019, most automotive companies have shut down their manufacturing facilities which have affected the supply chain of automotive parts in those countries which are relying on China for their automotive components.

However, various automotive manufacturers have taken initiatives to ensure the availability of important automobile components, ensure real-time monitoring and response management of liability coverage, insurance, and transit inventory. In addition, automotive replacement part suppliers need to actively engage with their customers to assure supply, complete ongoing deals, reduce marketing budget through digital media. Automotive replacement parts suppliers need to work on their channel expansion and service offerings to sustain the adverse impact of COVID-19.

Growing investment in research and development activities and technological advancement are projected to drive aftermarket growth. The market is highly competitive due to the presence of domestic and international players across the globe. Therefore, companies are striving to introduce innovative products and help buyers to gain knowledge about security needs, business practices, and changing technologies.

The major players include in this market are as follows:

• Delphi Automotive PLC

• Federal-Mogul Corporation

• Denso Corporation

• Continental AG

• 3M Company

• Magneti Marelli S.p.A.

• Robert Bosch GmbH

|

Attribute |

Details |

|

The market Size value in 2020 |

USD 390.1 billion |

|

The revenue forecast in 2027 |

USD 513.8 billion |

|

Growth Rate |

CAGR of 4.0% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD billion & CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Replacement part, distribution channel, service channel, certification, region |

|

Regional scope |

North America; South America; Asia Pacific; Europe; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Japan; China; India; Brazil |

|

Key companies profiled |

Continental AG; 3M Company; Delphi Automotive PLC; Federal-Mogul Corporation; Denso Corporation; Magneti Marelli S.p.A.; Robert Bosch GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Million Insights has segmented the global automotive aftermarket report based on the replacement part, distribution channel, service channel, certification, and region:

• Replacement Part Outlook (Revenue, USD Billion, 2016 - 2027)

• Tire

• Battery

• Brake Parts

• Filters

• Body parts

• Lighting & Electronic Components

• Wheels

• Exhaust components

• Turbochargers

• Others

• Distribution Channel Outlook (Revenue, USD Billion, 2016 - 2027)

• Retailers

• OEMs

• Repair Shops

• Wholesalers & Distributors

• Service Channel Outlook (Revenue, USD Billion, 2019 - 2027)

• DIY (Do it Yourself)

• DIFM (Do it for Me)

• OE (Delegating to OEM’s)

• Certification Outlook (Revenue, USD Billion, 2016 - 2027)

• Genuine Parts

• Certified Parts

• Uncertified Parts

• Regional Outlook (Revenue, USD Billion, 2016 - 2027)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• The Asia Pacific

• China

• India

• Japan

• South America

• Brazil

• Middle East & Africa

Research Support Specialist, USA