- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global non-alcoholic drinks market size was accounted for USD 1.1 trillion, in 2018. It is projected to grow at a CAGR of 5.3% over the forecasted period, from 2019 to 2025. The growing consumer interest for nutrient-enriched food along with changing healthy lifestyle trends is a key factor propelling the market growth. Moreover, the adverse impacts of alcoholic drinks are influencing people to look at soft drinks and other functional drinks as an alternative.

The growing population of working individuals, athletes, and fitness enthusiasts is projected to increase the demand for nutritional drinks. This factor is anticipated to boost the demand for juices, and energy drinks in the coming few years. Additionally, the customers are shifting towards organic and natural products are also expected to support the market growth.

The increasing health consciousness among consumers is boosting the growth of drinks with added natural elements. Thus, the manufacturers are developing products with low calories and sugar content to attract more consumers. Furthermore, antioxidant beverages, probiotic drinks, and sports drinks are also gaining in popularity. The manufacturers promote the new products by collaborating with celebrities and athletes to create awareness about the product in the market.

Government authorities are also taking initiatives to promote healthy drinks over alcoholic drinks. In the recent past, it can be observed, consumers are shifting towards fruit-based beverages. These fruit drinks include fresh fruit juices with flavors, paleo diet, food diet which is expected to spur the product demand.

According to the World Health Organization (WHO), over 1.9 billion people in the world suffered from obesity, in 2016. This includes around 340 million people between the age group 5 to 18 years. Due to these health problems, functional drinks or non-alcoholic beverages are projected to gain momentum in the next few years.

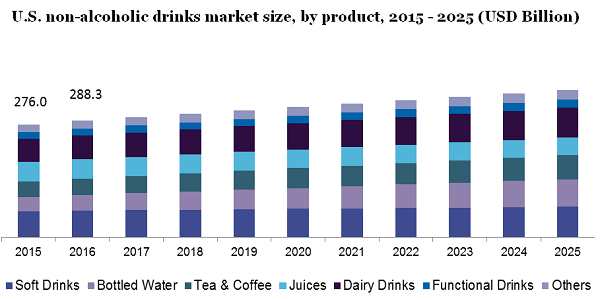

Depending on the product type the non-alcoholic drinks market is fragmented into soft drinks, tea & coffee, juices, dairy drinks, functional drinks, bottled water, and others. The soft drinks segment constituted the largest market share of around 24.3%, in 2018. Major players are introducing the product with less calorie and sugar content products for health benefits. For example, in 2018, Coca-Cola has launched a juice called Simply Light with less sugar.

The functional drinks category is anticipated to grow at the highest CAGR of 6.0% during the forecasted period, 2019 to 2025. The growing popularity of nutritional drinks with added natural ingredients is expected to propel the product demand. The shifting consumer preference especially in emerging countries such as India and China is projected to boost demand for dairy and fruit juice drinks. The increasing application of fruit juices in the bakery and confectionary sector is also supporting the market growth.

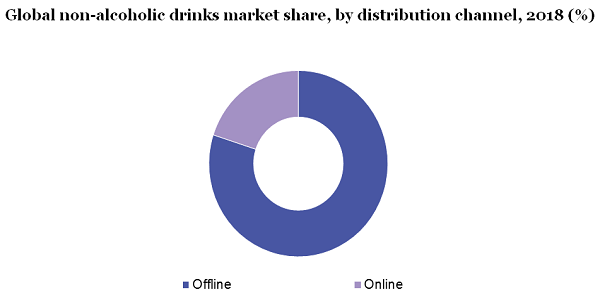

The distribution channels are bifurcated into offline and online. The offline channel segment attributed to a market share of more than 80.0%, in 2018. The offline channel comprises convenience stores, retail outlets, supermarkets, and other specialty stores. Major players in the segment include Amazon, 7-Eleven, and Walmart.

Moreover, the 7-Eleven has partnered with Future Group to open new stores in the Indian market in the year 2019. According to reports, Amazon is also planning to launch grocery stores in the American market. These strategies are expected to propel the growth of offline channels.

The online channel is projected to grow at the highest CAGR of around 5.6% during the forecasted period. The growing trend of digital media is allowing manufacturers to adopt promotional strategies to gain traction among consumers. Additionally, online retailers offer a wide range of discounts, coupon codes to increase their sales.

In 2018, North America held the largest non-alcoholic drink market share of over 34.0% in the overall market. The key players in the markets are focusing on product innovation and acquisitions to meet up with rising customer demand. For example, the Coca-Cola Company has launched cocktails of sparkling drinks with brands like Sangria, Ginger Mule, in 2019.

Asia Pacific region is anticipated to grow at the highest CAGR of 6.0% over the forecasted period. The increasing awareness about the product and health advantages over its consumption is mainly propelling the market growth. The companies are continuously looking for new product launches to increase their consumer base. For instance, in 2019, Gujarat cooperative milk federation has introduced fruit juices with different flavors.

Moreover, stiff government regulations and policies regarding alcoholic beverages are expected to boost the demand for non-alcoholic drinks. According to studies, it is found that over 310,000 deaths in 2017 were due to excessive alcohol consumption. All these harmful effects are expected to positively impact the growth of the market.

The market is heavily fragmented due to the spread of leading players including PepsiCo, Inc.; Nestle S.A.; The Coca-Cola Company; Danone S.A.; Starbucks Corporation; Parle Agro and Unilever.

Top players in the market are focusing on strategies such as product innovations, mergers, and acquisitions to expand their product portfolio and to gain traction among consumers. For instance, in 2018, United Breweries has introduced a new brand called Kingfisher Radler to increase their sales.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America & Middle East & Africa |

|

Country scope |

U.S., U.K., Germany, France, China, India, and Brazil. |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the global non-alcoholic drink market report based on product, distribution channel, and region:

• Product Outlook (Revenue, USD Billion, 2015 - 2025)

• Soft Drinks

• Bottled Water

• Tea & Coffee

• Juices

• Dairy Drinks

• Functional Drinks

• Others

• Distribution Channel Outlook (Revenue, USD Billion, 2015 - 2025)

• Offline

• Online

• Regional Outlook (Revenue, USD Billion, 2015 -2025)

• North America

• U.S.

• Europe

• U.K.

• Germany

• France

• The Asia Pacific

• China

• India

• Central & South America

• Brazil

• Middle East & Africa (MEA)

Research Support Specialist, USA