The global liqueurs and other spirits market size was valued at USD 258.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2028. This can be credited to the rising popularity of korn drinks in Europe. Surging consumer interest in San Cosme Mezcal Blanco based Tequila flavor is propelling market growth. Moreover, the growing demand for Aperol spritz across the globe is further expected to boost market growth.

High demand for Cocktails RTD and Alcopops products are supporting the market growth. Moreover, soaring demand for ouzo drinks in the U.K is stimulating the market growth during the forecast period. However, the availability of ready-to-drink non-alcoholic beverages may obstruct the growth. At present, key players are focusing to provide Irish cream liqueur with a soft and velvety taste. Hence, the market for liqueurs and other spirits is expected to perform significant growth during the forecast period.

Growing investment from the France-based Pernod Ricard SA to procure the premium Tequila flavors are refueling market growth. Rapidly growing demand for De Kuyper Bessen Jenever li Liqueurs in the U.K. is further anticipated to boost the growth of the market for liqueurs and other spirits. The growing demand for Chain fat licorice liqueur from consumers in Russia is driving the industry.

For the past 18 months, the pandemic had affected several industries. The supply chain of the consumer goods industry had slightly affected during the Covid-19 era. Offline trading platforms of the Asia Pacific were hampered due to the lockdown enforced by the central governments. In the COVID-19 pandemic, the demand for Liqueurs, Korn, and Tequila had increased. The key players of the market are raising the sales statistic through the e-commerce platform. Pandemic had generated a prominent trend in the global market with more brand awareness in the consumers. The increasing power to purchase capability of the client will prefer to buy the sophisticated drinks.

The growing demand for Crème de Cacao products from the consumers of Central and South America had propelled the growth of the market for liqueurs and other spirits. Several alcoholic beverages companies had projected positive growth due to the rapid sales of malt liquor products. The key players of the market are procuring value-added classic cocktails service to fulfill the demand for alcoholic drinks. Growing sales of artichoke-based bitter liqueur in China will reflect the positive growth during the forecast period.

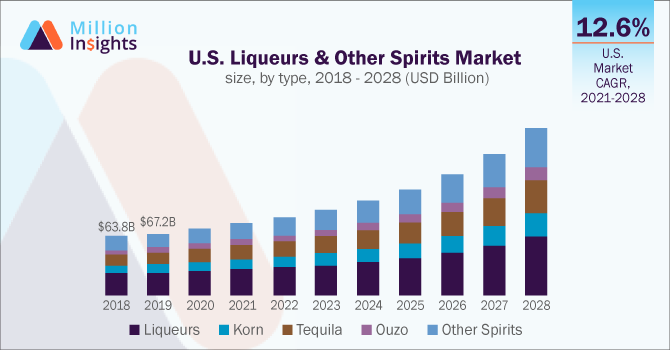

The liqueurs segment dominated the market for liqueurs and other spirits and accounted for the largest revenue share of more than 35.0% in 2020. The growing adoption of Amaretto liqueurs in North America owing to the special almond flavor and easy to paired mixture capability with a coffee liqueur. Rising demand for Amaro Meletti liqueurs from the consumers of Italy to provide the chocolate flavor for the local customers are propelling the growth of the market for liqueurs and other spirits. The rising demand for Amer Picon liqueurs in the U.S. to provide a distinct orange taste for consumers will enhance the segmental growth during the forecast period.

The tequila segment is expected to register the highest growth over the assessment period. This can be credited to the growing demand for Agavero flavor from the consumers of Asia Pacific. Agavero Tequila is a trending dink and it can be mixed with several varieties of cocktails. Korn, Ouzo, and the Alcopops also reflect the significant market growth during the forecast period. This can be credited to the rising demand for premium alcoholic beverages across the globe.

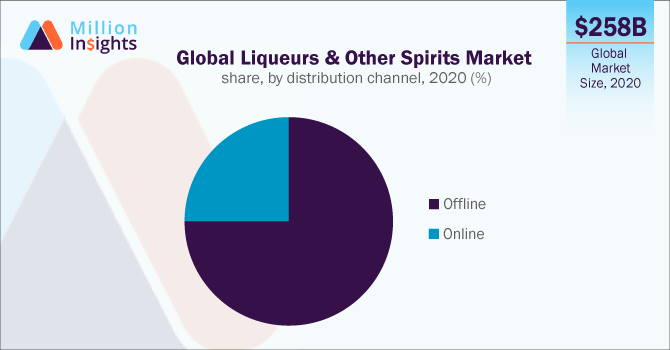

The offline segment dominated the market for liqueurs and other spirits and accounted for the largest revenue share of more than 75.0% in 2020. This can be attributed to the growing demand for bailey's original Irish cream liqueur products from developed countries such as U.S. and China. The offline segment consists of the domestic liquor stores, grocery shops, supermarkets, and the pub, bars, and restaurants. The long-lasting customer relationship of offline traders with the local consumers is refueling market growth during the assessment period.

In Europe, grocery shops are supplying a diversified portfolio such as cocktails, alcopops, tequila, korn, and ouzo. The rapid urbanization in the U.S. and U.K. will built the network of liquor stores. The immediate product offering and offline transaction service are the major factor to captivate the homegrown clients through the offline trading platform. Supportive measures taken by the liqueurs and other spirits manufacturers to provide affordable liqueur product for domestic suppliers will help to refuel market growth.

The online segment is projected to register the fastest growth in the market for liqueurs and other spirits during the forecast period. This growth is owing to the increased focus of liqueurs and other spirits retailers to adopt the internet retailing methodology. Electronic commerce is a technologically advanced cloud-storage based portal, which provides affordable product service. The cost-effective transaction methodology, quick home delivery, and the better way of approach to analysis the price ranges of the several products are the key feature of online retailing. Easy way to exchange the liqueur product and the reliability of the delivery service will contribute to enhance market growth.

North America dominated the liqueurs and other spirits market and accounted for the largest revenue share of over 33.0% in 2020 due to the increasing demand for alcopops in the U.S. and Canada. The rising trend in Canada to adopt the classic brand of the alcopops such as Hooch, Alize, and WKD will help to refuel the market growth. The market share of the U.S. is driven by the rising consumption rate of the liqueurs and korn. Ease of accessibility of liqueurs and other spirits products at a domestic grocery shop will contribute to boost market growth. Moreover, the rising demand for the Plomari Ouzo product in the U.S. is anticipated to boost market growth.

In Asia Pacific, the market for liqueurs and other spirits is projected to witness a CAGR of 13.4% from 2021 to 2028. This can be attributed to the increasing demand for strawberry liqueur from the consumers of the emerging economy such as China and India. The emerging trend in China and Japan is to consume Xuxu strawberry liqueur owing to the dessert topping, with sparkling wine. The growing adoption of tequila, Ouzo, and Korn flavors in India is further estimated to showcase the fastest growth rate over the forecast period. Moreover, the rising demand for the Hardenberg Dreikorn product in China is anticipated to boost market growth.

Companies' main focus is to provide the liqueurs and other spirits with higher quality standards. The prime key players are focusing to procure the woodruff liqueurs, which are tastier liqueur made from vodka with waldmeister. The industry participants are focusing to maintain the bizarre taste of the liqueurs. Multiple companies are targeting to launch the e-commerce portals to accomplish the rising demand for spirts and are launching premium Tequila products in the market. Some of the prominent players in the liqueurs and other spirits market include:

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 277.1 billion |

|

Revenue forecast in 2028 |

USD 642.2 billion |

|

Growth Rate |

CAGR of 12.8% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Russia;Italy; Rest of Europe; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Altria Group; Pernod Ricard SA; Constellation Brands; Jiangsu Yanghe Brewery; Brown-Forman Corp; Boston Beer Company; Molson Coors Beverage Co;Remy Cointreau; Compania Cervecerias Unidas; Willamette Valley Vineyards Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Million Insights has segmented the liqueurs and other spirits market report on the basis of type, distribution channel, and region:

Sign up today.

Call us at +1-408-610-2300 to speak with a

representative.