The global small appliances market size was valued at USD 70,689.3 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2021 to 2028. This can be credited to the surge in adoption of heat resistant microwave ovens from the consumers’ of China and India. Rising demand for auto cut protection-based electric kettles in Europe is propelling the market growth. Moreover, the growing adoption of small appliances for household applications is expected to aid market growth.

Rising demand for the smooth and delicious blended drinks product in U.K. is further refueling market growth. Moreover, the rising demand for toasters, grills, and roasters in the U.S is stimulating market growth. However, the short lifespan of hair-clippers and the higher cost of coffee machines are hindering market growth. At present, key players are focusing to provide stainless steel-based cavity material for microwave ovens. Hence the market is expected to perform significant market growth during the forecast period.

Growing investment from the Koninklijke Philips N.V. to procure lift and trim-based hair clippers are refueling the market growth. Rapidly growing demand for electric irons ranges in India is anticipated to support the market growth. The growing demand for deep cleaning upright vacuum cleaners from the consumers of the U.K. is driving the industry growth.

Covid-19 pandemic had exposed the fragileness of global supply chain. The inexorable impact of the pandemic is affected several industries. Pandemic is sensitive to economic cycles. During the pandemic market had been slightly hampered owing to the supply chain disruption of the offline trading. This can be attributed to the interruption in offline trading owing to the national lockdown enforced across the globe. Offline trade activities of the local suppliers were lurched owing to the stringent government guidelines for public gatherings during the pandemic era.

Auto-lock zoom wheel-based hair clippers had gained traction during the covid-19 pandemic. Rising concern for healthy beverages is refueling the coffee machines market growth. Prime key players of the market are approaching the e-commerce portals to refuel sales of the small appliances. Electronic commerce is transmuting the scalable approach for the small appliances product which, in turn, will refuel market growth.

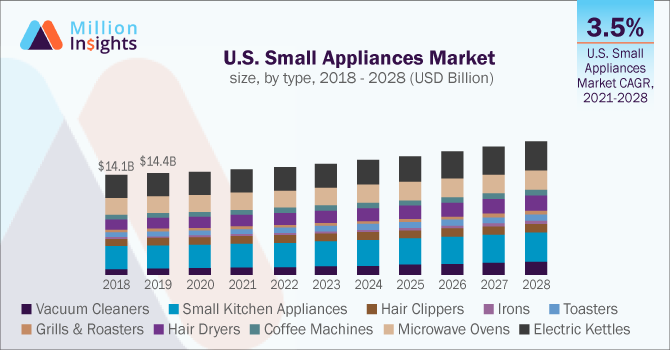

The small kitchen appliances segment dominated the market and accounted for the highest revenue share of over 20.0% in 2020. The growing adoption of food processors from the consumers of China is anticipated to boost the market growth. Rising demand for juicers from the consumer of the U.S. is escalating the demand of the small appliances product which will turn to boost the market growth in the upcoming years. The rising trend to adopt the blenders, mixers, food processors from the consumers of Brazil and South Africa will further enhance segmental growth during the assessment period.

The vacuum cleaners segment is expected to register the highest growth over the forecast period. This can be credited to the growing demand for foot operated vacuum cleaner from the consumers of the U.K. and Germany. Automatic cord winder, and suction control are the prime features of the vacuum cleaners. Irons, grills, and roasters, hair clippers, toasters also reflect the significant market growth during the forecast period. This can be credited to the rising demand for the innovative ergonomic design based small appliances product across the globe.

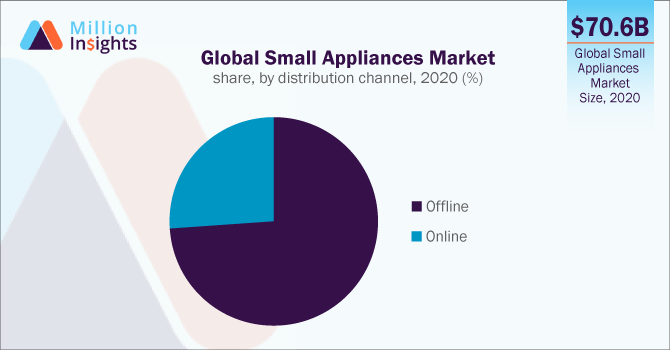

The offline segment dominated the market and accounted for revenue share of more than 70.0% in 2020. This can be attributed to the growing demand for the small kitchen appliances product from the consumers of the U.S. and Japan. The offline segment consists of the domestic appliances shops, supermarkets, and the hypermarket. Face-to-face interaction is possible through the offline distribution channel. Strong bonding with the local consumers will support to improve the sales statistics.

Domestic appliances shops are supplying the diversify portfolio such as electric kettles, microwave ovens, coffee machines, hair dryers, toasters, and many other small kitchen appliances. Rising disposable income of the developing nations are contributed to build the network of small appliances stores. Better customer support, and hard cash based offline transaction service are the major factor to boost the demand for small appliances through the offline distribution channel. Supportive measure taken by the small appliances manufacturers to provide the durable appliances product at a lower cost for the domestic distributers will help to boost market growth.

The online segment is projected to register the fastest growth during the forecast timeline. This growth is owing to the increased focus of small appliances manufacturers to adopt the e-commerce sales methodology. Quick setup, easily accessible trading, 24/7 availability of shopping portals, door-step delivery, and zero-dependency on the local consumers are the prime features of the online trading. Mobile trading application, cloud-based platform, and the advanced software system will contribute to enhance market growth.

Asia Pacific dominated the small appliance market and accounted for the largest revenue share of over 35.0% in 2020. This can be mainly credited to the increasing demand for single touch lid locking based electric kettles product from the consumer of China and India. The rising trend in India to adopt the big squeeze food processor for better cooking performance will further support the industry sales. The market share of the Japan is driven by the rising demand for commercial grade blender. Ease of accessibility of rechargeable all-in-one trimmer at a local appliances shop will contribute to boost the market growth. Moreover, the rising demand for the smart defrosting and cooking based microwave oven product in the China is anticipated to boost market growth.

In Central and South America, the market is projected to witness a CAGR of 5.4 % from 2021 to 2028. This can be attributed to the increasing demand for steam iron from the consumers of the Brazil and Argentina. The emerging trend in Brazil to embrace the automatic pop-up toasters. The growing adoption of mica heating based grills and roasters in Argentina is estimated to escalate the market growth over the forecast period. Moreover, the rising demand for the foldable hair dryers in the Brazil is anticipated to boost market growth.

Companies' main focus is to provide the technologically advanced wet and dry cylinder based vacuum cleaners. The prime key players are focusing to provide small kitchen appliances with affordable cost. Multiple companies are launching the soleplate technology based electric iron products in the market. Prime key players are providing non-sticky grills and roasters to fulfil the demand for household appliances. Some of the prominent players in the small appliances market include:

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 73.1 billion |

|

Revenue forecast in 2028 |

USD 1,00.2 billion |

|

Growth Rate |

CAGR of 4.6% from 2021 to 2028 |

|

Base year for estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K; Germany; France; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil; Argentina; Rest of Central & South America; Saudi Arabia; South Africa; Rest of MEA |

|

Key companies profiled |

Morphy Richards; Koninklijke Philips N.V.; Robert Bosch Gmbh; Electrolux Ab; Haier lnc.; Breville Group; Krampouz; Nemco Food Equipment; Hamilton Beach; Chefman; Panasonic Corporation; Dyson; Havells India Ltd.; Bajaj Electricals Ltd.; Weber-Stephen Products LLC; The Middleby Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Million Insights has segmented the global small appliance market on the basis of type, distribution channel, and region:

Sign up today.

Call us at +1-408-610-2300 to speak with a

representative.