- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

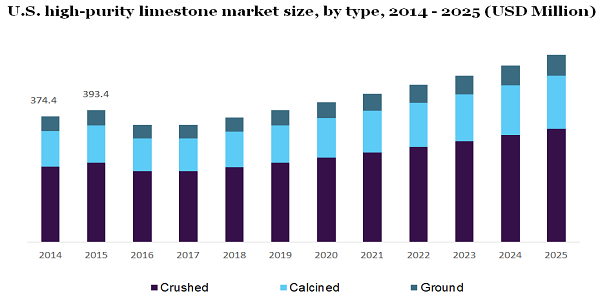

The America high-purity limestone market size was accounted for USD 766.2 million in 2017 and registering a 6.9 % CAGR over the forecast period, from 2018 to 2025. Growing demand for limestone-related products across several industries like metallurgy and construction is projected to fuel the market growth in North America.

An increasing number of new manufacturing plants, development of corporate offices, and roadway projects are expected to drive the demand for cement. Additionally, increasing government investment in green and social infrastructure along with public transit is anticipated to further boost the demand for cement, thereby estimated to surge the market growth in North America.

High-purity limestone is majorly used in metallurgical processes. For example, it works as fluxing material in steel manufacturing to remove impurities like sulfur, silica, and phosphorus. Moreover, high-purity limestone is also utilized for iron extraction to remove impurities.

Steel is a major material in the U.S. manufacturing industry for downstream producers in energy, machinery and equipment, rail, appliances, and automotive industries. The public and safety infrastructure sector use this metal to develop a water supply system, dams and reservoir, residential construction, and waste & sewage treatments.

In 2017, around 17 million vehicles were manufactured in North America. Moreover, growing emphasis on manufacturing lightweight vehicles by automotive companies to reduce fuel consumption is expected to surge the steel demand. This factor is expected to propel the demand for limestone in North America.

By type, the Americas high-purity limestone market is segmented into crushed, calcined, and ground. In terms of revenue the ground type segment is estimated to register a CAGR of over 6.0% during the projected period. This is used as a filler pigment or an extender in stains and decorative coating. In coatings, it plays a vital role to increase the efficiency of color pigments along with reducing the amounts needed to attain the desired color. In addition, it helps to fill the paint’s volume and reduce the usage of solvents or resigns.

In 2017, the crushed segment held the largest market share of more than 60.0% in terms of volume, as it is majorly used for construction. As per various applications, it is available in several shapes and sizes. It is primarily used to manufacture concrete that is made with a combination of crushed aggregate, sand, and water. Owing to its property not expand or contract, it is also used for bedding underground pipes.

In building and construction applications, limestone is majorly used to remove impurities in metal refining processes. Moreover, in the agriculture sector, it is used to balance the pH level of soil for improving its fertility.

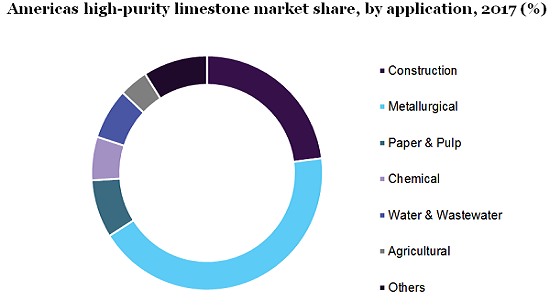

Based on application, the market is segmented into construction, metallurgical, paper & pulp, agricultural, water & wastewater, chemical, and others. In 2017, the metallurgical segment held the largest market share in terms of volume. In this industry, limestone-based products use to take out impurities after the metal is refined from ores. High usage of metals like aluminum and steel across several industries including transport, packaging, automotive, and construction is anticipated to surge the market growth in North America.

In addition, the paper industry also used limestone as a causticizing agent and for bleaching. When the limestone is used as a filter in this industry, it enhances the opacity, consistency, and whiteness of the paper. It is also used in the Kraft-pulping process and sulfite pulping process in pulp mills.

In water and wastewater application, the demand for limestone-related products increased to adjust the pH level of industrial water. Therefore, the water and wastewater application segment is projected to grow with the fastest CAGR of more than 7.0% in terms of revenue over the forecast period.

In 2017, North America holds the largest market share of more than 68.0% in terms of volume. The U.S. was a major contributor to regional market growth in the same year and it held a market share for over 70.0% of North America's market, in terms of volume. Growing investment to construct, upgrade, and maintain new infrastructure in the U.S. is a major factor to increase the usage of cement, thereby expected to drive the market growth in North America.

Growing demand for air travel in the U.S. is expected to propel the development of airports which is expected to propel the demand for cement. Moreover, the growing demand for steel in the automotive industry is expected to drive the market growth in Mexico during the forecast period. In 2016, vehicle production in Mexico was 3.5 million units and it reached 4.0 million units by the end of 2017, which is expected to drive the demand for high-purity limestone in Mexico during the forecast period.

America's high purity limestone market has been negatively impacted due to the outbreak of COVID-19. The landscape of the construction industry has changed rapidly over the past few months as governmental restrictions, supply chain disruption, and increased job site safety protocols across America. Many construction projects of roads, schools, corporates, and others have halted which has directly declined the demand for limestone in America.

However, in cities like Boston, Michigan, and New York which are some of the major cities in the U.S., the government has permitted to resume all construction projects with safety guidelines by May 2020. Such initiatives are expected to drive the demand for high-purity limestone and drive market growth to some extent.

Cement manufacturers need different types of fuels and raw materials including coal, clay, and limestone. Cement manufacturers that have their own mines are expected to have a stable supply of raw materials including limestone and others for cement manufacturing as a primary material. Further, suppliers are focusing on expanding their business to gain a maximum customer base from retail and construction industries that require concrete and cement products.

The major players operating in this market are Carmeuse; the United States Lime and Minerals, Inc.; Graymont Limited; Lhoist; Minerals Technologies Inc., Sumitomo Osaka Cement Co., Ltd.; and Nittetsu Mining Co., Ltd.

Domestic market players are also down streaming products like quicklime and hydrated lime. Some distributors include in this market are the United States Lime & Minerals, Inc.;

Indiana Limestone Company; and American Limestone Company. These products are used in metallurgy, agriculture, chemical, and construction.

|

Attribute |

Details |

|

The market size value in 2019 |

USD 896 million |

|

The revenue forecast in 2025 |

USD 1300 million |

|

Growth Rate |

CAGR of 6.9% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, type, region |

|

Regional scope |

North America, Central & South America |

|

Country scope |

U.S., Canada, Mexico, and Brazil |

|

Key companies profiled |

Graymont Limited; Carmeuse; Lhoist; Sumitomo Osaka Cement Co., Ltd.; the United States Lime & Minerals, Inc.; Nittetsu Mining Co., Ltd.; and Minerals Technologies Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts volume and revenue growth at regional & country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For this study, Million Insights has segmented the Americas high-purity limestone market report based on type, application, and region:

• Type Outlook (Revenue, USD Billion, 2014 - 2025)

• Calcined

• Crushed

• Ground

• Application Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

• Construction

• Metallurgical

• Paper & Pulp

• Chemical

• Water & Wastewater

• Agricultural

• Others

• Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

• North America

• The U.S.

• Canada

• Mexico

• Central & South America

• Brazil

Research Support Specialist, USA