- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The European civil engineering market size was worth USD 2,004.2 billion in 2018. The market is estimated to exhibit a CAGR of 2.7% over the forecast duration, 2019 to 2025. Rapidly increasing investment in construction sectors is proliferating the market growth. Further, the growth can be attributed to the increasing population, especially in Belgium, Ireland, and the U.K, and rising migration across Europe.

Rapid industrialization and urbanization across Eastern Europe and a growing focus on the development of environment-friendly building projects are anticipated to drive the market growth. Additionally, increasing government expenditure on the development of infrastructure in countries such as Finland and Poland is further estimated to boost market growth.

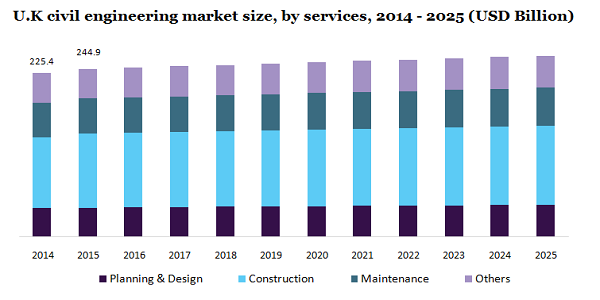

In 2018, the construction sector held 42.7% of the revenue share and this sector is likely to continue its healthy run over the forecast duration. Factors such as housing shortage, the growing trend of nuclear families, and the increasing purchasing power of consumers are supplementing the growth of the construction sector in the U.K.

However, the civil engineering market is sensitive to the economic downfall and sluggish growth of the economy in countries such as Belgium, which showed 1.7% of the GDP growth in 2018, is estimated to adversely affect the market growth. Further, the country is witnessing relatively low spending on construction projects, which, in turn, is anticipated to adversely affect market growth.

Digitalization has changed the way the industry functions and it has positively affected the construction industry in the recent past. Governments in countries like Germany, Belgium, France, and the U.K encourages the use of Building Information Management (BIM), which is likely to segment the market growth.

Further, the incorporation of advanced constriction additives is estimated to offer a lucrative opportunity for industry players over the forecast years. For example, cross-laminated timber is gaining traction among homeowners and developers, thereby, positively driving the industry growth.

In 2018, the construction segment emerged as the leading segment accounting for 42.6% of the market share by revenue. This segment is anticipated to continue its dominance over the forecast duration. Governments’ initiatives to increase the expenditure on housing projects amid a rising population are contributing to the growth of the European civil engineering market.

Conventional construction technique generates volatile organic compound (VOC), thereby, attributing to air pollution. To reduce the VOCs, manufacturers are using precast construction components and CLT as they emit low VOCs and are sustainable. Thus, these construction materials are witnessing increased demand and supplementing market growth.

Among different services, in 2018, maintenance accounted for 22.7% of the market share and is projected to register a considerable CAGR over the forecast period. The growing need for regular maintenance to increase the life of the building is driving the segment growth.

On the other hand, the planning and design division is estimated to grow considerably over the forecast period as planning and design ensure the integration of different construction processes such as costs, logistics operations, and resource management. However, owing to the deficiencies in the design of buildings, this segment is witnessing a decline in growth.

Among different applications, the real estate category held the largest share by revenue in 2018 accounting for 40.2% of the market share. Further, the segment is projected to grow significantly owing to emerging economies in the region. Countries such as Latvia, Sweden, and Estonia are investing significantly in housing projects to improve the standard of life and address the problem of the housing shortage.

The real estate segment was followed by the industrial sector as the latter accounted for 30.4% of the market share by revenue in 2018. Consolidation in the economy of France and growth in manufacturing activities in the U.K, Ireland, and Italy are attributing to the growth of this segment. The European Union has a strong manufacturing base, especially in developed countries such as France, Germany, and the U.K, which led to the construction of industrial and warehouses across Europe.

In 2018, the Infrastructure segment held 29.4% of the market share by revenue and was anticipated to grow considerably during the forecast period. The growing trend of designing flexible infrastructure along with a rise in investment in research and development is likely to boost the segment growth.

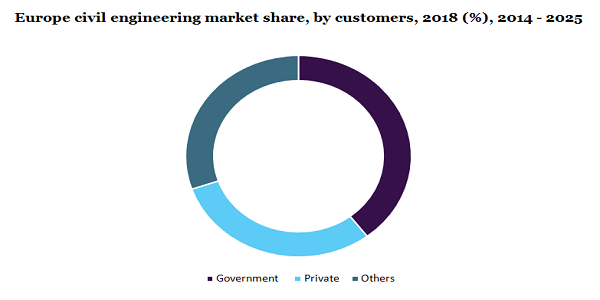

In 2018, the government consumer segment held more than 39.5% of the share in the market. Favorable government policies and increasing investment by the public sector are attributing to the growth of this segment.

Private sector consumers include developers of transport infrastructure and real estate, construction contractors, and individuals. This segment held 30.1% of the market share by revenue in 2018 and the segment is projected to witness significant growth over the forecast duration.

Increasing investment from the private sector in the development of public transport, healthcare, cultural establishment, parking areas, and green spaces are expected to drive market growth. Under the National Infrastructure and Construction Pipeline (NICP), National Infrastructure Delivery Plan (NIDP) has planned several investments in both public and private sectors with the help of 721 projects under its pipeline.

Across Europe, the construction sector occupies a significant share of the GDP. With the rising residential sector in countries such as U.K, France, and Germany, the civil engineering market in Europe is projected to witness significant growth over the forecast duration. Growing focus on renovation is a key factor attributing to the growth of the market in the region.

In 2018, Germany held more than 13.7% of the market share and is expected to consolidate its position over the next few years. Tax benefits provided by the government on several construction projects and a booming economy is driving the country’s growth.

U.K civil engineering market is likely to register significant growth owing to increasing construction projects and renovation activities in sectors like transport buildings, online retailing warehouses, resorts, and restaurants. With the imposition of several initiatives such as Energy Company Obligation (ECO), the government has mandated stakeholders to reduce the overall emission of carbon, which, in turn, is expected to bode well for the growth of the renovation activities in the region.

France, because of the development of major infrastructure projects, is anticipated to witness considerable growth in the civil engineering market. For instance, the projects named Asyel Arena, a sports arena with 10,500 seats along with over 2,000 square meters for shops, and project HexagoneBalard to create a new office of the defense ministry of France are predicted to offer a lucrative opportunity for the growth of the civil engineering market.

The European construction sector is severely affected due to the outbreak of COVID-19. According to the European Construction Industry Federation (FIEC), construction companies have suffered heavy financial loss owing to their inability to continue with construction projects. The European Union construction sector called the European Commission to designate the outbreak of coronavirus as a ‘force Majeure, which will help construction firms to avoid penalties in case of breach of contract amid crisis.

However, the construction sector is expected to play an important role in the GDP recovery of European countries once normalcy returns. As lockdown measures have been eased across Europe, the construction sector is recovering faster than several other sectors. Additionally, construction projects are expected to continue as following the social distancing norms is relatively easy in this sector. Thus, the resumption of several construction projects is expected to supplement the European market growth of civil engineering.

The industry is characterized by the presence of a number of players, which makes the low switching cost for the consumers. Additionally, owing to a lack of service differentiation, there is high competition in the market, thereby, low bargaining power for suppliers.

Ongoing industrialization in countries such as Finland, Poland, Denmark and Norway is anticipated to offer a lucrative opportunity for the investors. Leading players operating in the market are SNC-Lavalin, Jacobs Engineering Group, Inc., AECOM, and AMEC Foster Wheeler among others.

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 2,105.4 billion |

|

The revenue forecast in 2025 |

USD 2,412.9 billion |

|

Growth Rate |

CAGR of 2.7% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Services, application, customers, country |

|

Regional scope |

Europe |

|

Country scope |

U.K.; Germany; Russia; Netherlands; Belgium; Spain; France; Denmark; Norway; Finland; Italy; Poland |

|

Key companies profiled |

AECOM; AMEC Foster Wheeler; SNC-Lavalin; Jacobs Engineering Group, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional &segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the European civil engineering market report on the basis of services, application, customers, and country:

• Services Outlook (Revenue, USD Million, 2014 - 2025)

• Planning & Design

• Construction

• Maintenance

• Others

• Application Outlook (Revenue, USD Million, 2014 - 2025)

• Real Estate

• Infrastructure

• Industrial

• Customers Outlook (Revenue, USD Million, 2014 - 2025)

• Government

• Private

• Others

• Region Outlook (Revenue, USD Million, 2014 - 2025)

• Europe

• U.K.

• Germany

• Russia

• Netherlands

• Belgium

• Spain

• France

• Denmark

• Norway

• Finland

• Italy

• Poland

Research Support Specialist, USA