- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

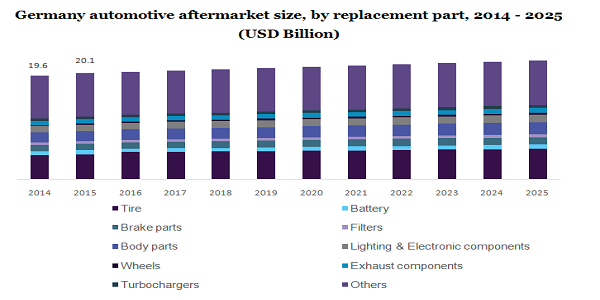

The German automotive aftermarket size was accounted for USD 21.5 billion in 2018 and expected to grow with a CAGR of 1.1 % over the forecast period, 2019 to 2025. Factors such as product innovation and rising service orientation are majorly driving the growth of the automotive aftermarket in Germany. Further, Innovation by market players in product lines including lighting & electronic components, turbochargers, and engines with high capacity are some major factors expected to boost the automotive aftermarket growth in Germany. In addition, to promote sustainable mobility and safety, suppliers and automotive manufacturers provide intelligent and innovative solutions.

Germany's automotive market is disrupted by various factors such as rapidly changing customer preferences, intense competitive dynamics, and digitalization. Rapid penetration of smartphone users has increased mobility services such as-hailing along with significant information which plays a vital role in buyer’s purchasing decisions.

The major factor responsible for influencing the sales of automotive parts in Germany can be attributed to the rising sale of hybrid and electric vehicles, over the last few years. Due to strict government regulations for low gas emission, customers are extensively moving from conventional to electric vehicles, thereby expected to increase the sales of replacement parts like body parts and batteries. Furthermore, increasing accidental repairs, the growing number of aging vehicles, rising wear and tear repairs are other factors that are expected to boost the demand for cost-effective and advanced auto parts in the market.

In Germany, automotive players are focusing to expand and secure their market position in the domestic market. Large buying groups and several distributors are implementing strategies like mergers and acquisitions to expand their footprints in the international market. Such initiatives are expected to drive market growth over the forecast period.

Based on replacement parts, the market is fragmented into filters, brake parts, turbochargers, body parts, lighting & electronic components, exhaust components, wheels, battery, and others. The tire segment has dominated the market and accounted for the largest market share, in2018. On the other hand, the turbocharger is projected to grow with the fastest CAGR from, 2019 to 2025. These turbochargers are helpful to meet government standards implemented for low emission of harmful gases like nitrous oxide and CO2 in vehicles.

Recent developments in brake parts, body parts, automotive tires coupled with the emergence of variable nozzle technology turbocharger is gaining popularity in the market. Hence, turbochargers are gaining popularity in LCV, HCV, and passenger cars due to the rising demand for high power generating vehicles and strict emission regulations in Europe.

In this market, the distribution channel segment is bifurcated into wholesalers & distributors, and service providers. In 2018, the retail segment has dominated the German automotive aftermarket. However, wholesaler & distributor is projected to have the fastest growth over the forecast period. Increasing the high adoption of e-commerce sales channels is highly impacting their marketing strategy and fueling the demand for automotive parts.

Dealers widely sell automotive parts at a retail level with OEMs suppliers through dealership contracts and offer spare parts and maintenance. From developing countries, some distributors are interested in trading with suppliers. Mobility services and Fleet management services companies have contract services with original manufacturers to offer spare parts and services. The rising adoption of green energy products is also emphasizing the production and distribution of aftermarket products.

Based on the sales channel, the German automotive aftermarket is fragmented into do-it-for-me (DIFM), original equipment (OE), and do-it-yourself (DIY). The OE segment has dominated the market, in 2018 and is followed by the DIFM sales channel. The DIY segment is anticipated to register the fastest CAGR from 2019 to 2025. However, do-it-yourself components & accessories are gaining popularity on e-commerce portals in the automotive industry. DIFM replacement part segment is anticipated to have significant growth, as sellers are offering smarter fulfillment models for customers.

There are various growth opportunities for market competitors to invest in DIFM and DIY segments. Furthermore, growing investment by market players in the domestic market has led to a high market share for the do-it-for-me segment, in the past few years. In addition, the demand for DIFM is driven by a rising need to repair and maintain vehicles.

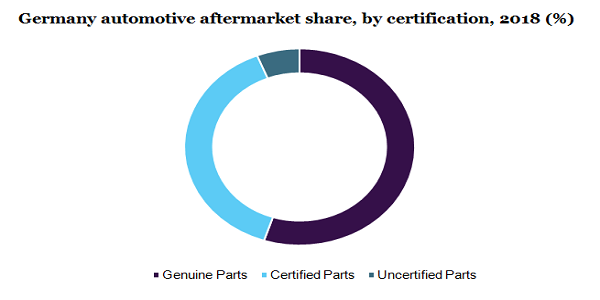

The market is segmented into genuine parts, certified parts, and uncertified parts. The genuine parts are projected to dominate the market and are anticipated to grow with the fastest CAGR during the forecast period. These parts are manufactured by OEMs and car manufacturers. These replacement parts promise diversity, warranty, availability, and quality. On the other hand, these parts are quite expensive and have to purchase from authentic dealers.

In the last few years, the necessity to ensure new vehicle models that follow passenger safety standards has increased. Certified and original parts assure quality and standards, thereby expected to retain its dominance in the German market over the forecast period. However, the consumers who are looking for cost-effective replacement parts are shifting towards uncertified automotive parts, as they are available at low cost compared to original and certified replacement parts these automotive parts are sold by local vendors at a very low cost to consumers who are looking for cost-effective replacement parts.

German government authorities have imposed lockdowns due to the increasing number of cases infected by a coronavirus. Restrictions imposed by the government in Germany have had a negative impact on the automotive aftermarket. Many people have postponed discretionary repairs and some transportation agencies have halted deadlines for technical control and inspections. These changes are reducing visits to service stations, garages, and repair workshops. German garages reported that their businesses are down by 50% during the pandemic situations.

Moreover, end-users are looking to purchase replacement parts through online channels which helps to reduce the effect of closed workshops and curfews. Therefore, increasing online purchasing of vehicle parts is expected to open new avenues for the automotive aftermarket in Germany during the pandemic situations.

The key market players operating in this market are Denso Corporation, Delphi Automotive PLC, 3M, Federal-Mogul Corporation, and Continental AG. The current aftermarket is highly competitive in nature and they are striving to strengthen their position in the market via product development and enhancement in service quality.

This scenario has led to the implementation of several strategies like merger & acquisition, and strategic alliances. Furthermore, manufacturers are offering a wide range of automotive parts at low cost as per customer’s requirements.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion and CAGR from 2019 to 2025 |

|

Country scope |

Germany |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Million Insights has segmented the German automotive aftermarket report based on the replacement part, distribution channel, sales channel, and certification:

• Replacement Part Outlook (Revenue, USD Billion, 2014 - 2025)

• Tire

• Battery

• Brake parts

• Filters

• Body parts

• Lighting & Electronic components

• Wheels

• Exhaust components

• Turbochargers

• Others

• Distribution Channel Outlook (Revenue, USD Billion, 2014 - 2025)

• Retailers

• W&D

• Sales Channel Outlook (Revenue, USD Billion, 2014 - 2025)

• DIY

• DIFM

• OE

• Certification Outlook (Revenue, USD Billion, 2014 - 2025)

• Genuine Parts

• Certified Parts

• Uncertified Parts

Research Support Specialist, USA