- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global advanced analytics market size was worth USD 9.8 billion in 2019. The market is estimated to grow at 25.3% CAGR over the forecast duration, 2020 to 2027. This analytics system involves the use of sophisticated techniques such as machine learning, semantic analysis, multivariate statistics, data mining, and neural networks to automatically examine content and data. Various industries such as energy & utilities, IT and telecom, and BFSI are increasingly using advanced analytics to make data-driven decisions to gain competitive advantages. The growing adoption of analytical solutions by the retail sector for behavior analytics, trade promotion, and demand forecasting is anticipated to drive market growth.

Data management tools have witnessed considerable growth in the last few years owing to the generation of the huge volume of data from video streaming platforms such as Hulu, Amazon Prime, and Netflix. To draw actionable insights from such a huge volume of data, advanced analytics play an important role. Further, the growing demand for location-based services and the integration of advanced analytics with Geographical Information System (GIS) has led to a rise in geospatial data. Thus, companies are using this technology to locate their customers on the map and prepare the strategy accordingly. Additionally, the growing e-commerce sector offers a lucrative opportunity for the market players.

The growing application of advanced analytics in predicting traffic trends, forecasting electricity consumption, and the trade market have bolstered its demand. In demand forecasting, advanced analytics can help organizations in making better decisions, thereby, boosting their profitability. Various sectors such as government agencies, BFSI, professional services, and manufacturing are hugely investing in big data analytics, which, in turn, is projected to drive market growth. For example, USD 20.8 billion was invested by the banking sector in big data analytics.

In large organizations, a huge amount of data is generated, which, in turn, increases the demand for predictive analytics and big data analytics, thereby, boosting the demand for advanced analytics. As researched by Seagate Technology LLC, by 2025, the world is estimated to produce 163 zettabytes of data against 12 zettabytes in 2015. Further, increasing demand for IoT predictive solutions, which collect data from several sensors, is expected to bode well for the growth of the advanced analytics market.

The Healthcare sector generates a huge amount of data and the processing of this data is important to draw actionable insights. Healthcare service providers use advanced analytics tools to mine Electronic Health Records (EHRs), which help them in deriving meaningful insights by identifying inaccuracies in their database.

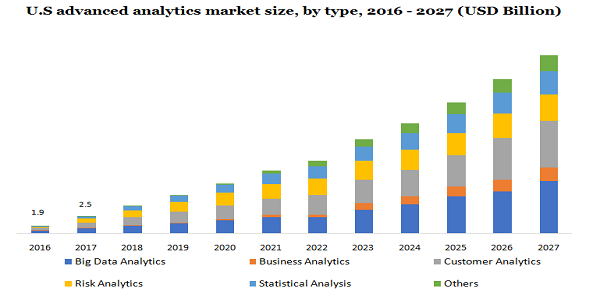

In 2019, the big data analytics category held the largest market share due to the growing popularity of social media and the rise in the number of virtual offices that generate a huge volume of data. In the beginning, big data analytics was not sophisticated and catered to limited needs for businesses. However, technical advancements have led to the emergence of the Software as a Service (SaaS) solution that has bolstered its demand. Moreover, big data is gaining traction in the industrial sector to make data-driven decisions.

The customer analytics category is projected to expand at a significant pace owing to the growing demand for lead management, enhancement of customer enhancement, and growing focus on customer retention. Additionally, the integration of various data processing tools with CRM suites to mine unstructured data of customers is gaining traction among end-use industries. Further, the growing demand for omnichannel experience among consumers in the retail industry is supplementing the market growth.

Various organizations opt for on-premise deployment as it allows better control and offers flexibility. On-premise deployment helps enterprises to protect their data from potential fraudulent activities and reduces their dependability on the internet. Additionally, the popularity of the on-premise model is gaining traction in the BFSI sector as fraudulent activities have spurred in this sector in the recent past.

Leading players such as Microsoft, SAP SE, and IBM Corporation are focusing on offering advanced analytics solutions with their cloud platforms. For example, Microsoft provides a big data analytics solution through its cloud platform Azure. Over the years, these leading players are expected to hold a dominant share in the advanced analytics market.

Large enterprises are witnessing considerable adoption of advanced analytics solutions. The growing need to effectively manage their large pool of customers and increasing focus on customer retention are attributing to the growth of this segment. Large enterprises generate a huge amount of data that require processing to make customer-oriented decisions. This, in turn, has increased the demand for predictive analytics and big data analytics. Additionally, large organizations are emphasizing data governance, enterprise planning, and location intelligence, thereby, augmenting the market growth. Further, these enterprises use advanced analytics to forecast sales and reduce their inventories.

The rise in the number of small and medium enterprises in countries like China, Singapore, Singapore, and India are proliferating the adoption of advanced analytics. Various government initiatives aimed at supporting these organizations financially and increasing cloud adoption in these organizations are boosting the growth of advanced analytics. For example, the Australian government offers financial support to start-ups under its Digital Australia Initiatives 2020. Additionally, to minimize the risk in their investment and grow their businesses, the adoption of advanced analytics has increased among small and medium businesses.

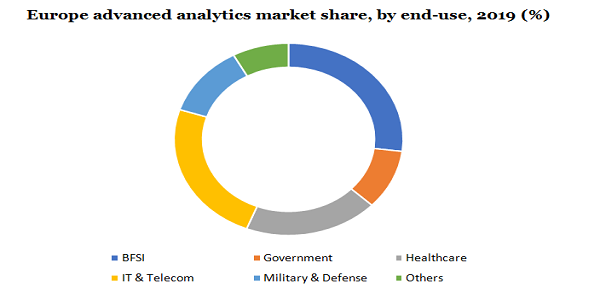

In 2019, the BFSI sector accounted for the highest share in the market. Factors such as growing demand for risk handling, alleviation funds, and optimize processes are attributing to the growth of the market. Advanced analytics help the BFSI sector with regulatory compliance that is region-specific. Additionally, the need for capital planning, insurance risk, and credit risk management is gaining traction among enterprises. Further, BFSI service providers are focusing on replacing their legacy systems with advanced analytics solutions, which, in turn, is driving the market growth.

Advanced analytics is being increasingly used in the telecom and IT sector due to the increasing demand for web conferencing and collaboration tools. Additionally, to prevent fraud, companies are adopting advanced analytics solutions. Telecom companies have a huge number of customer and use of big data enable them to build a customized solution. Further, the growing focus on network optimization has resulted in the adoption of advanced analytics among the IT & telecom sectors, thereby supplementing the market growth.

North America held the largest share in the market owing to the increased adoption of innovative technologies like big data analytics and artificial analytics. Further, increasing the use of advanced analytics solutions in the automobile is driving regional growth. SAS Institute Inc. received a Volvo Trucks contract to provide advanced analytics solutions. Further, the growing adoption of social media in North America is supplementing the market growth in the region.

The Asia Pacific is estimated to register a significant growth rate owing to the increasing number of fraudulent activities in the region. Additionally, the growing e-commerce industry in Singapore, India, and China has led to a rise in demand for predictive analytics and demand forecasting. Businesses are focus on investing in customer analytics in order to improve productivity and business efficiency. Further, travel companies such as TNT Korea Travel, Trafalgar, and China Ways LLC are opting for an advanced analytics solution to track buses, trains, traffic management, and breakdowns.

The demand for advanced analytics has grown significantly amid the COVID-19 pandemic. Using geospatial data, health officials figure out how the COVID-19 is affecting communities and regions. Considering the growing demand for advanced data analytics, various companies are focusing on offering targeted solutions. For example, QuadMed collaborated with data analytics service providers in order to learn about risk from COVID-19. By analyzing how COVID-19 impacts people of different age groups, health professionals can make a conclusive decision on patient care.

Additionally, owing to the lockdown and various restrictions imposed by governments, various industries have been severely affected that relied on manual operations. Advanced analytics help businesses in automating their operations, thereby, gaining wide adoption among various industries.

Major players operating in the market are Fair Isaac Corporation, Microsoft Corporation, RapidMiner, Inc., Trianz, SAS Institute Inc., IBM Corporation, Altair Engineering, and KNIME among others. Major industry players primarily dominate the market, however, niche companies, offering targeted solutions, have changed the market dynamics. Leading players are emphasizing mergers and acquisitions to consolidate their market position. For example, Trianz, in January 2018, acquired CBIG Consulting in order to strengthen its former analytics practice.

Major players such as Microsoft and IBM are focusing on increasing their investment in research and development. For example, IBM invests over USD 5 billion annually in its research and development program to build industry-specific solutions. IBM introduced a new IoT solution that usages a combination of AI and advanced analytics. Such solutions help asset-intensive industries in reducing their cost and risk of failure.

|

Attribute |

Details |

|

The base year for estimation |

2019 |

|

Actual estimates/Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Market representation |

Revenue in USD Million and CAGR from 2020 to 2027 |

|

Regional scope |

North America, Europe, APAC, South America, and MEA |

|

Country scope |

U.S., Canada, U.K., Germany, China, India, Japan, and Brazil |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insights has segmented the global advanced analytics market report based on type, deployment, enterprise size, end-use, and region:

• Type Outlook (Revenue, USD Million, 2016 - 2027)

• Big Data Analytics

• Business Analytics

• Customer Analytics

• Risk Analytics

• Statistical Analysis

• Others

• Deployment Outlook (Revenue, USD Million, 2016 - 2027)

• On-premise

• Cloud

• Enterprise Size Outlook (Revenue, USD Million, 2016 - 2027)

• Large Enterprises

• Small & Medium Enterprises (SMEs)

• End-use Outlook (Revenue, USD Million, 2016 - 2027)

• BFSI

• Government

• Healthcare

• IT & Telecom

• Military & Defense

• Others

• Region Outlook (Revenue, USD Million, 2016 - 2027)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• the Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa

Research Support Specialist, USA