- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global automotive finance market size has generated a revenue of USD 220.18 billion in 2019. It is expected to witness growth with a 6.7% CAGR over the forecasted years, 2020 to 2026. This growth can be associated with the rising trend towards the purchase of automobiles prevailing among the millennial population. Further, the rising investments in the automobile industry are expected to promote the business for banks, dealers, and credit unions.

The process of digitalization has paved the way for more customers buying automotive finance. Rising usage for blockchain technology, superior telematics, and online services are anticipated to further ease up the process for opting for automotive finance. Thus, several finance providers have started providing instant automotive loans with features like hassle-free and data-driven technologies.

Rapid advances are being carried out in terms of technology which is attracting the majority of the customers. Further, the usage of predictive analytics is being undertaken by several financers to assist customers in decision making and getting the best deals as per their desire. Several financers also have started offering flexible packages to the customers which are expected to drive the market growth in the upcoming years.

The majority of the banks and other financial institutions are providing automotive finance as a strategy for debt collection. Thus, customer engagement is being widely carried out by them by offering best-fit and instant services through online and offline mode. But, stringent rules and regulations being imposed by governmental authorities about the credit provision are expected to hinder the market growth for automotive finance in the upcoming years.

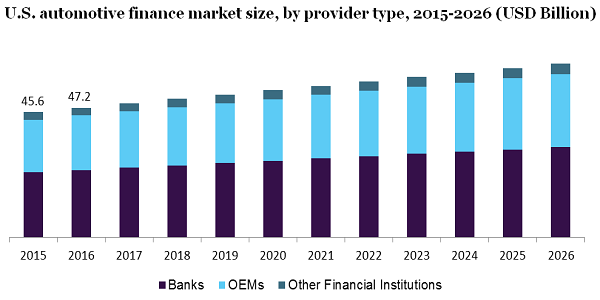

The segment of banks is anticipated to register the highest revenue from 20120 to 2026. This can be attributed to its features like fast processing, minimal document requirements, and more reliability features. The majority of the banks offer tenures for repayment of loans from 12 months to 60 months that can be fixed by the customers. As the majority of the customers are well aware of the bank procedures and rely heavily on the banks, they prefer bank loans instead of loans by other financial institutions.

The segment of OEMs & other financial institutions is anticipated to register the highest growth from 2020 to 2026. This can be attributed to the aftersales services like repair and replacement provided by the OEMs on taking loans from their side. While other financial institutions like independent finance and vehicle leasing companies are also expected to gain significant momentum in the upcoming years.

The segment of indirect finance is anticipated to register the highest growth during the forecasted period, 2020 to 2026. This can be attributed to its feature of expert advice provision available on-site by specialists for ensuring good vehicle finance assistance to the customers. The majority of the dealers have started approaching lenders for providing the best-suited financing options to their customers.

The segment of direct finance is being widely adopted across the globe for vehicle purchases. To get direct finance, consumers are required to meet requirements and provide finance sources. The majority of banks provide such service which involves detailed knowledge about different schemes, decision making, and research.

The segment of leasing is anticipated to register the fastest growth during the forecasted years, 2020 to 2026. This growth can be attributed to the rising number of vehicle leasing providers across countries like India, Japan, and China. Also, the shifting trend towards the leasing of vehicles instead of paying the overall vehicle cost has started prevailing among the millennial population. Thus, the business of vehicle leasing is being considered as one of the unexplored businesses which can grow at a faster pace in the upcoming years.

The segment of loans held the largest share across the global market, in 2019. This can be attributed to its feature of being one of the standardized car purchasing methods undertaken by a majority of the population. But, the automotive financing market is becoming matured across developed regions while it is gaining momentum across countries like Japan, India, and China.

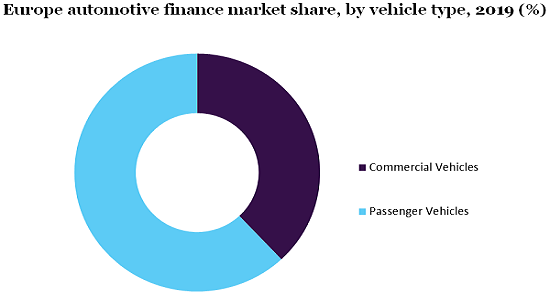

In 2019, the commercial vehicle type segment dominated the global market. This can be attributed to the high cost of commercial vehicles as compared to passenger vehicles. Thus, several banks and financial institutions have started offering attractive loan schemes for attracting customers. Moreover, the approval time required for taking commercial vehicle loans has been reduced by these financial institutions as compared to that required for passenger vehicle loans.

The passenger vehicle segment is anticipated to register the highest growth rate during the forecasted years. This growth can be attributed to the shifting trend among consumers towards the purchase of vehicles. Also, surging disposable income prevailing among the working population is paving way for rising willingness to opt for vehicle loans. Moreover, factors like the rising number of car registrations increase in the number of female drivers, and the millennial population who prefer to travel in their own vehicles opting out of public transport as done by their previous generation is expected to drive the market growth for automotive finance in the upcoming years.

In 2019, Europe held the largest share in the automotive finance market. This growth can be attributed to the rising number of financial service providers across this region. These providers have stated offering fleet services, maintenance, and insurance. Moreover, the trending advertising industry across this region has led to a rise in awareness about financial schemes among the millennial population. This factor is also expected to drive market growth in the upcoming years.

The Asia Pacific is expected to register substantial growth from 2020 to 2026 across the global market. This growth can be associated with the rising number of initiatives being undertaken by the governing authorities to promote the growth of the automotive industry. Further, the key players across countries like China, Japan, and India are expected to register strong competition on account of the rising number of vehicle showrooms and used car outlets.

The key players in the market are GM Financial Inc.; Hitachi Capital; Ally Financial; Daimler Financial Services; Capital One and Chase Auto Finance. These players have started providing online services to customers coupled with the launching of loan packages along with insurance services. Moreover, collaboration with several business customers like car rental companies and transportation startups is being carried out by these players.

The key players have adopted various strategies like acquisitions, mergers, and partnerships to widen their reach. They are also collaborating with automotive dealers and banks. These players have also started investing in R&Ds to develop mobile applications for online payment.

|

Attribute |

Details |

|

The base year for estimation |

2019 |

|

Actual estimates/Historical data |

2015 - 2018 |

|

Forecast period |

2020 - 2026 |

|

Market representation |

Revenue in USD Billion and CAGR from 2020 to 2026 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country Scope |

U.S., Canada, Germany, U.K., China, India, Japan, Brazil, and South Africa |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2015 to 2026 in each of the sub-segments. For the purpose of this study, Million Insights has segmented the global automotive finance market report based on provider type, finance type, purpose type, vehicle type, and region:

• Provider Type Outlook (Revenue, USD Billion, 2015 - 2026)

• Banks

• OEMs

• Other Financial Institutions

• Finance Type Outlook (Revenue, USD Billion, 2015 - 2026)

• Direct

• Indirect

• Purpose Type Outlook (Revenue, USD Billion, 2015 - 2026)

• Loan

• Leasing

• Others

• Vehicle Type Outlook (Revenue, USD Billion, 2015 - 2026)

• Commercial Vehicles

• Passenger Vehicles

• Regional Outlook (Revenue, USD Billion, 2015 - 2026)

• North America

• U.S.

• Canada

• Europe

• Germany

• U.K.

• the Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa (MEA)

• South Africa

Research Support Specialist, USA