- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global automotive motor market size was accounted for USD 31.33 billion in 2018 and is projected to grow at a CAGR of 6.7% over the forecast period, from 2019 to 2025. The use of automotive motors has been witnessing steady growth in the past few years. The growing focus by OEMs to optimize the design and implementation of advanced manufacturing processes for offering more efficient products will drive the product demand over the forecast period.

Technological advancement in manufacturing compact design and highly efficient motors is opening new opportunities for the growth of the automotive industry. These motors have several applications such as power windows, seat cooling fans, safety fitting, engine cooling fans, and others. Moreover, the rising popularity of advanced features like motorized massage seats, wipers, doors, and adjustable mirrors will further augment the market product demand over the forecast period.

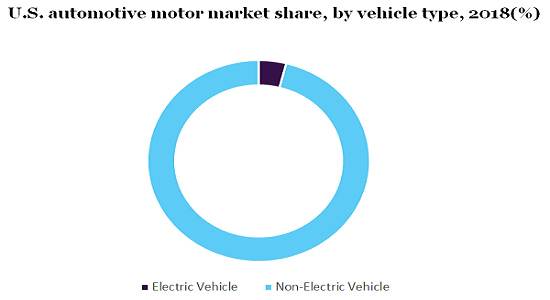

Technological advancement in manufacturing electric vehicles and increasing focus on renewable energy solutions has majorly driven the electrical vehicles demand. The rising penetration of electric vehicles is helping in solving various problems including environmental pollution, global warming, along with increasing fuel efficiency. Therefore, the government has taken several initiatives and mandated various policies to increase the adoption of electric vehicles, which in turn, is expected to fuel market growth across the globe. Electric vehicles are expected to gain traction, as it helps to reduce harmful gas emission coupled with rising awareness regarding environmental protection among consumers.

Automotive motors need replacement after a certain time which is anticipated to hamper the market growth. However, OEMs are striving to introduce the least wear & tear, high efficiency, and longer life motors which are anticipated to open new avenues for market growth. In addition, government initiatives to encourage manufacturers to introduce energy-efficient automotive vehicles will impel market growth shortly.

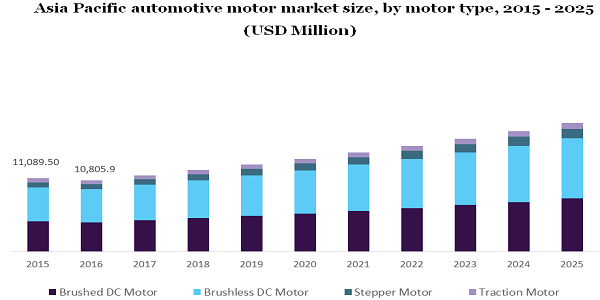

By motor type, the automotive motor market is segmented into a Brushless DC motor, brushed DC motor, stepper motor, and traction motor. In 2018, brushed DC accounted for the largest market share due to its low cost and simple drive control model. In addition, they provide high seed to vehicles and are very easy to install, thereby, making them efficient for several automotive applications. Various systems like cooling fans, power windows, and windshield wipers used brushed DC motors.

The traction motor is projected to register the fastest CAGR during the forecast period. These motors are majorly used in hybrid electric vehicles and battery electric vehicles due to their low power consumption and high-efficiency attributes. In addition, the rising penetration of electric vehicles is projected to propel the segment growth over the forecast period.

In the market, the sale channel segment includes aftermarket and OEM. In 2018, the OEM segment held a substantial market share, wherein aftermarket accounted for the largest market share in the same year and projected to register the fastest CAGR from 2019 to 2025. After a certain time, motors in vehicles need to be replaced owing to prolonged usage for better vehicle performance, which is expected to drive the segment growth in the next few years.

Factor like technological advancement is projected to drive the aftermarket segment growth. Increasing sales of auto parts and services on e-commerce portals will surge the segment growth. Growth in the production of passenger vehicles, digitalization in automobile services and maintenance, and the emergence of advanced technology for the fabrication of auto parts are key factors projected to fuel the expansion of this segment in the forthcoming years.

Based on application, the automotive motors market fragmented into performance, comfort, and safety. In 2018, the comfort segment dominated the global market and held the largest market share in terms of revenue. Automotive motors are integrated into hybrid and electric vehicles as well as other vehicles. The rising necessity of passenger vehicles for transportation has resulted in increasing demand for the comfort of drivers and passengers. Advanced automotive components such as adjustable seats are operated electronically use these motors. This automotive motor is integrated with the microcontroller platform to increase the safety and comfort of drivers and passengers. In addition, in electric power steering systems, this motor is used with a microcontroller platform to adjust the wheel position of the steering.

Sophisticated safety mechanisms like anti-lock braking systems integrated with automotive motor for road identification and offer an estimation of wheel speed by using wavelet signal processing methods. Automobile vendors are striving to enhance the safety and comfort of passengers by focusing on maintaining production costs. These motors offer several advantages like the low price, compact size, and ability to integrate with a microcontroller platform to run a complex algorithm.

The electric vehicle segment is projected to witness the highest growth during the forecast period. Electric vehicles can enhance air quality, increase energy security and help to reduce carbon emissions. The automotive industry is focusing on developing electric and hybrid vehicles owing to the rising concern of harmful gas emissions from conventional vehicles. This factor is anticipated to fuel the demand for electric vehicles shortly.

The electric vehicles segment is further sub-segmented into PHEVs and BEVs. In 2018, the demand for BEVs was the highest and expected to retain its dominance throughout the forecast period. However, PHEV is projected to emerge as the fastest growth over the forecast period, from 2019 to 2025. Furthermore, the fast and better-charging features of batteries are improving the maintenance of BEVs. In addition, bulk production of batteries is reducing the battery cost which has resulted in increasingly intense competition among BEV manufacturers. The above-mentioned factors are expected to propel the growth of the BEV segment over the forecast period.

The electric vehicles segment is further sub-segmented into PHEVs and BEVs. In 2018, the demand for BEVs was the highest and expected to retain its dominance throughout the forecast period. However, PHEV is projected to emerge as the fastest growth over the forecast period, from 2019 to 2025. Furthermore, the fast and better-charging features of batteries are improving the maintenance of BEVs. In addition, bulk production of batteries is reducing the battery cost which has resulted in increasingly intense competition among BEV manufacturers. The above-mentioned factors are expected to propel the growth of the BEV segment over the forecast period.

The pandemic caused due to COVOD-19 harms the automotive industry. Most automobile companies have temporarily ceased their vehicle production across the globe, especially in Europe and North America. This factor has adversely affected the automotive motors market growth. On the other hand, major automotive motor manufacturers such as Continental and Bosch have stopped their production due to supply chain bottlenecks, low demand, and to protect their employees. However, companies like Johnson Electric Holdings Ltd. are taking initiative to resume their operations along with taking care of their employees, which is expected to positively impact the market growth during the novel coronavirus pandemic.

Several government regulations have urged safety features in vehicle manufacturers such as airbags, start-stop systems, anti-lock braking systems, and others. In 2018, Asia Pacific held the largest market share in terms of revenue and projected to witness the fastest growth during the forecast period. This growth is attributed to the rising production of vehicles in several countries such as Japan, China, and India.

North America is projected to hold the second-largest market share by 2025. This is due to the presence of major market players in the U.S. and Canada. The European market is expected to witness significant growth over the forecast period due to the growth of the automotive industry. Increasing demand for efficient infotainment units in vehicles is projected to boost the regional market growth in the next few years.

The key players included in this market are Robert Bosch GmbH, Continental AG, Mitsubishi Electric Corporation, Johnson Electric Holdings Ltd., and Nidec Corporation among others.

Market players are extensively focusing on R&D activities to increase production capacity along with the expansion of product offerings. Intense competition among market players is enforcing them to invest in product development to fulfill customer needs.

|

Attribute |

Details |

|

The market size value in 2020 |

USD 35.3 billion |

|

The revenue forecast in 2025 |

USD 49.07 billion |

|

Growth Rate |

CAGR of 6.7% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Motor type, sales channel, vehicle type, application, and region. |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; China; India; Japan; Brazil; Mexico. |

|

Key companies profiled |

Nidec Corporation; Johnson Electric Holdings Ltd.; Robert Bosch GmbH; Denso Corporation; Continental AG; and Mitsubishi Electric Corporation. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the global automotive motor market report based on motor type, sales channel, vehicle type, application, and region:

• Motor Type Outlook (Revenue, USD Billion, 2015 - 2025)

• Brushed DC Motor

• Brushless DC Motor

• Stepper Motor

• Traction Motor

• Sales Channel Outlook (Revenue, USD Billion, 2015 - 2025)

• OEM

• Aftermarket

• Application Outlook (Revenue, USD Billion, 2015 - 2025)

• Safety

• Comfort

• Performance

• Vehicle Type Outlook (Revenue, USD Billion, 2015 - 2025)

• Electric Vehicle

• BEV

• PHEV

• Non-Electric Vehicle

• Passenger

• LCV

• HCV

• Regional Outlook (Revenue, USD Billion, 2015 - 2025)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• Middle East & Africa

Research Support Specialist, USA