- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global automotive steel market size was accounted for USD 104.47 billion in 2018 and expected to grow with a CAGR of 3.2% during the forecast period, from 2019 to 2025. Automobile manufacturers are focusing on reducing vehicle weight in order to meet stringent emission reductions. Therefore, manufacturers are using high-quality steel for weight reduction which is expected to drive the market growth over the forecast period.

Over the past few years, the automotive industry is facing challenges such as high carbon dioxide emissions from vehicles. To overcome these challenges, market players are focusing to develop lightweight vehicles which will help to improve fuel efficiency and reduce in the emission of harmful gasses from the vehicle. Materials like hot forming steel and metal composites have properties to cut the vehicle’s weight. It has been noticed by automakers that hot firming steel can reduce vehicle weight by 20% to 30%.

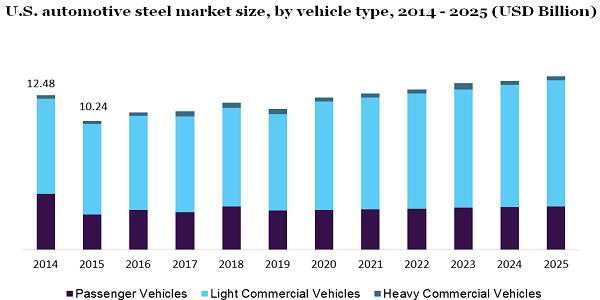

In North America, the U.S. is the largest producer of motor vehicles. Pickup trucks and passenger cars accounted for the largest number of vehicles in the country. Several manufacturers are using steel material for manufacturing passenger car components which are expected to drive the market growth over the forecast period. In addition, the introduction of compact SUVs has positively impacted the U.S. automotive industry, as several manufacturers are using stainless steel to reduce vehicle weight.

Growing investment in green infrastructure and stringent emission regulations are expected to drive the demand for steel-made automotive parts. Using steel in automotive construction reduces weight and helps to conserve resources without comprising safety standards implemented by the government for low carbon emission. For example, the Canadian government has invested around USD 3.5 million in green infrastructure and clean technologies by increasing the production of zero-emission vehicles. In addition, the Canadian government entered into a partnership with private sector companies in order to increase the sales of electric vehicles. In 2019, the Canadian government has invested around USD 98 million in charging infrastructure. Moreover, the government is offering some incentives that are buying zero-emission vehicles. Therefore, several initiatives taken by the government of Canada to increase sales of electric vehicles will propel the demand for lightweight material in order to reduce overall vehicle weight

The development of advanced high-strength steels (AHSS) is a major factor to focus on for market players. This material has a combination of mechanical properties that helps improve efficiency, durability, and safety at an affordable cost. Further, the safety standards set by the National Highway Traffic Safety Administration (NHTSA) which are focused on improving the safety standard of vehicles and fuel efficiency are expected to drive the demand for this material.

On the basis of vehicle types, the automotive steel market is segmented into passenger vehicles, light, heavy commercial vehicles, and commercial vehicles. In 2018, the passenger vehicle segment dominate the market and held the largest market share of more than 71.0% in terms of revenue. Increasing demand for passenger vehicles in developing regions such as the Asia Pacific is expected to drive the segment growth in the next few years. According to OICA statistics, countries such as Malaysia, Indonesia, India, and Thailand have production growth of 13.7%, 7.5%, 2.6%, and 7.2% respectively.

Technological advancement in steel-based composite material for automotive and growing anticipation for commercializing are major factors that are expected to drive the passenger vehicles segment growth during the forecast period. Several automotive market players across the globe are focusing on the development of autonomous vehicles, which is expected to drive the segment growth in the next few years.

The light commercial vehicle is estimated to grow at the fastest rate during the forecast period in the report. The demand for LCV is expected to increase from commercial and industrial transportation services. In addition, the development of road infrastructure, government supportive policies, and rapid urbanization are expected to propel the demand for LCVs from 2019 to 2025.

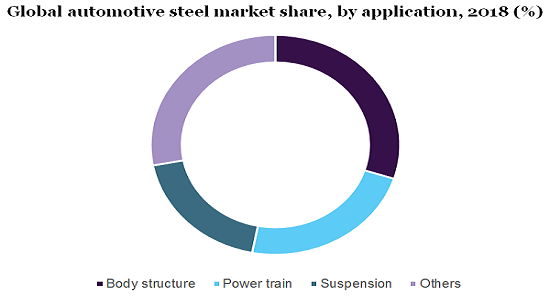

Based on application, the market is fragmented into suspension, body structure, power train, and others. In 2018, body structure held the largest volume share of more than 35.0% Body structure comprises frames, panels, trunks, doors, and bonnet. These automotive parts are generally manufactured by steel to offer crash energy absorption and high robustness to the body structure. In addition, stringent regulation by governments across the globe for safety around vehicle parts is expected to drive the segment growth in the next few years.

Market players in the automotive industry are focusing on power train weight reduction which is expected to fuel the demand for automotive steel. On the other hand, some automotive manufacturers are using plastic and composites to reduce the weight of power trains, which is expected to hamper the market growth for this segment to some extent.

The suspension segment is projected to grow with a CAGR of more than 3.0% in terms of revenue over the forecast period. Growing demand for high strength and high rigidity is expected to fuel the automotive steel demand for suspension applications. Vehicle suspension helps to reduce high-level stress and vibrations. Therefore, the material used for automotive components especially springs should be able to bear such stress without damages.

North America is projected to grow with a CAGR of more than 2.5% from 2019 to 2025 in terms of volume. In this region, the demands for electric vehicles are increasing, as they are manufactured with lightweight materials including steel. Therefore, increasing demand for electric vehicles in Mexico, Canada, and the U.S. is expected to impel regional market growth. For example, in 2018, Zacua established a new vehicle production plant worth USD 4.3 million in Mexico.

In Europe, Germany is a substantial and integral part of the automotive industry. Moreover, Germany is a major producer of passenger cars, heavy automotive vehicles, and precision equipment. Growing exports of luxury cars in this country and rising investment in R&D activities in order to develop premium cars are projected to drive the market growth in Europe.

In 2018, Asia Pacific accounted for a market share of more than 45.0%, in terms of revenue in the global market. Favorable government policies are projected to drive the automotive industry growth in the Asia Pacific. Moreover, manufacturers are striving to come up with attractive designs and develop advanced manufacturing processes in order to fulfill the rapidly changing demand for OEMs.

Due to the COVID-19 pandemic and lockdown, all manufacturing operations in the automotive industry are suspended. The automotive industry is one of the major consumers of steel material, which may hamper the automotive steel market growth to some extent. Recently, various manufacturers including Nissan, VW, Volvo, and others have decided to re-open their factories and restart vehicle production in European countries which is expected to drive the demand for steel. In addition, as China is the largest consumer of steel across the globe, it is focusing on imports of semi-finished steel, thereby expected to fuel the market growth during this pandemic situation.

According to International Energy Agency (IEA), the sales of the electric car are expected to reach around 10 million this year despite the COVID-19 pandemic. In addition, government favorable support to sale electric vehicles is expected to further augment the market growth for automotive steel.

Geographical expansion and continuous production in developed nations such as Japan and the U.S. are expected to remain key strategies among market players. For example, Japan is home to key automakers including Mitsubishi, Fuso, Hino, Daihatsu, Toyota, Honda, Subaru, Nissan, Mazda, Lexus, and others. Therefore, rising demand for steel from these automakers is expected to drive the market growth over the forecast period.

Some major manufacturers operating in this market are ArcelorMittal, JFE Steel Corp., JSW Group, Hyundai Steel, POSCO, U.S. Steel, Tata Steel, Nucor Corporation, and China Steel Corp.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Volume in Kilotons, Revenue in USD Billion & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Brazil |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insight has segmented the global automotive steel market report based on vehicle type, application, and region:

• Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2014 - 2025)

• Passenger Vehicles

• Light Commercial Vehicles

• Heavy Commercial Vehicles

• Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2014 - 2025)

• Body structure

• Power train

• Suspension

• Others

• Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2014 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• The Asia Pacific

• China

• Japan

• India

• Central and South America

• Brazil

• Middle East & Africa

Research Support Specialist, USA