- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

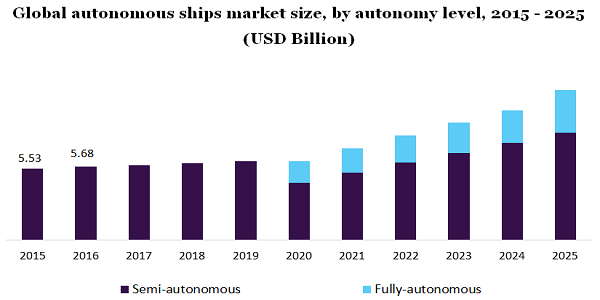

The global autonomous ships market size was worth USD 6.03 billion in 2018. It is estimated to register a 13.5% CAGR from 2019 to 2025. Increasing marine trade and rising maritime tourism activities are supplementing the market growth. In addition, the decreasing number of sailors is estimated to bolster the demand for autonomous ships over the next six years. Autonomous ships are equipped with various components such as the propulsion control system, automated system for navigation, and sensors among others. These components facilitate various operations such as automatic propulsion and navigation. Already these systems are widely used in automobiles and aerospace. To incorporate these systems, marine industry players are significantly investing in the development of reliable and cost-effective solutions.

Marine trade accounts for nearly 90% of the total trade worldwide. Ships are used to transport goods in different parts of the world. These ships are also used to supply crucial items like oil & petroleum. The increasing number of accidents in marine operations not only results in financial losses but harms the marine ecosystem as well. Moreover, governments across the globe have stringent regulations in place against such incidents and pollution caused by them. Autonomous vessels are estimated to significantly reduce such incidents, thereby, projected to gain traction over the forecast duration.

Increasing marine trading has resulted in a rise in the number of vessels for freight transportation. A large number of seafarers are required to operate these vessels. However, in the recent past, there has been a significant decline in the seagoing profession owing to its attractive nature. Issues such as isolation are limiting millennial's participation in this profession. Owing to these factors, the number of seafarers has decreased considerably, which in turn drives the demand for unmanned ships.

Autonomous ships help in reducing labor intensity. With most of the operation being autonomous, only technical and navigation, tasks are left to be done manually. Thus, seafarers’ job has become more attractive than what it was earlier.

With increasing AI and robotics applications across various sectors, IoT is expected to make a huge impact on marine operations. Leading marine market players such as Rolls-Royce, ABB, Tieto and Wärtsilä established One Sea Ecosystem in 2016 to promote autonomous ships solutions. The body is focusing on the level of autonomy that is achievable by 2025.

Based on the autonomy level, the autonomous ship market is categorized into fully autonomous and semi-autonomous. Currently, the semi-autonomous segment dominates the market and fully autonomous ships are projected to be popular by 2020. The semi-autonomous system is equipped with a navigation system, sensors, and other pre-installed components. It can be installed in traditional ships operating fully manual.

On the other hand, fully autonomous ships are anticipated to hold a significant share in the market by 2025. Compared to semi-autonomous ships, the fully autonomous segment offers various benefits and significantly reduces the chances of incidents. Further, it reduces human errors and risks in transportation by reducing human dependency. In addition, fully autonomous ships offer comparatively faster operation and it reduces the cost of operations significantly.

Depending on the solution, the market is segregated into structures, systems & software. In 2018, the system & software category accounted for the highest share in the market. The growing use of automated systems in vessels is driving the segment growth. In addition, some other systems such as Collision Avoidance (CA), Route Planning (RP), Situational Awareness (SA), and Dynamic Positioning (DP) are being increasingly installed in new vessels.

The structure operation of fully autonomous ships is estimated to commence by 2020. This segment is likely to be the fastest-growing segment during the forecast years. Structures are projected to be equipped with the in-built autonomous system. As fully autonomous ships do not need space for sailors, they are likely to have more cargo space.

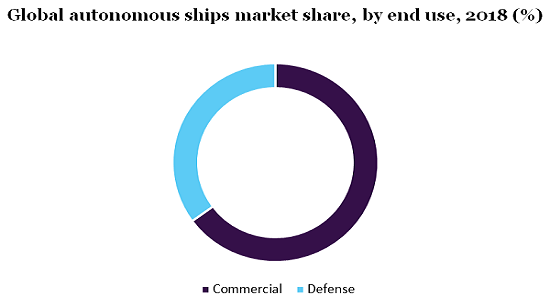

In 2018, the commercial segment held the largest share in the market. The rise in the shipment of cargo led to an increasing number of vessels and sailors. The commercial segment is further estimated to gain traction owing to the deployment of fully autonomous ships from 2020. Fully autonomous ships not only offer more cargo space but also reduce the operating cost significantly.

Although autonomous ships are designed to operate with the least human interventions, the probable damage can be enormous. For defense applications, autonomous ships are vulnerable to hackers, terrorists, and criminals. Lack of personnel increases the risk of cyber-attacks as these ships are dependent on the electromagnetic spectrum. Thus, the defense segment is likely to witness slow growth concerning the deployment of fully autonomous ships.

The Asia Pacific led the autonomous ship market by accounting for the highest share in 2018. Further, the region is projected to continue its dominance over the forecast duration. Increasing demand from China, which is one of the topmost shipping countries in the world, is driving the growth of the region. The country has a significant number of container ports. Of the total trade, sea trade accounts for over 60% of the country’s total trade. Further, the country is estimated to witness growth in the sea trade owing to the emergence of autonomous ships.

On the other hand, Europe is likely to be the fastest-growing region from 2019 to 2025. The rise in demand for autonomous and cruise ships is driving regional growth. The region has the highest number of individuals owing ships. Increasing demand to automate the operations of existing ships is estimated to drive the market growth in the region. Technical advancements in the shipbuilding industry and increasing spending on research and development are further anticipated to bolster the demand.

The COVID-19 outbreak has adversely affected the market. The pandemic has disrupted the supply chain, thus, negatively affecting the shipbuilding processes. Further, global trade has been hit severely following the outbreak of coronavirus. Several countries have distanced themselves from China, which is a major trading destination. In addition, the deployment of fully autonomous ships, which were likely to make their mark in 2020, has been delayed as companies have reduced their spending on research and development. However, COVID-19 impact on the market is expected to be for the short-term and autonomous ships are the way forward.

Key players operating in the market are Rolls-Royce, Kongsberg Gruppen, ABB, Wartsila, L3 ASV Siemens and Rh Marine. To gain a higher share in the market, these players are focusing on various Recent Developments such as mergers & acquisitions, contractual agreements, and partnerships. In addition, leading market players are testing fully autonomous vehicles, which, in turn, are expected to benefit the entire industry. For example, Mitsui O.S.K. Lines and Rolls-Royce entered into a deal in 2017 to prepare Intelligent Awareness System (IAS). This system would easily detect obstacles with the help of advanced sensors and offer operational support instantly.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million and CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, U.K., Germany, France, China, India, Japan, Brazil, and Mexico |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the global autonomous ships market report based on autonomy level, solutions, end-use, and region:

• Autonomy Level Outlook (Revenue, USD Million, 2015 - 2025)

• Semi-autonomous

• Fully Autonomous

• Solutions Outlook (Revenue, USD Million, 2015 - 2025)

• Systems & Software

• Structure

• End-use Outlook (Revenue, USD Million, 2015 - 2025)

• Commercial

• Passenger Cruise

• Bulk Carrier & Container Ships

• Tankers

• Others

• Defense

• Submarines

• Aircraft Carriers

• Destroyers

• Frigates

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• France

• The Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• Middle East & Africa

Research Support Specialist, USA