- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global beer glassware market size was estimated at USD 375.5 million in 2018 and is projected to grow at a significant rate over the forecast period. This growth is majorly attributed to the growing consumption of the product, especially among the female population. Moreover, the growing number of bars and pubs in the developing regions are also expected to be a key factor responsible for market growth.

Beer is known to be the highest consumed beverage in the alcoholic beverage category. Rising demand for the product from restaurants, bars, pubs, and hotels is expected to boost the market growth. Additionally, manufacturers are launching new flavors such as cheese, chocolate, lemons, and apple to attract a large consumer base. This is gaining traction among consumers and is also expected to bolster market growth.

The increasing popularity of craft beer is propelling the product demand across the globe. Moreover, the growing adoption of beer products over whiskey and rum is a key factor driving the demand for the product. Increasing the inclination of youth towards drinking games and house parties is boosting the market growth.

Glassware styles include serving measures, stacking, traditions, and folk art. Drinkware manufacturers use these styles in commercial breweries. Various types of glasses with different styles are used to enhance beer head, aroma, and appearance.

Based on application, the beer glassware market is bifurcated into household and commercial segments. In 2018, the commercial segment held the highest share of more than 60.0% in the overall market. Increasing penetration of bars, pubs, and clubs is surging the demand for the product.

The household segment is projected to grow at a CAGR of 4.0% over the forecasted period. This growth is primarily attributed to the growing trend of induction hobs. Consumers prefer drinking beer at home rather than at bars and pubs. For instance, the British beer & pub association (BBPA) observed that over 51% of beer was sold through off-trade channels in U.K. Heavy tax on drinking beer in bars, is influencing consumers to drink in the home. These trends are expected to proliferate the market growth.

In 2018, the offline channel held a market share of over 80.0% in the overall market. The offline channel is comprised of hypermarkets and supermarkets. Availability of a wide range of products across hypermarkets and supermarkets is a prominent factor gaining traction among consumers.

Online channel is projected to grow at a CAGR 0f 4.4% during the forecast period. A growing network of e-commerce and a rising number of smartphone users is expected to boost the market growth. The online sector is also expected to have significant growth over the forecast period, as the top manufacturers sell their products through assured delivery services, with the aim of providing a better consumer experience.

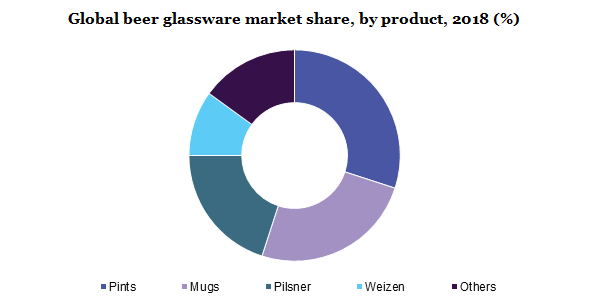

The global market is divided into pints, mugs, pilsner, weizen, and others depending on the product. In 2018, the pints segment held a market share of over 30.0% in the overall market. Pints are available in sizes such as 16, 20 ounces. The 20-ounce category is the most popular as it is offered with high beer crowning heads. The glasses are suited with classic ales like a brown ale, English dark & mild ale, Irish ale, and American ale.

Weizen glassware is anticipated to grow at the highest CAGR of 5.1% over the forecast period. This glass ware is suitable to Hefeweizen, Kristalweizen, Weizenbock, and Dunkelweizen. These products show the color of wheat ale with curvature. The pilsner glassware is also projected to grow significantly in the next few years. The pilsner type contains less percentage of ale in comparison with pints.

In 2018, Europe accounted for a market share of over 30.0% in the overall market. The growth of microbreweries in countries such as Germany, Spain, France, the U.K., and Belgium are fostering the demand for the product. In Europe, more than 6000 breweries were small and medium enterprises type. Furthermore, an increasing number of homebrewing is also anticipated to propel market growth.

Asia Pacific is estimated to grow at the highest CAGR of 6.2% over the forecast period. The rise in beer-drinking culture especially among the younger generation of Vietnam, India, Thailand, and others is expected to surge the market growth. Moreover, the rising number of bars, lounges, and pubs is projected to proliferate the demand for the product over the forecast period.

The COVID-19 pandemic has negatively impacted the global beer glassware market. During the lockdown, all the restaurants, bars, and hotels were shut down which is expected to adversely impact the growth of beer glassware production. In addition, beer glassware manufacturing facilities are not working at full capacity due to lockdown measures. The supply chain disruption and lack of labor force have hampered the growth of beer glassware products.

For instance, in April 2020, Libbey Inc. has reduced its manufacturing and distribution operations in Mexico. Moreover, to reduce capital expenses, the company has also cut down the salaries of its employees. However, once the lockdown eases the market is expected to grow at a sluggish rate in the next few years.

Leading players in the market include Arc International; Libbey, Inc.; Bormioli Rocco; Oneida Group; Corelle Brands, LLC; BayerischeGlaswerke GmbH; Shanxi Dahua Glass Industrial Co., Ltd.; The Boelter Companies; Ocean Glass; and Duralex USA.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America &Middle East & Africa |

|

Country scope |

U.S., Germany, U.K., China, India, Brazil, and South Africa. |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global beer glassware market report on the basis of product, application, distribution channel, and region:

• Product Outlook (Revenue, USD Million, 2015 - 2025)

• Mugs

• Pints

• Pilsner

• Weizen

• Others

• Application Outlook (Revenue, USD Million, 2015 - 2025)

• Household

• Commercial

• Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

• Offline

• Online

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Europe

• Germany

• U.K.

• the Asia Pacific

• China

• India

• Central & South America

• Brazil

• Middle East &Africa (MEA)

• South Africa

Research Support Specialist, USA