- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global combined heat and power (CHP) installation market size was accounted for USD 9.4 billion in 2019. The market is projected to witness a 3.1% CAGR over the forecast duration, 2020 to 2027. The shift towards the replacement of conventional energy systems with energy-efficient systems and the need for utility supply without interruption is estimated to drive the market. Further, consumers’ preference for sustainable energy and the rise in demand for captive power generation is estimated to bolster the market growth. In addition, increasing investment to curb carbon emission will drive the CHP installation.

The use of thermal power plants is prevalent in emerging countries. These power plants utilize only half of the total heat and the remaining heat is lost through the cooling tower, flue gas, and other ways. With the help of CHP, the remaining heat can be used for electricity generation, which, in turn, can increase the efficiency of the power plants by 80%. Stringent government regulation to reduce the CO2 emission is projected to drive the installation of combined heat and power.

Easy availability of natural gas at a low price is estimated to positively affect market growth. Natural gas is the main fuel used for CHP installation and it is available in adequate quantity in countries such as Iran, Russia, the United States, and Qatar. Moreover, natural gas-based systems are easy to install and prove cost-effective in the long run compared to other alternate fuels. The rise in energy prices has led to finding ways and means for cost-effective power generation.

Awareness about sustainable and cost-effective energy is gaining traction in emerging countries. Thus, the growing need for cost-effective energy is predicted to supplement the CHP installation from 2020 to 2027. However, the high initial cost incurred in the installation of a CHP system is estimated to restrain its market growth over the next seven years. Compared to diesel generators and boilers, CHP systems are costly.

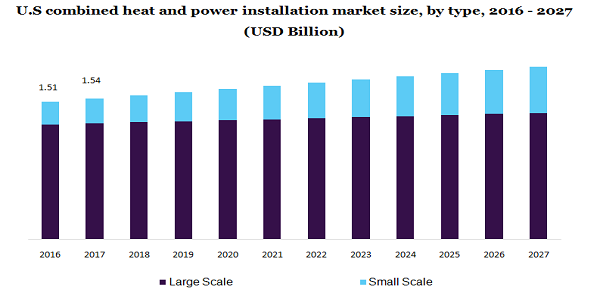

In 2019, the large-scale category held 79.5% of the share in the total market. Large scale segment finds its application in both industrial and commercial sectors. Increasing demand for energy from major industries such as textile, pharmaceuticals, sugar, refining, chemical, pulp, paper, and cement is driving the segment growth. This segment is used in these industries owing to the requirement for high pressure and temperature. On the other hand, the small-scale division held a little over 20% share in the market in 2019. Further, the segment is anticipated to register a 5.5% CAGR over the forecast duration.

The rise in demand for clean energy from both the commercial and residential sectors is estimated to drive market growth. Combined heat and power installation industries, owing to their sustainability, are increasingly favored over the conventional source of energy. CHP systems are widely used in the treatment of wastewater in the residential sector in countries such as Japan, the United States, and Germany. In addition, these systems find their application in various commercial set-ups such as hospitals, airports, military bases, and office buildings.

Based on fuel type, natural gas-powered CHP is estimated to hold a 66.0% share in the market by 2027. In 2019 also, the segment accounted for more than 65% share in the market and emerged as the largest among all. Easy and cost-effective availability of natural gas is the prime reason driving the segment growth. In addition, natural gas is considered to be a clean form of energy that helps in curbing carbon emissions. On the other hand, coal-based systems accounted for over 18% share in the market and are estimated to grow at a moderate pace over the forecast duration. Low cost and high calorific value make it a relevant source of energy to be used for the CHP system.

However, the emission of harmful gases and the high cost involved in handling is estimated to limit the use of coal. Biomass is the other renewable source of energy used in the CHP system. They are predominantly used in small-scale CHP systems and are likely to grow considerably over the forecast duration owing to their ability to curb carbon emissions. Various other fuel includes oil, processed waste, and wood. Wood waste is used in small-scale systems in both commercial and residential applications.

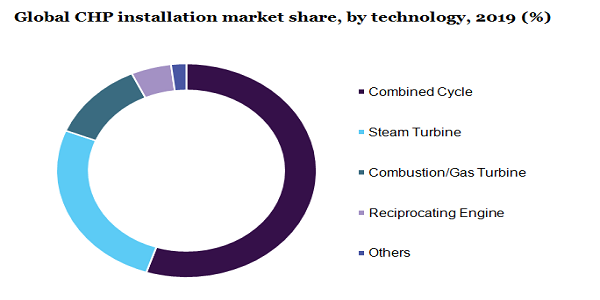

Depending on the technology, the combined cycle category held over 55% share in the market in 2019. The segment accounted for more than 6 billion in 2019. These systems are mostly used in applications where there is a need for high energy. Such applications are in industries like sugar, chemical, refining, paper, pulp, and pharmaceuticals. This technology offers various advantages such as low emission, thermal output, low installation, and energy efficiency.

Steam turbine-enabled technology held more than 26% of the share in the market in 2019. Further, the segment is likely to grow at a moderate pace from 2020 to 2027. Some of the other technologies incorporated in CHP installation are waste heat recovery, microturbine, fuel cell combustion turbine, and waste heat recovery among others. Of them, microturbines are used to generate electricity in the range of 30KW to 250 KW. Fuels such as natural gas, sour gas, and other liquid fuels are used in this system.

In 2019, Europe held the largest share in the market with over 50%. Further, the region is predicted to continue its dominance from 2020 to 2027. Government regulations to reduce pollution in countries such as U.K, France, and Germany are driving regional growth. On the other hand, in North America, the total demand for CHP installation was 110.5 GW in 2019. Further, the demand is anticipated to touch 142.9 GW by the end of 2027, expanding with a 3.3% CAGR. Regulations imposed by the U.S EPA are driving the CHP installation.

Asia Pacific held a 27% share in the market and was estimated to register a 4.3% CAGR over the forecast duration. The presence of large-scale manufacturing units in countries such as India, China, Japan, and South Korea is driving regional growth. Further, these countries are also focusing on curbing the emission, thereby, supplementing the CHP installation.

The outbreak of novel coronavirus has adversely affected the global combined heat and power installation market growth. The pandemic outbreak has led to the closure of several industries such as chemical, food & beverage, pulp, paper, manufacturing, and others. These industries are the major end-users of large-scale combined heat and power installation systems. The closure of these industries has adversely affected the demand for power consumption. In addition, key players in the market reduced their expenditure on research and development owing to lack of demand, thereby, considerably affecting the market growth.

CHP installation market is characterized by its moderately consolidated nature. Key players are focusing on building Recent Developments to introduce innovative products in the market. The introduction of new products helps companies in gaining a competitive edge over others. Technical advancements, partnerships, and increasing research & development activities are further anticipated to bolster the market growth. For example, GE signed an agreement with GreenTech installation of CHP in the Russian food and beverage, chemical and glass industries. Major players operating in the market are Centrica, Cummins Inc., General Electric, Caterpillar, Wartsila, E.ON SE, Clarke Energy, Tecogen Inc., and Siemens among others.

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 9.8 billion |

|

The revenue forecast in 2027 |

USD 12.0 billion |

|

Growth Rate |

CAGR of 3.1% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, fuel, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; RoW |

|

Country scope |

The U.S.; Canada; Mexico; The U.K.; Germany; Spain; Poland; Netherlands; France; Russia; Italy; China; India; Japan; South Korea; Taiwan |

|

Key companies profiled |

E.ON SE; Mitsubishi Hitachi Power Systems, Ltd.; Siemens; Centrica; General Electric; BdrThermea Group; Aegis Energy Services Inc.; Clarke Energy; Cummins Inc.; Capstone Turbine Corporation; Caterpillar; Elite Energy Systems, LLC; Doosan Fuel Cell America, Inc.; Tecogen Inc.; Wartsila |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Million Insights has segmented the global combined heat & power installation market report based on product, fuel, technology, and region:

• Type Outlook (Volume, GW; Revenue, USD Billion, 2016 - 2027)

• Large Scale

• Small Scale

• Fuel Outlook (Volume, GW; Revenue, USD Billion, 2016 - 2027)

• Natural Gas

• Coal

• Biomass

• Others

• Technology Outlook (Volume, GW; Revenue, USD Billion, 2016 - 2027)

• Combined Cycle

• Steam Turbine

• Combustion/Gas Turbine

• Reciprocating Engine

• Others

• Regional Outlook (Volume, GW; Revenue, USD Billion, 2016 - 2027)

• North America

• The U.S.

• Canada

• Mexico

• Europe

• Germany

• The U.K.

• France

• Russia

• Poland

• Spain

• Italy

• Netherlands

• the Asia Pacific

• China

• India

• Japan

• South Korea

• Taiwan

• Rest of World (RoW)

Research Support Specialist, USA