- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global field device management (FDM) market size was accounted for USD 1.2 billion in 2018. It is projected to grow at the CAGR of 6.8% over the forecast period, 2019 and 2025. The growing trend of smart and automated technologies is a key factor supporting market growth. In addition, digitalization in product lifecycle management for greater productivity is projected to propel the demand for smart technology devices.

The rising penetration of industry 4.0 and smart factories is projected to create ample opportunities for market growth. Mass production in the manufacturing and automotive sector requires FDM solutions for better efficiency. These solutions also help in lowering maintenance & operational costs.

The development of industrial IoT applications in the manufacturing sector is expected to positively impact market growth. Industrial IoT solutions offer high-speed operation with greater efficiency. This also allows integration with advanced systems with high automation. Thus, automation companies focus on developing industry 4.0 standard solutions for enhanced performance in manufacturing operations.

From the last few years, the increasing investments by the industry players in utilizing smart devices are projected to surge the demand for FDM solutions. In large manufacturing companies, mass production is done using FDM solutions. Furthermore, the growing trend of digitalization in the automation industry is also expected to support market growth.

FDM solutions are highly used in industrial automation applications. Additionally, smart factories benefit from these smart solutions that offer real-time data management. The companies get high compliance and better mobility owing to the utilization of field device solutions.

The offering segment is comprised of software and hardware system. The software offering segment led the field device management market with the highest share in the overall market. Some of the key players include Siemens, ABB, Schneider Electric, Fanuc Corporation, and Honeywell International. FDM solution needs configuration tools for troubleshooting purposes. Software solutions provide predictive maintenance analysis for better efficiency.

In the market, few companies provide both hardware & software-based solutions. For example, Hamilton Company provides Arc sensors with a configuration tool. Similarly, PHOENIX CONTACT provides hardware such as isolators, and converters, repeaters, gateways, multiplexers, and extenders. Emerson Electric offers asset management solutions through software tools that are integrated with industry 4.0 standards. Thus, the software segment is anticipated to grow at a significant rate in the next few years.

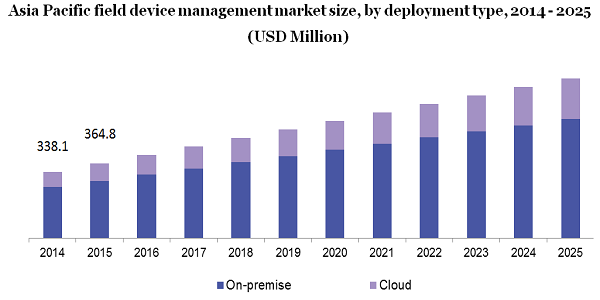

The on-premises segment held the largest market share in the overall market, mainly due to rising cybersecurity concerns. On-premise deployment solutions offer better security and integration capability. The companies prefer on-premise solutions for addressing legal liabilities and indemnification issues.

Cloud-based deployment solutions are anticipated to grow at a significant rate due to the rising trend of IoT-enabled devices. Moreover, various smart solution providers focus on developing IoT-based and cloud solutions. Key players in the market offer these services through acquisitions and mergers activities by expanding their product portfolio. However, on-premise solutions are expected to continue their dominance in the next few years.

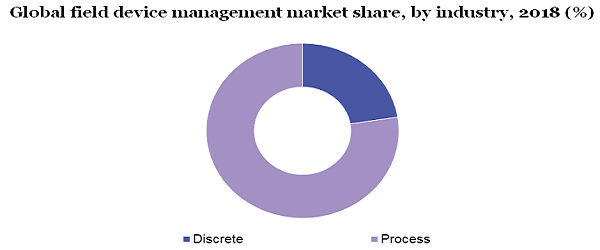

Depending on industries, the market is split into process industries and discrete industries. Discrete industries are comprised of manufacturing, aerospace, and automotive. On the other hand, process industries include chemicals, oil & gas, metals & mining, food & beverages, pharmaceuticals, and others. In 2018, process industries have contributed to the largest market share in the overall market. In addition, increasing demand for industry 4.0 standard, big data is expected to create huge opportunities for market growth.

In the process industry, the FDM solution helps in prioritizing maintenance and operational tasks, while in the discrete industry it helps in reducing operational costs. Moreover, FDM solutions are highly required for chemicals, energy & utilities, and oil & gas applications. FDM solutions offer automation & improved control for maintaining assets in the company. In various manufacturing units, process automation is needed for better operational performance, which, in turn, is projected to boost segmental growth.

In 2018, North America led the field device management market with a market share exceeding 25.0% in the overall market. Growing industrial automation & development along with rising income levels in the region is projected to foster market growth. In addition, rising investment in IIoT solution development is a key factor proliferating the demand for FDM solutions.

Asia Pacific is projected to grow at the fastest CAGR over the forecasted period. This growth is attributed to rising demand from food & beverages, energy, and oil & gas industries. Furthermore, rapid industrialization and supportive government policies are expected to surge the growth of the market. In the Asia Pacific, growing economies such as Japan and China are expected to be major contributors to the market.

COVID-19 crisis has disrupted the market owing to the lack of workforce and supply chain operations. However, this impact is expected to restrain the market growth for a shorter period of time.

Several companies in the automobile and electronics industries are focusing on accelerating their business through automation and advanced analytics. This helps to enhance field operation at manufacturing or operations sites. COVID-19 pandemic has posed various challenges in business operations, due to which companies are seeking automated remote systems. Thus, the market is expected to grow steadily over the next few years.

Leading players in the market include Siemens; ABB; Rockwell Automation Inc.; OMRON Corporation; Yokogawa; Mitsubishi Electric; Metso Corporation; FANUC Corporation; Schneider Electric; Valmet; Azbil Corporation; PHOENIX CONTACT; and Hamilton Company.

Key players in the market collaborate with others and focus on strategic acquisitions to remain competitive in the market. For example, in 2018, Emerson Electric acquired an intelligent platform offered by General Electric to expand its presence across the globe.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, South America & Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, and Brazil. |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the global field device management market report on the basis of offering, deployment type, industry, and region:

• Offering Outlook (Revenue, USD Million, 2014 - 2025)

• Hardware

• Software

• Deployment Type Outlook (Revenue, USD Million, 2014 - 2025)

• Cloud

• On-Premises

• Industry Outlook (Revenue, USD Million, 2014 - 2025)

• Discrete Industries

• Automotive

• Manufacturing

• Aerospace & Defense

• Process Industries

• Energy & Utilities

• Metals & Mining

• Oil & Gas

• Food & Beverages

• Chemicals

• Pharmaceuticals

• Others

• Regional Outlook (Revenue, USD Million, 2014 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• Asia Pacific

• China

• Japan

• India

• South America

• Brazil

• Middle East & Africa (MEA)

Research Support Specialist, USA