- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global insulated food containers market size was worth USD 1.5 billion in the base year 2018. Growing demand for chilled and fresh food from consumers is driving the market growth. Further, insulated packaging helps in ensuring the food quality remains the same for a longer duration, thus, fueling the market growth.

Further, technological innovation in the manufacturing of lightweight plastics as an alternative to metals is likely to be a key factor driving the insulated food container market growth over the forecast duration. Moreover, plastic containers are cost-effective than metal ones and are expected to gain traction among consumers over the forecast period, 2019 to 2025.

Preparation of fresh food requires time and lack of time owing to changing lifestyles encourages consumers to rely on insulated containers. Long working hours and hectic lifestyles further make it difficult for consumers to ensure the availability of fresh foods. Growing working-class populations in countries such as India and China are expected to provide lucrative opportunities for manufacturers to expand their market presence.

Among the working-class population, insulated tote bag has gained huge traction in the past few years. Factors such as aesthetically appealing design and durability make it a popular choice among consumers. Insulate tote bags are witnessing significant demand from developed regions such as Europe and North America as consumers use these bags to carry different kinds of beverages during their travel and picnic.

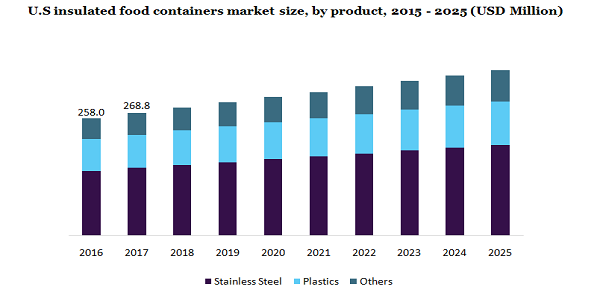

Based on the product, the insulated food containers market is segmented into stainless steel and plastic. Stainless steel held the maximum share with 58.9%, in 2018. Owing non-toxic, corrosion-resistant, and non-reactive properties of stainless steel, it can be used to store different kinds of foods and beverages. Further, it does not permit the transfer of bacteria and odor thus, ensuring product safety.

On the other hand, plastic made insulated food containers are anticipated to witness the fastest growth over the forecast period. Lightweight and cost-effectiveness are primary factors supplementing the growth of this segment. The cost of plastic is one-third of that of stainless steel. Further, it is non-reactive to different kinds of foods and beverages.

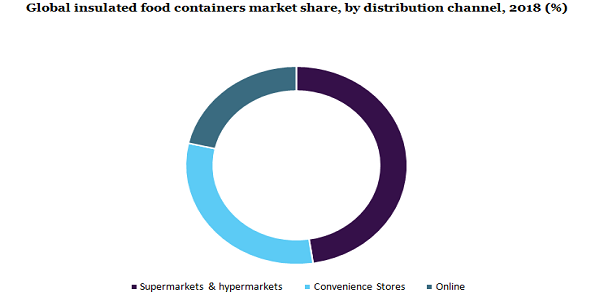

Among different distribution channels, the hypermarkets and supermarkets category held 45% of the market share, in 2018. The availability of a wide range of supermarkets and hypermarket stores across the regions is bolstering the segment growth. These sales channels allow customers to check the products physically and their quality, thus, attracting a huge customer base.

On the other side, the online sales channel is estimated to foresee a maximum CAGR of 6.8% over the forecast period. Various features such as doorstep delivery, discounts, and a wide range of product availability are driving the sales through the online channel. Emerging countries such as India and China are witnessing significant growth in e-commerce, which, in turn, offers a lucrative opportunity to market players to strengthen their online presence.

Asia Pacific is likely to grow at the highest CAGR of 6.2% over the forecast period owing to increasing demand for insulated food containers from the working-class population. As reported by the International Labor Organization, 68.2% of the population in Asia is employed, in 2018 and this number is expected to increase further shortly. In this region, most of the school-going students carry their home-cooked foods. This factor, in turn, will further boost product demand. China, alone, held 41% of the market share in the Asia Pacific while India is expected to grow fastest owing to the rapidly surging working-class population.

North America held over 20% of the market share, in 2018. The growing working-class population in the United States drives the region's growth. The country is the home of 130 million employees working full-time. Further, the increase in the middle-class population in Mexico is anticipated to drive regional growth over the forecast period.

Leading players operating in the market are Zojirushi America Corporation, Carlisle FoodService Products, Hamilton Housewares Pvt Ltd, TokyoPlast, Cambro Foodservice Equipment and Supplies, Valor Industries, and thermos L.L.C, Stanley among others. These companies are focusing on the introduction of new products, mergers & acquisitions, and other strategic initiatives to hold a larger market share. For example, Avon Appliances introduced stainless steel-made food containers in 2017 in the 14 to 40 liters capacity range.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million and CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S., Germany, U.K., China, India, Brazil, and South Africa |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the global insulated food containers market report based on product, distribution channel, and region:

• Product Outlook (Revenue, USD Million, 2015 - 2025)

• Stainless Steel

• Plastics

• Others

• Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

• Hypermarkets & Supermarkets

• Convenience Store

• Online

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Europe

• Germany

• U.K

• the Asia Pacific

• China

• India

• Central & South America

• Brazil

• Middle East & Africa

• South Africa

Research Support Specialist, USA