- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

With reference to the report published, the global laboratory proficiency testing market size was prized by USD 1.1 billion in 2019. It is estimated to witness a 7.3% CAGR from 2020 to 2027.

Due to the strict rules, in addition to the rising concentration on diagnostic laboratories, caused by the COVID-19 pandemic, the enlargement of the market should be credited to the growing acceptance of laboratory proficiency testing.

The increasing number of novel proficiency testing programs, presented by the major companies, is furthermore estimated to push the market for laboratory proficiency testing. The proficiency testing helps to make sure that the tests for the discovery of the new coronavirus are being processed, understand, and managed correctly, to attain greater precision and trust in results. As a result, proficiency tests offer laboratories, by way of the guarantee, that their diagnosis is precisely completed.

In December 2018, the corroboration of cannabis products in the U.S., along with the steady growth of this market, is pushing the requirement for the testing of security and usefulness for medicinal utilize. Rising demand for excessive strength cannabis has caused the organization of the laboratories that test the cannabis strength. So, the execution of the system, to check the effectiveness and contaminants, is likely to increase the expansion of the laboratory proficiency testing market.

Proficiency testing is critical in every area, affected by the pandemic. Different associations are taking on the programs to fight the challenges confronted by the laboratories, connected to the official recognition, by this means, increasing the development of the market. For example, the European Civil Protection and Humanitarian Aid Operations (ECHO) and WHO operated with the Department of Health (DOH) and native administrations, to offer training and make official recognition of certain testing laboratories, in November 2020.

In 2019, hospitals retained the major 32.8% share of the laboratory proficiency testing market. On account of the extensive utilization by physicians, patients, and hospitals, the diagnostic laboratories section is estimated to observe the highest enlargement, throughout the forecast period. This sector is additionally segmented into specialty and independent laboratories. Diagnostic labs should contest with hospital laboratories for sampling. Yet, the extensive variety of tests, offered by these labs in a restricted period, is a good advantage.

Contract research organizations are anticipated to observe considerable expansion, during the forecast period. Promising markets like China and India are the most important centers for contract research organizations. Strict rules by FDA about the clinical trials and R&D are estimated to increase the range of laboratory proficiency testing, by way of contract research organizations.

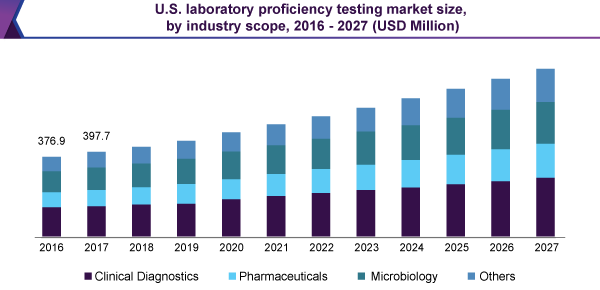

The clinical diagnostics section retained the biggest 34.5% revenue share, in 2019. This is credited to the advancement of the composite analytical tests and the greater speed of before-time diagnosis, being carried out. This creates quality administration, by the exercise of proficiency testing, an indispensable feature in clinical diagnostics. Proficiency testing is able to; furthermore, increase testing accurateness, the effectiveness, and test reproducibility of clinical diagnostics.

The clinical diagnostics section is subdivided into coagulation, oncology, immunochemistry, molecular diagnostics, hematology, and clinical chemistry. Due to the existence of the tests for immunoglobulin, urine electrophoresis, hormones, allergies, serum electrophoresis, infectious diseases, and autoimmune diseases, in the section, immunochemistry retained a significant market share, in 2019.

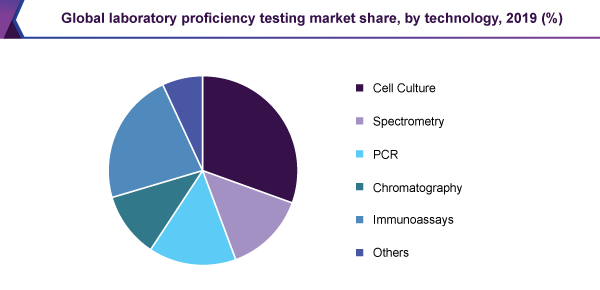

In 2019, the cell culture sector held the largest 30.4% revenue share in the laboratory proficiency testing market. Due to its usage in diagnosing the existence of communicable microbes in the blood, it is expected to develop at a profitable rate, in the near future. Besides, these tests are carried out in pharmaceutical manufacturing, to confirm the benefits of cell culture-based products and vaccines.

The growth in the acceptance of cell-culture sourced products, for example, monoclonal antibodies, has initiated an enhancement in the acceptance of cell culture tests, to attain utmost production from the microbial strain cultures. The existing proficiency tests, in this sector, are to gauge the efficiency of the laboratories and verify the contamination in cell cultures.

Due to its utilization in the diagnosis of particular antigens or antibodies, inside the blood, the immunoassays sector retained a large share of the market, in 2019. They are fast, precise, and easy to function. It can be used in labs and on-site. They are, furthermore, utilized for measuring any particular analytics in the blood, by means of the exercise of immunological reactions.

Asia Pacific is expected to show the highest 9.5% CAGR, throughout the forecast period. Rising alertness regarding healthcare and the increasing figure of laboratories, ready for global accreditations within the region, is expected to stimulate the enlargement of the laboratory proficiency testing market.

North America held the biggest 44.2% revenue share, in 2019, and is estimated to keep up its leading position during the forecast period. This is credited to the strict regulatory structure and the rising acceptance of proficiency testing. The existence of key players in the U.S. is, furthermore, anticipated to add to the enlargement of the local market for laboratory proficiency testing.

The market functions by a greater complication. It contains a quarterly as well as a yearly system that permits testing capability of the laboratories and contains products, to check the ability of labs.

Companies are taking on mergers & acquisitions and joint ventures with the intention of making stronger their manufacturing capability, product range, and offer reasonable demarcation. For example, the Central Testing Laboratory of the Abu Dhabi Quality & Conformity Council executed a program for proficiency testing in association with Biogenix Lab, to confirm the ability of the medicinal laboratories, executing COVID-19 tests, in October 2020.

The existence of major companies in this market considerably reduces the opening for a fresh entry into the market, since it is hard to go with the necessities for the excessive investment.

• INSTAND

• RCPA

• NSI Lab Solutions

• AOAC International

• Weqas

• QACS - The Challenge Test Laboratory

• Bio-Rad Laboratories, Inc.

• American Proficiency Institute

• UK NEQAS

• Absolute Standards, Inc.

• BIPEA

• ERA

• Merck & Co., Inc.

• Randox Laboratories Ltd.

• College of American Pathologists

• LGC Limited

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 1.2 billion |

|

The revenue forecast in 2027 |

USD 1.9 billion |

|

Growth Rate |

CAGR of 7.3% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Industry scope, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Singapore; Malaysia; Thailand; Vietnam; Oceania; Brazil; Argentina; South Africa; North Africa; UAE; Saudi Arabia; Qatar; Bahrain |

|

Key companies profiled |

LGC Limited; American Proficiency Institute; College of American Pathologists; Bio-Rad Laboratories, Inc.; Randox Laboratories Ltd.; QACS - The Challenge Test Laboratory; Merck & Co., Inc.; Weqas; ERA; AOAC International; BIPEA; NSI Lab Solutions; Absolute Standards, Inc.; RCPA; UK NEQAS; INSTAND |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insights has segmented the global laboratory proficiency testing market report on the basis of industry scope, technology, end-use, and region:

• Industry Scope Outlook (Revenue, USD Million, 2016 - 2027)

• Clinical Diagnostics

• Clinical Chemistry

• Immunochemistry

• Hematology

• Oncology

• Molecular Diagnostics

• PCR

• Others

• Coagulation

• Pharmaceuticals

• Biologics

• Vaccines

• Blood

• Tissues

• Others

• Microbiology

• Pathogen Testing

• Sterility Testing

• Endotoxin & Pyrogen Testing

• Growth Promotion Testing

• Other Microbial Testing

• Others

• Technology Outlook (Revenue, USD Million, 2016 - 2027)

• Cell Culture

• Spectrometry

• Polymerase Chain Reaction

• Chromatography

• Immunoassays

• Others

• End-use Outlook (Revenue, USD Million, 2016 - 2027)

• Hospitals

• Contract Research Organizations

• Pharmaceutical & Biotechnology Companies

• Academic Research

• Diagnostic Laboratories

• Independent Laboratories

• Specialty Laboratories

• Regional Outlook (Revenue, USD Million, 2016 - 2027)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• Italy

• Spain

• The Asia Pacific

• Japan

• China

• India

• South Korea

• Singapore

• Malaysia

• Thailand

• Vietnam

• Oceania

• Latin America

• Brazil

• Argentina

• Middle East & Africa

• South Africa

• North Africa

• UAE

• Saudi Arabia

• Qatar

• Bahrain

Research Support Specialist, USA