- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global light-duty vehicles market size was worth USD 522.62 billion in 2018. The market is estimated to witness an 8.5% CAGR over the forecast duration, 2019 to 2025. These vehicles’ Gross Vehicle Weight Ratio is less than 8,500 lbs. These vehicles are known to emit low pollution, thereby gaining traction among consumers. In addition, government regulation to reduce carbon emission is anticipated to encourage electric light-duty vehicles.

The Indian government has introduced Bharat Stage Emission Standards (BSES) with different categories. It helps in regulating the amount of air pollution generating from automobiles. Similarly, the European Union has set up an emission standard that decides the acceptable exhaust emission limit. Light-duty vehicles emit lower pollutants, thereby, becoming the first choice for goods and people transportation.

In recent years, manufacturers are introducing light-duty vehicles having features such as fleet tracking, safety, and navigation. Technical advancements have resulted in the increasing adoption of self-driven vehicles equipped with analytics and location-based services. Further, telematics integration, which has led to easy tracking of vehicles, is anticipated to bode well for the growth of the market.

The supply chain, which is a critical part of logistics and transportation, has become complex. Amid changing consumers’ preferences, last-mile delivery has become the need of the hour. Further, increasing innovation concerning the transportation of passengers and last-mile delivery is predicted to augment the growth of the market. With the rapidly increasing e-commerce industry, the demand for light-duty vehicles is expected to surge considerably over the next few years.

Governments across the globe have regulations in place aimed at increasing the efficiency of light-duty vehicles, which in turn, likely to supplement the market growth. For example, the Corporate Average Fuel Economy (CAFE) implemented by the United States government is aimed at improving the efficiency of light-duty vehicles including cars in the U.S. Technical developments in drivetrain technology are further permitting automakers to provide fuel-efficient vehicles.

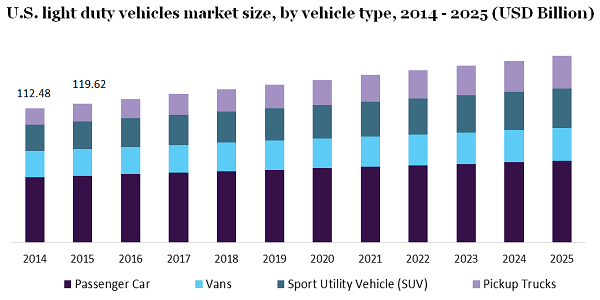

Depending on the vehicle type, the light-duty vehicle market is bifurcated into the van, pickup trucks, passenger car, and Sports Utility Vehicle (SUV). Among them, in 2018, the passenger car division accounted for a significant share in the market and is anticipated to witness steady growth from 2019 to 2025. Increasing demand for passenger cars in tourism is a key driving factor. On the other hand, the van category also held a significant share in the market. E-commerce and healthcare sectors have been increasingly deploying van in their operations. In addition, some other services such as ambulance service, policing, rescue operations, and postal services are increasingly witnessing demand for vans.

The pickup trucks are anticipated to witness the highest growth over the forecast duration. Increasing demand for pickups for towing vehicles is driving the market growth. Pickup trucks offer longer torque, thus, there are capable of pulling campers, trailers, and boats conveniently. In addition, pickup trucks can be used in different weathers and terrains. Further, the increasing popularity of smaller and fuel-efficient vehicles like Hyundai Santa Cruz is driving the demand for pickup trucks vehicles.

The market is categorized into gasoline, diesel, electric, and hybrid by fuel type. In 2018, gasoline vehicles accounted for the highest share in the market. Gasoline-powered vehicles not only emit lesser emissions than diesel but they are cost-effective as well. However, electric vehicles are estimated to witness the fastest growth rate from 2019 to 2025. Electrical vehicles are capable of high performance and emit zero emission. Across the globe, governments are focusing on increasing the adoption of electrical vehicles by building the necessary infrastructure.

Manufacturers are also offering incentives to the buyer on electric vehicles. For example, discounts and bonus payments are offered on insurance in North America on the purchase of electric vehicles. Electric vehicle adoption is also fueled by the stringent emission norms imposed by governments in countries like France, U.K, China, India, and the Netherlands.

Depending on the drivetrain, the light-duty vehicles market is categorized into Four Wheel Drive (4WD), Rear Wheel Drive (RWD), All-Wheel Drive (AWD), and Front Wheel Drive (FWD). Of them, RWD is the most common type and is majorly used in passenger cars. It helps in better balancing and traction of vehicles. Owing to this, an RWD car accelerates faster than one with FWD.

On the other hand, the AWD category is projected to witness the highest growth in the next six years. It includes the center, rear, and front differential that help in distributing the power uniformly to all four wheels. These kinds of drivetrains are most commonly used in minivans and SUVs. AWD equipped vehicles to improve the performance of the vehicle in cold environmental conditions. Additionally, AWD is suitable for vehicles, which have all-terrain driving capabilities.

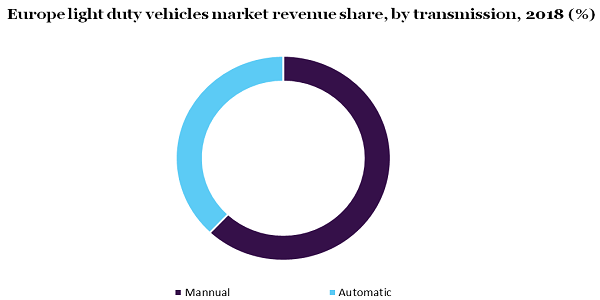

By transmission, the market is bifurcated into automatic and manual. In 2018, the manual division accounted for the largest share in the market. This transmission offers better fuel efficiency apart from consuming 5-10% less fuel than automatic transmission. Moreover, vehicles with manual transmission are cheaper than automatic ones. In recent times, the demand for clutch-less manual transmission vehicles has increased significantly.

On the other hand, the automatic transmission segment is projected to witness the highest growth rate from 2019 to 2025. Factors such as technological advancements and end-user preferences are driving the growth of this segment. Unlike manual transmission, the fuel efficiency in automatic transmission vehicles is not dependent on driver proficiency. The autonomous transmission segment has witnessed significant investment in the past few years.

In 2018, North America held the largest share in the light-duty vehicle market due to the rise in the sales of electric vehicles coupled with favorable government initiatives. The United States has the largest number of light-duty vehicles, which further contribute to the growth of the region. Besides, APAC is likely to exhibit the fastest growth from 2019 to 2025. The rapidly growing e-commerce industry is the prime factor attributing to the growth of the region. Government regulation to curb vehicular emission is also projected to drive the adoption of light-duty vehicles.

Europe held a significant share in the market in 2018. European countries are well connected via roads. Increasing road transportation in cargo delivery is attributing to the growth of the region. As per the Eurostat, more than 75% of inland cargo transport, which is equivalent to 1,750 billion metric ton-kilometer (tkm) takes place by road.

The outbreak of COVID-19 has led to a sudden fall in the production of the automobile including light-duty vehicles. Manufacturers of light-duty vehicles rely heavily on raw materials. Owing to the outbreak of COVID-19, the supply chain was disrupted severely, which halted the production of new light-duty vehicles. In addition, the demand for passenger vehicles has also gone down as public spending reduced significantly.

Indian commercial vehicles sales are projected to contract by 8 to 10% in the financial year 2021. The United States is also estimated to witness a similar trend. On the other hand, China witnessing a v-shaped growth trajectory as the country controlled the spread of COVID-19 to great extent. However, the COVID-19 impact would be for the short to mid-term only and the demand for light-duty vehicles would pick pace once the situation gets normal. To address the current crisis, companies can focus on mergers and acquisitions. In addition, they can increase their spending in research and development to manufacture cost-effective light-duty vehicles.

Major players operating in the market are Daimler AG, Ford Motor, Honda Motor, Nissan Motor, BMW AG, and Subaru Corporation among others. Key players are aiming to consolidate their position in the market and focusing on introducing new light-duty vehicles. Some major manufacturers such as Volkswagen, Daimler, and Renault-Nissan are working in tandem to create a common platform to minimize lead-time and reduce development costs.

Manufacturers of light-duty vehicles are highly dependent on suppliers as they source over 50% of components from them. Thus, OEMs prefer to establish strong partnerships with component suppliers in order to ensure uninterrupted supply. Major market participants are aggressively investing in research and development to build an innovative solution and obtain competitive benefits over their peers.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion, Volume in Million Units, and CAGR from 2019 to 2025 |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. |

|

Country scope |

U.S., Canada, U.K., Germany, India, China, Japan, South Korea, Brazil, and Mexico |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the global light-duty vehicles market report on the basis of vehicle type, fuel type, transmission, drivetrain, and region:

• Vehicle Type Outlook (Volume, Million Units; Revenue, USD Billion, 2014 - 2025)

• Passenger Car

• Van

• Sports Utility Vehicle (SUV)

• Pickup Truck

• Fuel Type Outlook (Volume, Million Units; Revenue, USD Billion, 2014 - 2025)

• Diesel

• Gasoline

• Hybrid

• Electric

• Transmission Outlook (Volume, Million Units; Revenue, USD Billion, 2014 - 2025)

• Manual

• Automatic

• Drivetrain Outlook (Volume, Million Units; Revenue, USD Billion, 2014 - 2025)

• Front Wheel Drive (FWD)

• Rear Wheel Drive (RWD)

• Four Wheel Drive (4WD)

• All-Wheel Drive (AWD)

• Regional Outlook (Volume, Million Units; Revenue, USD Billion, 2014 - 2025)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• The Asia Pacific

• China

• India

• Japan

• South Korea

• Latin America

• Brazil

• Mexico

• Middle East & Africa

Research Support Specialist, USA