- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global natural household cleaners market size was accounted for USD 3.7 billion, in 2018 and is anticipated to grow at a CAGR of 11.1% over the forecast period of 2019 to 2025. Increasing awareness towards health and hygiene, along with adverse effects on the environment by using cleaning products having harmful chemicals, is projected to propel market growth.

Additionally, natural ingredients like vinegar, baking soda, essential oils, and natural salt are used in the formulation of these products, which restrain the contamination of the open environment due to the toxicity of these products. Further, these products are not harmful to the skin that results in the application of these products in numerous areas.

Over the last few years, wide-scale usage of ordinary household cleaning products like glass, fabric, and floor cleaners, have led to an increase in the number of chronic diseases. Hazardous chemicals as ingredients in cleaners get absorbed into the skin or are inhaled by consumers that may lead to chronic diseases like asthma and skin allergies. Rising concerns regarding bacteria, viruses, and other germs in living spaces along with increasing awareness towards health and hygiene have resulted in an increase in demand for natural products having disinfectant and antimicrobial properties. Additionally, governments all around the world are trying to confine the content of hazardous chemicals from household cleaning products.

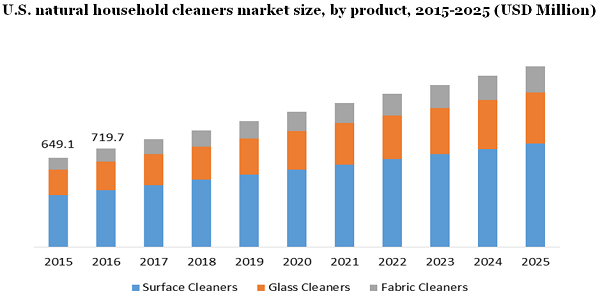

Surface cleaners dominated the natural household cleaner market with over 50% of the share in the total revenue in 2018. Rising concerns towards the potential threat of spreading bacterial infections and diseases because of contaminated surfaces and floors have propelled the demand for natural cleaners. Manufacturers are concentrating on launching new products, using innovative technologies, and expanding their production capacity to meet the demand of the consumers for natural cleansers.

For example, Saje Natural Business, in April 2018 introduced a variety of home cleaners like glass cleaner, dish soap, tub and tile cleaner, fabric cleaner, multi-purpose cleaner, and biodegradable cleaning cloths that are 100% natural cleaners. The company is concentrating on providing natural products for health and hygiene concerns.

The kitchen application segment is anticipated to grow at a CAGR of 11.3% over the forecast period. Major players like Reckitt Benckiser Group Plc, Unilever, Henkel Ag & Co. Kgaa, and The Procter & Gamble Company are introducing a new range of products for meeting the demand for natural kitchen cleaners. For example, Target Corporation, a retail giant, launched a variety of sustainable and natural cleaning products under the brand name Everspring that included paper towels, dish soap, and fabric detergents in April 2019.

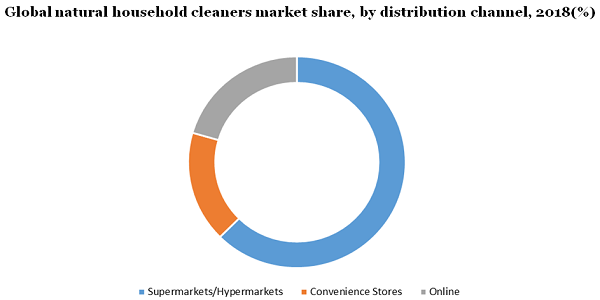

The online distribution channel is anticipated to grow at the fastest CAGR of 11.6% over the forecast period due to the ease and convenience of shopping. Further, digital platforms like Google ads and social media websites or applications play an important role in convincing the consumers to switch their method of buying from offline stores to e-commerce platforms like Amazon, Walmart, Grofers, Rakuten, and Auchan. Moreover, the feasibility of high-speed internet and extensive use of smartphones is anticipated to drive the segment growth in the forecast period. The online grocery business is prospering in emerging economies like India because of the lucrative opportunities the market provides. Further, global retail and e-commerce companies like Walmart, Amazon, and Alibaba are investing in the Indian market to gain traction in the natural household cleaners market.

The supermarkets and hypermarkets segment dominated the market with 62.5% of the total share in the revenue in 2018. The unorganized retail sector is one of the major channels of distribution in emerging economies like Thailand, India, Bangladesh, and Indonesia. A very limited number of manufacturers sell their products directly to consumers. Amway is one of the leading direct sellers of personal care and household care products that also include cleaning products. Additionally, Amazon has launched its own grocery stores across major states in the U.S., for gaining a larger part of the market share in this segment as it’s already one of the market leaders in the online segment.

Europe dominated the market with over 30% share in 2018 and is projected to grow steadily over the upcoming years due to considerably increasing consumer awareness towards health and hygiene along with adverse effects of cleaning products on the environment in countries like France, the U.K., and Germany. Moreover, the government in these countries has mandated the certification as a large number of companies producing natural products are raising significantly.

The Asia Pacific has two of the world’s most populated countries that are India and China. Major international players along with domestic manufacturers are constantly introducing new products to meet the demand of the region that is significantly increasing owing to rising awareness regarding hygiene and cleanliness. For example, P&G launched a new line of antibacterial cleaning products under the name Microban 24.

The major global players in the industry include Reckitt Benckiser Group Plc, Unilever, Henkel Ag & Co. Kgaa, and The Procter & Gamble Company. Further, some of the major domestic players like Saje Natural Business, AlEn USA, and Netsurf Network are capturing the market with their innovative range of products and great pricing strategy. Moreover, manufacturers are adopting strategies like developing new products, using advanced technology, celebrity endorsements, mergers & acquisitions, and expanding distribution channels for capturing a large consumer base. For example, Reckitt Benckiser Group Plc is driving the mission of “Har Ghar Swachh” in India by promoting its brand Harpic with the help of celebrities as its brand ambassador.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Country Scope |

U.S., Germany, U.K., France, China, India, Brazil |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global natural household cleaners market report based on product, application, distribution channel, and region:

• Product Outlook (Revenue, USD Million, 2015 - 2025)

• Surface Cleaners

• Glass Cleaners

• Fabric Cleaners

• Application Outlook (Revenue, USD Million, 2015 - 2025)

• Bathroom

• Kitchen

• Others

• Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

• Supermarkets/Hypermarkets

• Convenience Stores

• Online

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Europe

• Germany

• U.K.

• France

• the Asia Pacific

• India

• China

• Central & South America

• Brazil

• Middle East & Africa

Research Support Specialist, USA