- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global premium larger market size was worth USD 161.1 billion, in 2018. It is expected to grow with a CAGR of 4.5% from 2019 to 2025. The market is expected to gain traction owing to rising demand among consumers for a larger beer with its smooth taste when compared to conventional beer available in the market.

Health-related problems such as diabetics, prevention of minor fractures, blood pressure, and fungal infection can be dealt with with the consumption of premium larger products. Further, other factors like rising in disposable income, urbanization, and increasing customer inclination towards the consumption of alcohol-based beverages are projected to accelerate the market in developing nations like China and India are.

Moreover, trends of adopting western culture like alcohol consumption in office parties can be a significant factor propelling the premium larger market. Newmarket opportunities are expected from the tremendous shift of rural population towards urban areas in the developed countries mentioned above along with their adoption of western culture.

Supportive policies of government are predicted to play a major role in determining the industry trends. Recently, various agencies such as the U.S. TTB (Alcohol and Tobacco Tax and Trade Bureau), and the U.S. EPA (Environmental Protection Agency) have been incorporating strict norms on emissions and packaging related to the manufacturing of beer. Moreover, other norms include legal issues related to age limit, consumption, and sale of alcohol are projected to negatively affect the demand-supply over the forecast period.

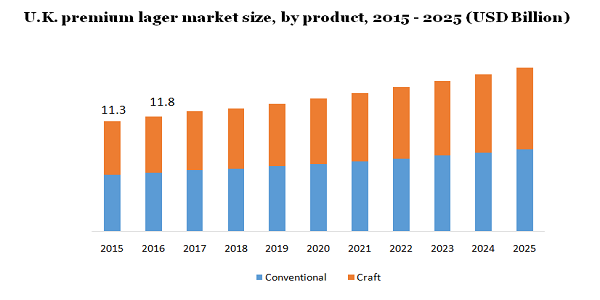

In 2018, traditional premium beer held the largest share with 54.6%s. It is manufactured by breaking down at a relatively low temperature of 45 to 60-degree Fahrenheit. The low price of raw materials along with easy procurement of these beers, easy preparations facilitate a satisfactory return on investment for the producers.

The growth accounts for the existing consumption of regular beers in European countries like the U.K., France, and Germany. Moreover, increasing consciousness pertaining to the health benefits of beer like faster recovery from injury and pain, better kidney health, and prevention of type 2 diabetes is predicted to boost the demand for a regular premium lager.

Craft premium lager beer is projected to grow with a CAGR of 4.8% in the forecasted period. Beers manufactured in craft brewing facilitate an original taste that is attributed to attracting customer desires. Canada, U.S., U.K., and Germany are the leading consumers of larger products. Daily drinking of beer to prevent anxiety and work stress is preferred by the population of these countries. The producers are concentrating on the development of new flavors and types with added health benefits from having this type of beer.

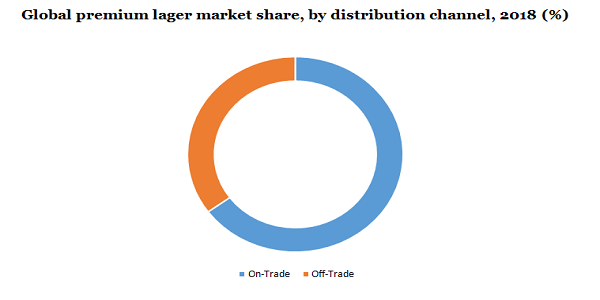

The premium lager is procured through on-trade channels like restaurants, hotels, bars, and clubs. The on-trade division accounts for the highest share of 65.0% as a result of an increase in resto-bars in big economies. Furthermore, the pure taste of beer or good ambiance of clubs attracts more customers. New players like B-Dubs, an international sports bar like Buffalo Wild Wings, Inc., are entering with new alcoholic products for India. These are some of the key factors driving the market growth.

The off-trade segment is anticipated to grow with a CAGR of 5.0% in the forecasted period. The off-trade channel is projected to remain a leading channel among the customers in evolving nations like India and China as they provide products in retail. Services like combo packs and gift packages also draw customers to these channels. The hectic work style of the working class is promoting an after-drinking culture which is predicted to drive the use of these channels by customers to buy alcoholic drinks like premium lager from off-trade channels like beer stores.

In terms of region, Europe is expected to acquire a share of 40.0%, by 2025. The prevalent drinking of premium lager in Western European countries such as the U.K. and Germany with relation to rising health benefits like appropriate functioning of kidneys, digestive system, and heart are predicted to remain a key trend. Moreover, premium products by new entrants acquiring new verticals of larger markets. In January 2017, Heineken announced the launch of a new craft lager production in collaboration with Bintang an Indonesian lager beer brand in the U.K.

The market in the Asia Pacific is projected to touch USD 63.7 billion by 2025. On account of the increase in middle-class families in major countries like India, the Philippines, Thailand, and China are anticipated to gather some notable gains. Increase in spending of customers on resto-bar due to the incorporation of new offices in service and manufacturing sectors with the help of auxiliary government policies. This scenario is predicted to increase resto-bars and pubs with the growing use of premium lager over the forecast period, 2019 to 2025.

Major players in this market are Anheuser-Busch InBev SA/NV, Heineken N.V., Carlsberg Breweries A/S, B9 Beverages Pvt. Ltd. and Constellation Brans. Anheuser-Busch InBev subsidiary of Stella Arotis announces the launch of gluten-free premium lager with an alcohol content of 4.8%, in 2018.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Report Coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Country Scope |

U.S., Germany, U.K., India, China, and Japan |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global premium larger market report on the basis of product, distribution channel, and region:

• Product Outlook (Revenue, USD Billion, 2015 - 2025)

• Conventional

• Craft

• Distribution Channel Outlook (Revenue, USD Billion, 2015 - 2025)

• On-trade

• Off-trade

• Regional Outlook (Revenue, USD Billion, 2015 - 2025)

• North America

• U.S.

• Europe

• Germany

• U.K.

• the Asia Pacific

• India

• China

• Japan

• Central & South America

• Middle East & Africa

Research Support Specialist, USA