- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global software-defined radio (SDR) market size was accounted for USD 20.4 billion in 2019 and expected to grow with a CAGR of 8.7% during the forecast period, 2020 to 2027. Rising investments by the government in military & defense communications infrastructure across the globe and growing adoption of software-defined radios for commercial telecommunication purposes are expected to be the key driving factors for the market growth in the coming years. Additionally, growing demand for advanced communication systems and technological development in the wireless networks such as 3G to 4G and 5G, are forcing service providers as wells as subscribers to switch to SDR technology, which will eliminate the hardware requirements. Thus, projected to drive the market growth in the forthcoming years. Furthermore, SDR is commonly used in space communication systems as it enhances the performance of satellite communications systems and enables them to operate precisely on different frequency bands. This factor is expected to boost the market growth in the upcoming years.

SDR allows users to receive signals from several mobile standards, such as GSM and WiMAX. SDR systems are highly adopted by mobile operators, to reduce the hardware cost and provide high-speed data to customers. Moreover, it also improves the connectivity solutions without any hardware constraints. Furthermore, the network function virtualization (NFV) and SDR are projected to play a significant role in the integration of various communication technologies. The 5G wireless network is based on the NFV/SDR infrastructure, which in turn, projected to create a huge opportunity for the market in the upcoming years.

The rising adoption of wireless and IoT devices is expected to positively affect the market in the upcoming years. For example, in 2017 there were about 30 commercial deployments of LTE-M and NB-IoT were done in the U.S., China, and various other counties of Europe. Furthermore, the GSM Association has predicted that the IoT-connected devices are expected to reach around 3.1 billion across the globe by end of 2025, which amounts to 12.0% of total IoT connections across the globe. Additionally, the growing adoption of wireless sensors in electronic devices is expected to bolster market growth.

SDR is an advanced type of radio communication system, which is embedded with software instead of hardware like detectors, amplifiers, demodulators, mixers, modulators, and filters. Additionally, it can transmit and receive a wide range of frequencies, which is an added advantage over hardware systems. As a result, expected to drive market growth over the forecast period. Further, the rising deployment of LTE commercial cellular technology and the emergence of 5G technology are projected to augment the SDRs demand in the forthcoming years. The LTE technology is currently operating in the range of 450 MHz to 3.8 GHz and shortly, it is expected to reach 5 GHz, which in turn, is expected to fuel the software-defined radio (SDR) market growth.

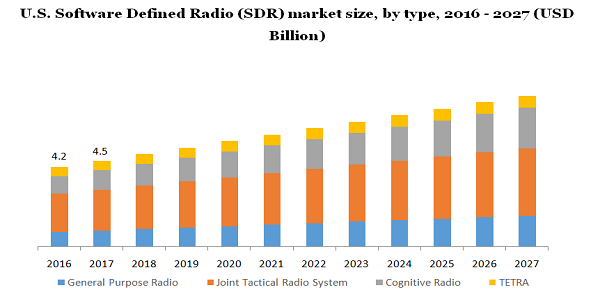

The type segment has been bifurcated into General Purpose Radio, Joint Tactical Radio System (JTRS), Cognitive Radio, and TETRA. The JTRS segment has captured the largest market share in 2019 and is projected to see significant growth during the forecast period. The technology is widely used in the military & defense industry, as it includes multi-band/multi-mode preemptive radio sets, which allow the warfighter to communicate through voice and data simultaneously. An open system architecture, based on the software communications architecture 4.0 (SCA), is an important component of the JTRS. The JTRS program of the U.S. Department of Defense is also projected to support the segment growth in the forthcoming years.

TETRA is a European standard for trunked radio systems. It offers high emergency services capabilities and is highly beneficial for commercial applications. Additionally, TETRA identifies certain interfaces like inter-system interface, terminal equipment, and air interface, which enable them to work efficiently in the multivendor industry. TETRA is one of the biggest land mobile radio communication standards with high spectrum efficiency and enhanced features to communication systems, such as high-speed data, security, voice calls, and short call setup time features. These features are projected to accelerate the segment growth in the upcoming years.

The component segment is divided into hardware, software, and services. The hardware segment is further bifurcated into antenna, transmitter, receiver, and others. The hardware segment held the largest market share in 2019, owing to the high demand for portable SDRs. Additionally, the segment demand is driven by the advancement in electronic devices and the ability to provide digital and analog technology in a single embedded chip. Furthermore, it reduces the separate hardware requirements, which makes it lighter, flexible, portable, and cheaper. Thus, projected to boost the market growth in the upcoming years. The rising demand for field-programmable gate array (FPGA), which is incorporated with digital-to-analog converters (DACs) and analog-to-digital converters (ADCs), is expected to boost the segment growth in the forthcoming years.

The software segment is projected to see significant growth, during the forecast period, 2020 to 2027, owing to rising demand in the commercial industry. The software in SDR is generally used for defining the functions and specifications in the SDR systems. The software offers greater flexibility in the network while loads distribution and removes capacity bottlenecks for backhaul core packet-switched networks. SDR algorithms are customizable and downloadable over the entire lifecycle of SDR. This helps SDR in providing flexibility, which is highly demandable in defense and commercial applications. Furthermore, it is deployed in various other applications such as text messaging, global positioning systems, accessing data & voice information, and remote radio monitoring, which in turn, is expected to amplify the segment growth in the upcoming years.

The frequency band segment is divided into HF band, VHF band UHF band, and others. The high-frequency band is expected to see moderate growth over the forecast period. The SDR systems with high-frequency bands are commonly used for tactical and mission-critical communications. The IP systems provide various advantages such as lower transaction costs and improved end-user experience thus, fueling the demand for advanced IP systems which are integrated with SDR systems. Manufacturers across the globe such as Codan Communications, Collins Aerospace Systems, and BAE Systems, keep on developing high-frequency SDR, which in turn, are projected to augment the segment growth. For example, Codan Communications has launched the Sentry-H system in September 2016. It is a high-frequency radio-equipped system, which is equipped with 3G Automatic Link Establishment (ALE), USD connectivity, and GPS. The system also provides a smart handset and a simplified, in-built menu system, which offers multiple language features.

The UHF frequency bands are widely used for commercial applications such as 5G networks and cellular systems. UHF SDRs offer a wide range of bandwidth spectrum and incessant services to customers. Furthermore, the rising adoption of smartphones, growing use of the internet, and increasing demand for IoT applications are projected to boost the market growth in the forthcoming years. Therefore, the segment is projected to dominate the SDR market by the end of 2027.

The platform segment has been classified into ground, naval, airborne, and space. The ground segment captured the largest market share in 2019, as it is widely used in military & defense, and space sectors for tactical communication purposes. SDR simplifies the base stations designs and enhances the sensitivity of the base stations in the satellite communications systems. The Increasing number of space projects in the space communications sector and rising integration of SDR technology is expected to play a crucial role in the new architecture of space communications. Additionally, the deployment of an advanced phased array incorporated with the SDR system is projected to fuel the segment growth in the forthcoming years.

An airborne SDR is a high-speed data communication system, which is commonly used in commercial and military applications. The key players in the market are heavily investing in the development of SDR technology and manufacturing secure, mission-critical, and cost-effective systems. For example, L3 Harris Technologies and Collins Aerospace are incorporating SDR solutions with the existing airborne applications, thus producing cost-effective and technologically advanced systems. Additionally, the SDR system is incorporated with a wideband network spectrum, which is highly feasible for secure airborne communications. Furthermore, it provides mobile networked connectivity in warships/ battlespace with having precise signals. Thus, projected to fuel the segment growth during the forecast period, 2020 to 2027.

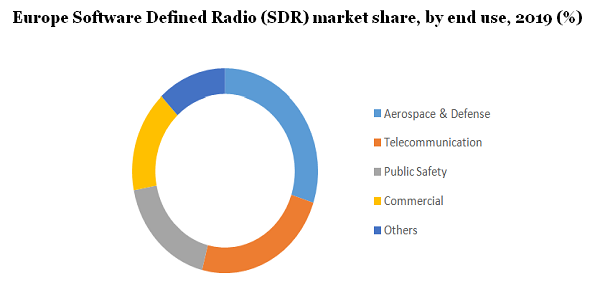

The end-user segment has been divided into aerospace & defense, public safety, telecommunication, commercial, and others. SDR is commonly used in the military & defense sector, due to its wide functional scope. Additionally, the system provides higher flexibility, adaptability, precision, interoperability, and clarity. For example, Falcon is the leading player in the market, which offers a wider implementation of SDR systems, backed up by an SCA 4.0 for the military & defense sector. Furthermore, over the last few years, countries are increasing their expenditure on the defense sector, which is projected to accelerate the segment growth in the forthcoming years.

The commercial segment is projected to see the fastest growth during the forecast period, 2020 to 2027, owing to the increasing adoption of SDR systems in several industries such as transportation and automotive. The increasing demand for traditional car radios, which provide traditional digital systems and analog systems is expected to augment the segment growth. Furthermore, SDR enables car radios, which are compatible with various digital radio broadcast protocols such as Digital Audio Broadcasting (DAB), Digital Radio Mondiale (DRM), HD Radio in the U.K., U.S., and India respectively.

The North American market has accounted for the largest SDR market share in 2019 and is projected to see substantial growth, during the forecast period. The region's growth is attributed to the rising number of Joint Tactical Networking Center (JTNC) programs in the U.S., which provides enhanced technical development for various wireless communication systems. SDR systems are extensively used in the U.S. defense sector, due to the high number of research initiatives and the incorporation of all communication systems with the federal and state agencies. Additionally, rising investments by the U.S. government for the development of advanced radio communication systems that can accommodate the X-band frequencies are expected to propel the demand for SDR systems in the region over the forecast period.

Asia Pacific market is projected to see the fastest growth over the forecast period, 2020 to 2027. The market growth is attributed to the growing number of terrorism activities in various countries such as Pakistan, Afghanistan, and Bangladesh, which in turn, is fueling the demand for advanced communications systems like SDR. The military & defense sectors in the regions are making a huge investment in the development and implementation of enhanced SDR communication systems. As a result, provides advanced information systems, secure collaboration, and shared situational analysis. For example, China army has offered a contract to Elbit Systems Ltd. in December 2018, which manufactures CNR-710MB airborne radios. Additionally, the advanced communication systems are highly efficient, during natural calamities rescue operations, which is expected to fuel the regional market growth in the upcoming years. Additionally, the governments of different countries such as China, Australia, and Japan, are increasing their funding for SDR development, which in turn, is projected to boost the market demand in the forthcoming years.

Telecommunications is one of the worst-hit sectors in the ongoing pandemic COVID-19. The deployment of the 5G network in the European and American region has been delayed, due to which network operators have been facing a significant loss over the last few months, which in turn, reducing the demand for SDR deployment. Thus, expected to hinder the market growth. Furthermore, SDR chips can be deployed in mobile handsets, which provide flexibility to network providers and upgrades its wireless network services from 4G to 5G. However, as the deployment of the 5G network has been put on hold, it is expected to hamper the market. Although post-COVID-pandemic, the deployment of a 5G network will increase, consequently, the demand for SDR systems will also increase. As a result, expected to drive market growth in the forthcoming years.

Key companies in the market are Elbit Systems Ltd.; Harris Corporation; L3 Technologies, Inc.; Datasoft Corporation; BAE Systems; Raytheon Company; Collins Aerospace Systems; and others. The major players in the market are focusing on product development, mergers & acquisitions, collaboration, and increasing their investment in R&D activities. For example, in Nov-2019, Rohde & Schwarz has signed a contract with Lockheed Martin, a leading player of advanced technologies, aerospace, security, and defense. This company will provide airborne radio communications systems for the F-16 Block 70 aircraft. Additionally, L3 Technologies, Inc. has collaborated with the Harris Corporation in April 2019 and form a new company known as L3 Harris Technologies, Inc. This is a defense technology company, which will develop mission-critical solutions. Similarly, BAE Systems has launched an SDR assembly for space applications, in April 2019. This will fulfill the demand of the U.S. Defense Department.

|

Attribute |

Details |

|

The base year for estimation |

2019 |

|

Actual estimates/Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Market representation |

Revenue in USD Million and CAGR from 2020 to 2027 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, U.K., Germany, Australia, India, China, Japan, Brazil, and Mexico |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Million Insights has segmented the global software-defined radio market report based on type, component, frequency band, platform, end-use, and region:

• Type Outlook (Revenue, USD Million, 2016 - 2027)

• General Purpose Radio

• Joint Tactical Radio System

• Cognitive Radio

• TETRA

• Component Outlook (Revenue, USD Million, 2016 - 2027)

• Hardware

• Antenna

• Transmitter

• Receiver

• Others

• Software

• Service

• Frequency Band Outlook (Revenue, USD Million, 2016 - 2027)

• HF Band

• VHF Band

• UHF Band

• Others

• Platform Outlook (Revenue, USD Million, 2016 - 2027)

• Ground

• Naval

• Airborne

• Space

• End-Use Outlook (Revenue, USD Million, 2016 - 2027)

• Aerospace & Defense

• Space

• Military

• Telecommunication

• Public Safety

• Commercial

• Others

• Regional Outlook (Revenue, USD Million, 2016 - 2027)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• The Asia Pacific

• India

• China

• Japan

• Australia

• Latin America

• Brazil

• Mexico

• MEA

Research Support Specialist, USA