- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global soy dessert market size was accounted for USD 55.5 billion, in the year 2018. It is estimated to grow at a CAGR of about 7.2% over the forecast period, 2019 to 2025. Rising concerns for health among people and the inability to digest the lactose carbohydrate commonly called lactose intolerance are the fundamental reasons behind the growth of this market. The product contains less amount of cholesterol and fats when compared to dairy products. Therefore, soy desserts are expected to attain more popularity among fitness freaks.

The lifestyle of people is changing rapidly, and they are more inclined towards consuming healthy food. Nowadays, people focus more on the nutritional content of the product. This is a low-calorie product as compared to dairy products, which helps people to reduce the number of calories they are consuming each day. Therefore, people can add this product to their diet plan and consume it without any guilt. This factor has driven the demand for this product. Moreover, the buying power of the working population is increasing gradually, and they are more inclined towards consuming healthy and nutritional desserts. These factors are expected to accelerate market growth over the forecast period.

A high level of cholesterol is responsible for blocking the blood vessels resulting in heart failure. Soy consists of a molecule named phytosterol which restricts the absorption of cholesterol which in turn reduces the risk of heart diseases. These factors have made the product more popular among people suffering from heart diseases. Furthermore, there is a large number of consumers in countries like the U.K. and the U.S. who are lactose intolerant but prefer consuming a large number of confectionery products. This product is highly suitable for such people and therefore gaining high popularity among them.

However, there is an absence of calcium in the product. Manufacturers are trying to incorporate artificial calcium into the product but on the counterparts, the product loses some of the vital nutritional elements. This factor is estimated to affect the demand for the product and suppress market growth.

In the U.S., there are strict norms for the nutritional content of food products. According to various studies and researches, the soy market is losing its sales in the U.S. because of this factor. Manufacturers are putting their efforts to add calcium by maintaining the nutritional content of the product. This factor is anticipated to drive soy desserts market growth from 2019 to 2025.

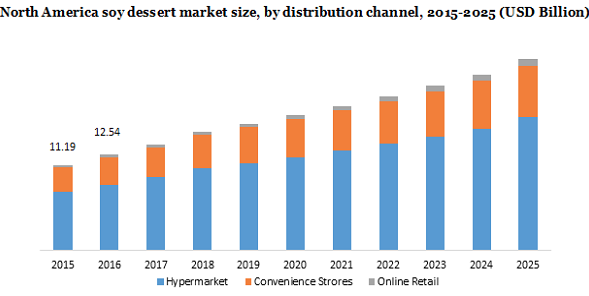

In terms of revenue, the segment of hypermarkets accounted for greater than 65% market share, in 2018. A variety of products are easily available in hypermarkets. In addition to this, attractive offers, discounts, and influencing advertisements are attracting a high number of consumers to choose this distribution channel over others. Moreover, consumers can taste the product before buying it and they can choose the product very easily by evaluating their tastes and preferences. This has influenced the customers to buy the products using this distribution channel.

The online distribution channel segment is projected to grow at a CAGR of about 9.1% during the approximated period. An increase in the number of online retail stores that provide attractive discounts and the rising number of working populations who prefer using online retail shops for easier accessibility have driven the demand for this segment. Moreover, there has been a rise in the adoption and usage of the internet among the rural population which is one of the most important driving forces anticipated for the growth of this segment.

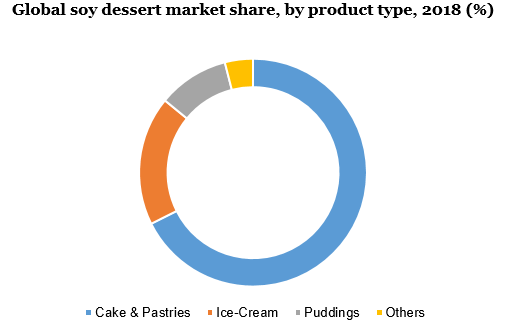

The soy dessert market can be categorized into puddings, ice cream, and cakes, and pastries. In 2018, the market share of the cake segment accounted for more than 65% and is estimated to have the largest market share among the other segments. It has been observed that the consumption of cake in regions like Europe and North America is rapidly increasing. For instance, the cake segment was valued at USD 2.5 billion for the U.K. region in 2018.

The ice cream segment is estimated to be the fastest-growing segment, growing at a CAGR of about 8.0% through, 2018 to 2025. The demand for ice creams is high in the regions such as MEA and the Asia Pacific. An increase in the level of lactose intolerance among consumers is anticipated to be the major driving force for the growth of the segment. Moreover, manufacturers are focusing more on introducing different varieties of flavors, which attract consumers. These products are super affordable and are easily available. These factors are anticipated to further drive the growth of the ice cream segment.

In 2018, the revenue share held by North America was 28.0% and it is anticipated to grow significantly in the upcoming years. The U.S. held the largest share of about 33.0% in the North American region in the year 2018. The regional growth is driven by factors such as high consumption of products like ice creams, puddings, and cakes and the presence of a large number of consumers with a high level of lactose intolerance. For example, the market share of the cake segment in the U.S. accounted for USD 3.4 billion, in the year 2018.

Asia Pacific is anticipated to grow at the fastest rate with a CAGR of about 8.3% in the approximated period. Soy products originated from China. Further, Asia Pacific has the largest consumer for soy dessert. These are the major factors driving the growth of the market over the forecast period.

Leading players in this industry include AFC soy foods, The Hershey Company, Archer Daniels Midland Company, Hain Celestia, Kerry, Now Foods, Alpro, Gluten Intolerance Group, and Turtle Mountain. For coping up with a high level of competition in the market, the leading companies are focusing more on product innovations and mergers and acquisitions. New entrants can easily enter the market because of medium-low entry barriers. Manufacturers are investing more in R&D to cater to market competition.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, MEA, and CSA |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Country scope |

U.S., Canada, U.K., Spain, China, India, Brazil, and UAE |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the global soy dessert market report based on product type, distribution channel, and region:

• Product Type Outlook (Revenue, USD Billion, 2015 - 2025)

• Cakes & Pastries

• Ice Cream

• Pudding

• Others

• Distribution Channel Outlook (Revenue, USD Billion, 2015 - 2025)

• Hypermarket

• Convenience Stores

• Online Retailers

• Regional Outlook (Revenue, USD Billion, 2015 - 2025)

• North America

• U.S.

• Canada

• Europe

• Spain

• U.K.

• the Asia Pacific

• China

• India

• Central & South America

• Brazil

• Middle East & Africa

• UAE

Research Support Specialist, USA