- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global video conferencing market size was accounted for USD 3.85 billion in 2019 It is anticipated to grow at a CAGR of 9.9% over the forecast period, 2020 to 2027. Video conferencing uses telecommunication technologies that involve real-time and transmission of video & audio content. Video conferencing solutions help in taking decisions faster with reduced cost.

These solutions benefit manufacturing companies by improving productivity, reduced management costs. Additionally, growing adoption of authentication technologies such as facial detection & recognition. Moreover, increasing the adoption of cloud solutions and virtual reality (VR) is expected to foster market growth.

Rapid globalization in business and the rising need for a remote workforce are boosting the demand for video communication solutions. In developing countries such as India, the Philippines, and Brazil, there is a huge demand for online education, and telemedicine. Furthermore, a growing number of international workshops and online seminars are expected to increase the demand for video solutions.

Companies such as IBM Corporation and SAP SE focus on adopting these systems while training its employee & workforce. For example, IBM Corporation uses video solutions offered by Cisco Systems to provide unified training practices to their employees.

Several companies in the market utilize video conferencing systems for interacting & collaboration with dispersed teams across different regions. In addition, due to benefits such as reduced cost & fast decision making, services like webcasts & telepresence are evolving with the help of advanced technologies. Various companies such as Robert Bosch, Sony Corporation have collaborated to develop standards like Open Network Video Interface Forum (ONVIF).

Telepresence plays a vital role in industries such as the healthcare & education sector. In the healthcare industry, telepresence robots help in assisting the doctor while treating the patient from a remote location. Holographic technology is used in telepresence for higher efficiency.

Furthermore, development in 5G technology is projected to create ample opportunities for market growth. Companies like Microsoft Corporation and Cisco Systems are focusing on developing video solutions using VoIP (Voice over internet protocol) technology. For example, in 2018, Cisco Systems has introduced the Cisco Webex Edge Connect system that uses the company’s unified communication manager. Additionally, the increasing adoption of cloud-based solutions like Zoom, and AvayaLive Video are boosting the market growth.

However, high costs linked with the deployment of these systems along with rising security concerns may restrain the market growth. Data security tools are used for efficient data transmission. Companies such as Hall & Zoom are offering free video communication tools for SMEs.

Annual and Monthly subscriptions are offered by these solution providers. Monthly subscription costs around USD 25. Plantronics Inc. and Cisco Systems provide an annual subscription plan for USD 500 that can host 25 users.

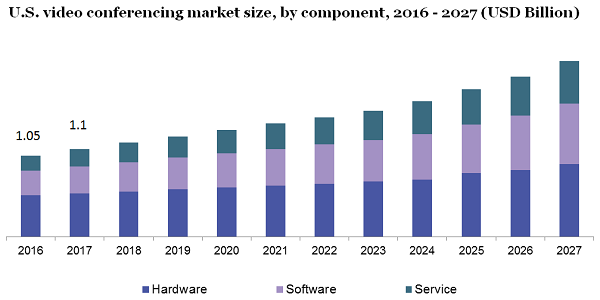

In 2019, the hardware component segment led the market with the largest market share in the overall market. The growing trend of cloud-based solutions and IoT devices is mainly boosting segmental growth. The rising emphasis of camera manufacturers such as AVer information for developing video cameras with additional features like artificial intelligence & facial recognition is supporting market growth. In 2019, AVer has introduced a camera called CAM540 with advanced 4K features, smart frame functions. The microphones segment is anticipated to grow at a significant rate owing to its high demand from sports events.

The services type segment is projected to propel at a significant rate from 2020 to 2027. Increasing demand for employee training, project consulting services is mainly contributing to market growth. Small & medium scale enterprises are using these services and also use VoIP and 4G technologies. Companies like Cisco Systems, Adobe Inc., focus on instituting long-term contracts with enterprises.

Depending on enterprise size, large enterprises dominated the video conferencing market owing to the rising adoption of video solutions for corporate business operations. These solutions help companies to collaborate their employee bases across different locations. In the telecom sector, companies such as Logitech S.A., and Cisco Systems are contracting with telecom companies. For example, in 2016, Tech Mahindra has contracted with Cisco Systems to get video solution services for seven years.

The small & medium enterprise segment is estimated to grow at a significant rate over the forecasted period. Government authorities are providing funding for small firms to utilize video conferencing tools using cloud-based solutions. For example, the Canadian government offer funds to new startup firms for adopting the cloud-based solution. According to National Association of Software & Service Companies (NASSCOM), the adoption of cloud-based solution are projected to increase up to 75.0% in the next eight years.

In 2019, the corporate segment held the largest market share in the overall market. The growing need for effective communication and fast decision-making with reduced cost are key factors contributing to the growth of video conferencing tools in the corporate business. The growing trend of Voice over internet protocol (VoIP) is enabling IT business to effectively manage their network infrastructure through free communication. Moreover, Microsoft Corporation and Huawei Technologies continuously engage in developing innovative video solutions. For instance, in 2019, ezTalks has introduced the ezTalks meeting tools for communication through whiteboard via drawing.

The healthcare segment is projected to foresee substantial growth due to the advancement in telemedicine solutions. The rising demand for medical assistance for treating patients from remote places is boosting the market growth. According to the Telemedicine Association of America, in the U.S, around 76.0% of healthcare firms utilize telehealth services. In developing countries, healthcare companies are using these systems for training their employees.

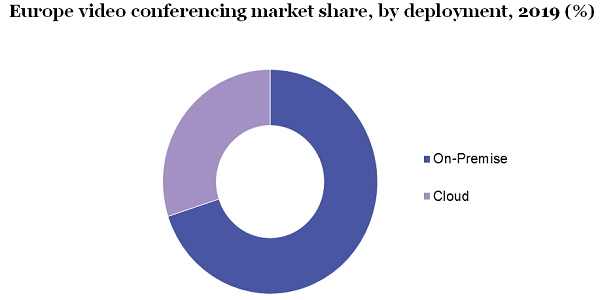

Depending on deployment, the market of video conferencing is divided into on-premise and cloud-type deployment. The cloud-based solutions segment is projected to propel at a significant rate during the forecasted period. Cloud solutions provide improved convenience using multiple channels. Development in protection solutions with enhanced encryption & password security is anticipated to increase the demand for these solutions. Cloud systems can be easily upgraded at any time.

On-premise deployment solutions are expected to grow at a substantial rate in the next few years. Large-scale enterprises are adopting these solutions due to their effective data security system. Companies like Microsoft Corporation, and ezTalks Logitech are focusing on improving software capabilities to meet consumer needs. For example, in 2019, ezTalks has upgraded its video solutions called ezTalks Rooms which allows meetings of over 9,000 participants.

In 2019, North America led the market with the highest share in the market. The presence of high-tech companies in the market is mainly driving the demand for these systems. In addition, high-speed internet access is expected to support the market growth. Several enterprises offer innovative services such as digital tours. For example, Vancouver Biennale provides artwork tours through mobile phones. Moreover, the growing use of virtual private networks across different enterprises is expected to bolster the demand for video conferencing solutions.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecasted period, 2020 to 2027. The rising number of technology and service-based companies across countries such as China and India is projected to boost market growth. Moreover, development in broadband technologies such as WiMAX, and High-Speed Downlink Access is estimated to proliferate the demand for video conferencing solutions. In addition, increasing demand from the education sector for web conferencing is anticipated to surge the market growth.

Various corporate events, trade shows, and international seminars have been canceled owing to the COVID-19 crisis initiated earlier January 2020. Thus, several companies are focusing on adopting video conferencing tools, which is expected to surge the market growth, various government agencies also are carrying out their procedures through video conferencing due to lockdown situations.

The majority of the corporate businesses are adopting the Work from Home policy due to the coronavirus pandemic. Thus, network analytics companies like Kentik have foreseen growth in video traffic. For example, Eighth Conference on Learning Representation was projected to be held in March 2020, but owing to COVID-19, this was scheduled in April 2020 through video conference.

However, due to the COVID-19 outbreak, the market is expected to witness a decline in the demand for hardware components. Governments across Japan, China, and India have made it mandatory for their service providers to lower down the video quality to reduce the strain on the network.

Leading players in the market include Array Telepresence Inc.; Adobe Inc.; Cisco Systems, Inc.; Avaya Inc.; Huawei Technologies; Microsoft Corporation; Plantronics, Inc.; Logitech International S.A.; West Corporation; and Vidyo Inc.

Key players in the market engage in new product launches, innovations, and strategic acquisitions to expand their product offerings. For example, in 2019, Adobe, Inc. has introduced new software called Adobe Connect with enhanced capabilities. Companies like Cisco Systems, Adobe, and Microsoft have a strong presence across the world. For example, in 2018, Plantronics has acquired video solution developer, Polycom to boost its company’s business.

|

Attribute |

Details |

|

The market size value in 2020 |

USD 4.2 billion |

|

The revenue forecast in 2025 |

USD 8.6 billion |

|

Growth Rate |

CAGR of 9.9% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Actual estimates/Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative Units |

Revenue in USD billion & CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. |

|

Country scope |

U.S., Canada, U.K., Germany, France, China, Japan, India, Brazil. |

|

Key companies profiled |

Adobe Inc.; Array Telepresence Inc.; Avaya Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Logitech International S.A.; Microsoft Corporation; Plantronics, Inc.; Vidyo Inc.; and West Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For this study, Million Insights has segmented the global video conferencing market report based on component, deployment, enterprise size, end-use, and region:

• Component Outlook (Revenue, USD Million, 2016 - 2027)

• Hardware

• Camera

• Microphone & Headphone

• Others

• Software

• Services

• Professional Service

• Managed Service

• Deployment Outlook (Revenue, USD Million, 2016 - 2027)

• On-premise

• Cloud

• Enterprise Size Outlook (Revenue, USD Million, 2016 - 2027)

• Large Enterprises

• Small & Medium Enterprises (SMEs)

• End-use Outlook (Revenue, USD Million, 2016 - 2027)

• Corporate

• Education

• Healthcare

• Government & Defense

• BFSI

• Media & Entertainment

• Others

• Regional Outlook (Revenue, USD Billion, 2016 - 2027)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• The Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa (MEA)

Research Support Specialist, USA