- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global wealth management software market size was accounted for USD 2.15 billion, in 2018. It is estimated to attain a CAGR of 15.3% from 2019 to 2025. This growth is attributed to the rising adoption of emerging tools by individuals for managing their financial affairs. Moreover, the rising adoption of such software by the majority of financial advisors for improving their service is anticipated to drive the software demand. In addition, the rising number of High-Net-Worth people and the growing need for effective financial solutions are some of the factors which are expected to drive the market positively.

Vendors of this software are designing customized tools to cater to specific requirements. Moreover, the growing preference for digital tools over conventional or traditional tools among financial advisors for providing effective solutions is projected to drive the demand for wealth management software. Furthermore, technological advancements such as blockchain technology, artificial intelligence, and Robotic Process Automation are projected to revolutionize the overall industry of financial technology (FinTech).

Rising adoption of API i.e. Application Program Interface by the majority of financial advisors and service providers owing to ease of selling their products and services through digital portals and channels of various banks is anticipated to proliferate the demand for such software. Furthermore, the rising adoption of flexible in-house platforms by a large number of traditional financial advisors and service providers to cater to specific requirements of their clients is anticipated to further propel the market growth from 2019 to 2025.

However, the reliance of the majority of investors on traditional methods and tools over digital platforms and rising threats regarding the security of the personal information of clients are some of the factors hampering the market growth.

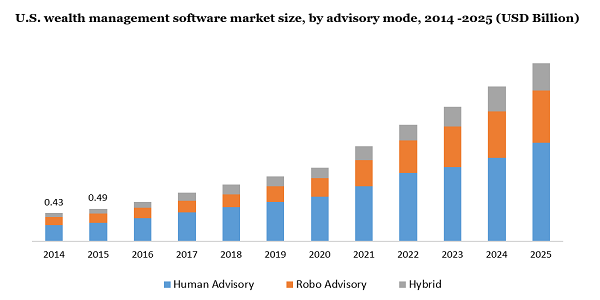

Based on advisory mode, the wealth management software market is categorized into hybrid, human advisory, and Robo advisory segments. The segment of Robo advisory is projected to grow at the fastest CAGR from 2019 to 2025. This segment of advisory mode is secured, efficient, and cost-effective. Moreover, technological advancements including cognitive computing, artificial intelligence, and machine learning help in reducing the cost of operations and improving the efficiency of software. Rising investments of advisory firms in advanced analytics and big data to cater to specific requirements of clients and to provide efficient solutions to their clients is anticipated to propel the growth of the Robo advisory segment over the forecast period.

Based on deployment, the market is divided into on-premise and cloud. The cloud-based deployment segment is projected to be the most opted process of deployment owing to its feature that helps in reducing operational costs. Cloud-based deployment is mostly preferred in developing regions such as the Middle East & Africa and the Asia Pacific. Easy accessibility and flexibility are some of the key benefits of cloud deployment which are anticipated to propel the growth of the segment from 2019 to 2025.

The segment of portfolio, trading & accounting held the largest revenue share across the global market, in 2018 owing to the rising adoption of these solutions by High-Net-Worth individuals for managing their financial affairs and for ensuring the security of their financial assets. Moreover, the rising number of individuals with High-Net-Worth (HNW) across the globe is contributing to the segment’s growth from 2019 to 2025. Furthermore, these solutions aid the decision-making process by providing accurate and real-time analytics. In addition, they enhance the agility of operations and optimize the performance management process. These factors are expected to drive the segment’s growth over the forecast period.

The wealth management software market is categorized into trading & exchange firms, brokerage firms, banks, and investment management firms, based on end-use. In 2018, the segment of banks held the largest revenue share and is expected to maintain its leading position from 2019 to 2025. Rising adoption of wealth management software by banks to manage the financial assets and financial affairs of individuals by employing client-centric techniques.

This software helps banks to enhance their portfolio of financial products and services and provide flexibility to clients in making investment decisions. Moreover, the rising adoption of wealth management software by the majority of financial institutions for enabling integration of various financial and digital platforms is anticipated to augment the market growth in the forthcoming years.

The market is categorized into small and medium enterprises and large enterprises based on enterprise size. The segment of small and medium enterprises (SMEs) is projected to attain the fastest growth from 2019 to 2025 owing to rising demand for capital management solutions among the majority of SMEs to regulate the financial affairs and optimize the costs required for monitoring the assets.

Moreover, an increasing number of small and medium enterprises in developing countries such as China and India is anticipated to propel the software demand. Further, rising digitization and automation across the majority of SMEs to improve operational efficiency is further projected to propel the market growth over the forecast period.

In 2018, North America held the largest share across the global market owing to the rising population of High-Net-Worth individuals and the rising number of SMEs in this region. Furthermore, Asia Pacific is projected to attain the fastest CAGR during the forecast period, 2019 to 2025, owing to the growing population of High-Net-Worth individuals.

Leading players operating in this industry are Temenos Headquarters SA; Fiserv, Inc.; Fidelity National Information Services, Inc.; SS&C Technologies Holdings, Inc.; Profile Software; SEI Investments Company; Dorsum Ltd.; Objectway S.p.A.; and Finantix, Comarch SA. These players are focusing on various strategic initiatives like product upgrades, M&A, and strategic partnerships to expand their service portfolio and to retain their market share.

For example, InvestEdge, Inc. and Finserv, Inc. went into partnership in October 2015 to improve the accessibility and data management of customized solutions offered to advisory firms and investors operating on Unified Wealth Platforms of Finserv, Inc.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2018 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion and CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, U.K., Germany, China, India, Japan, and Brazil |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the global wealth management software market report based on advisory mode, deployment, application, end-use, and region:

• Advisory Mode Outlook (Revenue, USD Billion, 2014 - 2025)

• Human Advisory

• Robo Advisory

• Hybrid

• Deployment Outlook (Revenue, USD Billion, 2014 - 2025)

• Cloud

On-premise

• Application Outlook (Revenue, USD Billion, 2014 - 2025)

• Financial Advice & Management

• Portfolio, Accounting, & Trading Management

• Performance Management

• Risk & Compliance Management

• Reporting

• Others

• Enterprise Size Outlook (Revenue, USD Billion; 2014 - 2025)

• Large Enterprises

• Small & Medium Enterprises (SMEs)

• End-Use Outlook (Revenue, USD Billion, 2014 - 2025)

• Banks

• Investment Management Firms

• Trading & Exchange Firms

• Brokerage Firms

• Others

• Regional Outlook (Revenue, USD Billion, 2014 - 2025)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• the Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa (MEA)

Research Support Specialist, USA