- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global mobile payment market was prized by USD 31.5 billion in 2020. It is estimated to witness a 31.8% CAGR from 2021 to 2028.

The enlargement of the market for mobile payments can be caused by the rising utilization of mobile devices, to create a variety of payments to government organizations. In the U.S., the accessibility of mobile payment alternatives, in diverse government dealings, go along with a memo authorized by ex-president Barack Obama, in 2012.

On the other hand, safety concerns linked with mobile payments are holding back the expansion of the market. Consistent with the information, presented by a financial service provider, pay vision, merely online sales were responsible for 27.0% of mobile payment scams, in 2019. It was a considerable rise from 18.0%, in 2018.

Further, in the diverse payment scam category in 2018, bank account invasion comprised 89.0% of digital scam victims. Account invasion scam includes fraudsters getting admission to client’s accounts, by means of a mobile malware otherwise stolen apparatus.

The eruption of the Covid-19 pandemic has created an optimistic influence on the mobile payment market. Quite a lot of companies took part in joint ventures, to fulfill the rising demand for mobile payments, in the background of the pandemic.

For example, Norway-based fintech company Vipps AS, and a payment technology company, VISA, joined to speed up the implementation of mobile payment through Europe, in September 2020. The joint venture predicts the customers of Visa increasing the abilities of the Vipps platform, to build up the digital wallet as well as recommend clients an innovative method to administer their expenditure.

The remote payment sector held above 59.0% revenue share and led the mobile payments market, in 2020. Since remote payments don’t necessitate any straight contact; these are becoming common, after the eruption of the Covid-19 pandemic. A number of companies are introducing apps, to permit clients to get paid, distantly.

The proximity payment sector is estimated to observe the highest development, during the forecast period. Proximity payments need the person paying and the payee to be in closeness and the transactions happen between the payer’s and the payee’s devices, by means of Bluetooth connectivity, QR codes, or NFC.

Mainly, the eruption of the pandemic has altered the means, clients wish to pay for services and supplies. In line with eMarketer, around 100.0 million Americans are expected to be making use of the proximity mobile payment systems, by 2025.

In 2020, the B2B sector held above 60.0% revenue and led the mobile payment market. The forceful funds by personal equity, in addition to risk investment funds in B2B payments, are generating fresh openings for the expansion of the sector. Likewise, banks are, gradually more, taking on B2B mobile payments, to increase the feel for business customers.

The B2C section is estimated to observe the highest development during the forecast period. B2C payments are completed by the customers, whilst buying a product otherwise subscribe to a service for individual utilization. The rising part of mobile payments within the e-commerce business vertical is inspiring the enlargement of the section.

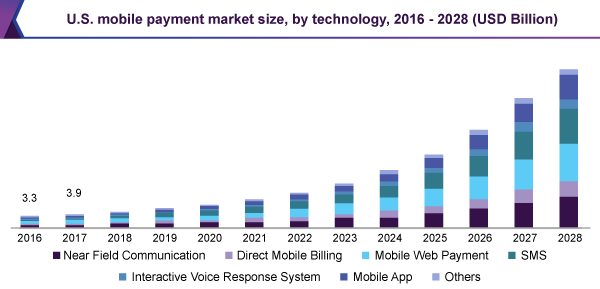

The mobile web payment section held, above 23.0% revenue share and led the market for mobile payments, in 2020. The development of the section can be accredited to the flexibility along with the safety offered by mobile web payment resolution. The rising popularity of m-commerce, furthermore, shows potential for the enlargement of the section.

The near-field communication section is anticipated to observe the highest development, during the forecast period. The technology of NFC permits merchants, to put together client trustworthiness agenda into their procedure for the payment and clients, to cash in instantly their coupons by means of mobile phones. The growth in e-commerce display places, along with the continuous realization of the most recent technologies in fiscal communications, is estimated to impel the expansion of the segment.

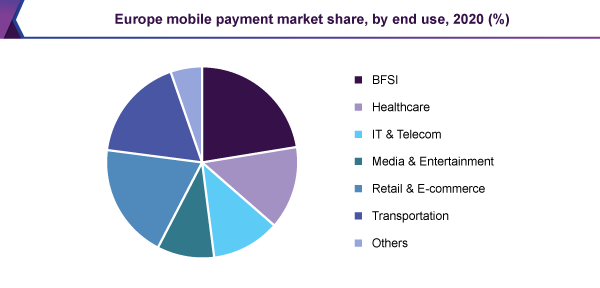

The BFSI division held above 22.0% revenue share and led the market, in 2020. A number of banks are insistently trying to set up mobile payments, in that way adding to the expansion of the division.

The retail & e-commerce sector is anticipated to observe the highest development during the forecast period. The rising figure of smartphone consumers as well as the following growth in mobile retail sales has potential for the enlargement of the sector. Apps are rising like the most favored means of shopping, by means of smartphones. Rising cross-border trade is moreover, appearing like one of the most important features, inspiring the inclination for mobile payments.

In 2020, Asia Pacific held above 34.0% revenue share and dominated the global mobile payment market. The rising infiltration speed of smartphones in the nations like Thailand and Japan is mainly inspiring the enlargement of the online trading of parceled foodstuff & beverages. Consistent with PwC, Thailand held a 10.7% share of the online retailing of parceled foodstuffs and beverages, in the Asia Pacific. The increasing sales of wrap-up foodstuff, by means of the online trade network, are estimated to impel the enlargement of the market, within the Asia Pacific, during the forecast period.

The market in North America is expected to observe considerable expansion, during the forecast period. North America is a homeland for the number of important companies in the market. Besides, the state has been the first accepter of the most recent as well as sophisticated technologies. The rising figure of unmanned stores in the U.S. is, furthermore, encouraging the acceptance of mobile payments. For example, a Netherland-based supermarket Ahold Delhaize, declared the starting of the store without a cashier, in November 2019.

Being an effort to strengthen their place in the market for mobile payment, main companies are following policies like upgrading the product, presentation of new product as well as the tactical accord. Besides, they are concentrating on planned joint ventures with the suppliers of financial services, to improve client experience. The major companies are, moreover, insistently investing in improving their product assistance.

• WeChat (Ten cent Holdings Limited)

• Samsung Electronics Co. Ltd.

• Money Gram International

• American Express Company

• Amazon.com Inc.

• Google (Alphabet Inc.)

• Visa Inc.

• PayPal Holdings Inc.

• M Pesa

• Apple Inc.

• Alibaba Group Holdings Limited

|

Report Attribute |

Details |

|

The market size value in 2021 |

USD 39.5 billion |

|

The revenue forecast in 2028 |

USD 273.1 billion |

|

Growth rate |

CAGR of 31.8% from 2021 to 2028 |

|

The base year of estimation |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, payment type, location, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil |

|

Key companies profiled |

Google (Alphabet Inc.); Alibaba Group Holdings Limited; Amazon.com Inc.; Apple Inc.; American Express Company; M Pesa; Money Gram International; PayPal Holdings Inc.; Samsung Electronics Co. Ltd.; Visa Inc.; WeChat (Tencent Holdings Limited) |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Million Insights has segmented the global mobile payment market report based on technology, payment type, location, end-use, and region.

• Technology Outlook (Revenue, USD Billion, 2016 - 2028)

• Near Field Communication

• Direct Mobile Billing

• Mobile Web Payment

• SMS

• Interactive Voice Response System

• Mobile App

• Others

• Payment Type Outlook (Revenue, USD Billion, 2016 - 2028)

• B2B

• B2C

• B2G

• Others

• Location Outlook (Revenue, USD Billion, 2016 - 2028)

• Remote Payment

• Proximity Payment

• End-use Outlook (Revenue, USD Billion, 2016 - 2028)

• BFSI

• Healthcare

• IT & Telecom

• Media & Entertainment

• Retail & E-commerce

• Transportation

• Others

• Regional Outlook (Revenue, USD Billion, 2016 - 2028)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• The Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa

Research Support Specialist, USA