- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

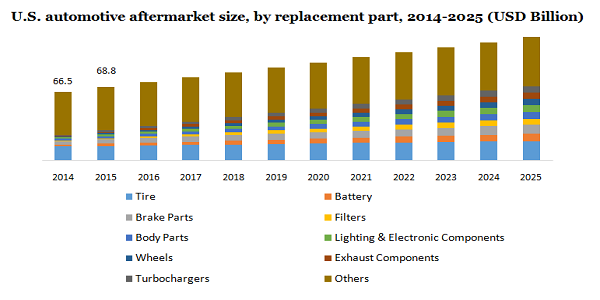

The U.S. automotive aftermarket size was accounted for USD 75.31 billion, in 2018 and is anticipated to grow at a CAGR of 1.8% over the forecast period of 2019 to 2025. The U.S. automotive industry has gained a significant boost in its sales of aftermarkets parts and OEMs as the aftermarket business has generated attractive revenues and margins in the evolving market. The growing requirement of proper maintenance of parts of vehicles has promoted aftermarket sales. The automotive aftermarket is regulated by strict government norms and regulations with regard to the heavy-duty vehicles market.

Favorable government regulations, subsidies, and policies in the U.S. are propelling the demand for the electric vehicles industry. Since electric vehicles are eco-friendly, their usage supports government policies for pollution control and climate change. Moreover, these vehicles are battery-powered and do not function on regular fuels like gasoline, thereby eliminating the emission of harmful gases. The rising use of lightweight auto parts in electric vehicles to enhance its efficiency is anticipated to drive market growth in the forecast period.

Digitization assures transparency in auto maintenance and repair service delivery. This allows several stakeholders, along with car owners, to observe the repair and replacement cost of parts. With the help of online services, car owners can fulfill their desire of ordering customized components like resonators and mufflers from abroad for their unusual specifications and low prices. Moreover, the rapid improvement of digitalized technologies has augmented opportunities for service dealers, and automakers to manufacture innovative products for the sake of maintaining the competition in the U.S. market.

Latest production technologies are expected to render significant cost benefits to vehicle owners. For example, the influence of 3D printing in fabricating car components is expected to increase all over the world with time as it enables minimal production costs and greater efficiency with time utilization and optimal material. Further, rising investments are being made by associations and manufacturers in R&D activities to provide cost-efficient and high-end materials. This is anticipated to propel the growth of the U.S. automotive market.

The U.S. automotive aftermarket has been segregated into various segments like tire, filters, body parts, lighting & electrical components, turbochargers, battery, brake parts, wheels, exhaust components, and others, on the basis of the replacement parts. The other segment dominated the U.S. market in 2018, seconded by the tire segment. The turbocharger segment is anticipated to grow at the fastest rate in the forecast period owing to its ability to increase the volumetric efficiency of engines and making them amenable to stringent emission standards.

The tire segment is expected to dominate the automotive aftermarket in the U.S. by 2025 owing to factors like frequent replacement of tires when compared to its automotive counterparts. Further, the turbocharger segment is anticipated to grow at the fastest CAGR in the forecast period. The surging trend of downsizing of engines and using turbochargers to balance power requirements are anticipated to propel the demand for turbochargers in the forecast period.

On the basis of distribution channels, the automotive aftermarket in the U.S. is segmented into wholesalers, distributors, and retailers. For basic automobile models, the distribution channel comprises members like automobile exhaust sale hubs, tier 1 distributors, and aftermarket units comprising of jobbers and at last repair shops. The major contribution towards overall sales of aftermarket parts is by tier 1 distributors, seconded by direct channel sales. The retailer's segment dominated the market in 2018. Further, the distributors and wholesalers segment is anticipated to witness rapid growth in the forecast period.

The adaption of the latest distribution techniques like online catalogs and e-commerce by vendors has helped them in adding value to the products offered and distribution network. Manufacturers are expanding their regional and global presence rapidly by supplying their products to automobile manufacturers all over the world via online platforms. Moreover, several distributors and suppliers are adopting strategies like collaborating with local market players to gain traction in the domestic market.

The automotive aftermarket in the U.S. is divided into OE (delegating to OEMs), DIFM (Do It for Me), and DIY (Do It Yourself), on the basis of the service channel. The OE segment dominated the market in 2018, seconded by the DIFM segment. The DIY segment is anticipated to grow at the fastest CAGR in the forecast period. DIY car kits are growing popular rapidly owing to their easy availability, convenience to use, and help save time. DIY customers are highly sensitive towards the price and the expansion of e-commerce has helped customers in making economical purchases, thereby, leading to an increase in overall sales of aftermarket parts. Further, rapidly evolving technologies in the U.S. market have cautioned the players to evaluate their performance to retain their market position.

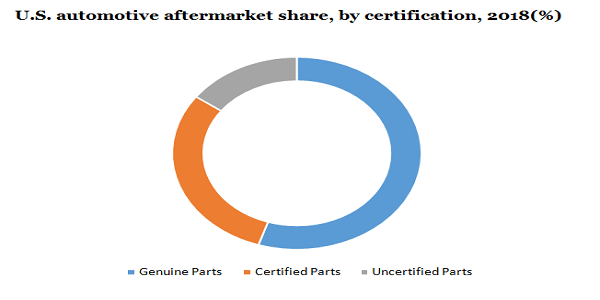

The automotive aftermarket in the U.S. is categorized into uncertified parts, certified parts, and genuine parts, on the basis of certification. Genuine parts are produced by vehicle manufacturers while certified automotive parts are inspected and tested by authorized organizations, and uncertified parts can be used in the place of original automotive parts. The genuine automotive parts segment is expected to dominate the automotive aftermarket in the U.S. by 2025. Further, the certified parts segment is expected to grow at a significant CAGR in the forecast period.

The market is witnessing a surge of strategic collaborations and alliances between leading auto insurance companies and collision repair centers to gain a competitive advantage and capture a considerable amount of share in the market. Moreover, manufacturers are concentrating on manufacturing certified parts in compliance with NSF standards. This is anticipated to propel the demand for certified parts in the U.S. market.

The U.S aftermarket automotive is been severely affected owing to the outbreak of coronavirus. The country is one of the topmost in terms of COVID-19 spread. The prolonged lockdown has disrupted the supply chain, which, in turn, has adversely affected the market growth. Further, uncertainty among consumers regarding the market scenario in the future has resulted in lower spending on automotive products. The shortfall in liquidity and cash crunch has severely affected the sales of automotive in the U.S, thereby, adversely affecting the market growth. However, relaxing lockdown measures and reopening the economy in major cities across the U.S are projected to accelerate the market growth.

The major players functioning in the automotive aftermarket in the U.S. are Federal-Mogul Corporation, Delphi Automotive PLC,3M, Continental AG, and Denso Corporation. The competition in the market is high and has encouraged the players to focus on catering high-quality products to retain their competitive advantage. Further, a growing focus on strategic initiatives like mergers, acquisitions, and alliances has resulted in market consolidation. This has helped companies to enhance their brand value and customer loyalty base along with instituting their global presence. With the rising competitiveness in price, several companies are challenged to offer innovative products at an economical price. The increasing number of domestic players in the country has emerged as a threat to the leading players. Key players are adopting mergers and acquisitions to increase their market share and maintain their position in the market.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion & CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Country Scope |

The U.S. |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the U.S. automotive aftermarket report on the basis of replacement parts, distribution channels, and service channels, and certification.

• Replacement Part Outlook (Revenue, USD Billion, 2014 - 2025)

• Tire

• Battery

• Brake Parts

• Filters

• Body parts

• Lighting & Electronic Components

• Wheels

• Exhaust components

• Turbochargers

• Others

• Distribution Channel Outlook (Revenue, USD Billion, 2014 - 2025)

• Retailers

• Wholesalers & Distributors

• Service Channel Outlook (Revenue, USD Billion, 2014 - 2025)

• DIY (Do it Yourself)

• DIFM (Do it for Me)

• OE (Delegating to OEMs)

• Certification Outlook (Revenue, USD Billion, 2014 - 2025)

• Genuine Parts

• Certified Parts

• Uncertified Parts

Research Support Specialist, USA