- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

With reference to the report published, the global cold chain market was prized by USD 210.49 billion in 2020. It is estimated to witness a 14.8% CAGR from 2021 to 2028.

The rising infiltration of the linked devices along with the computerization of refrigerated warehouses throughout the world is expected to prompt the enlargement of the market for cold chains, throughout the forecast period.

The growing quantity of structured retail stores in rising markets are producing augmented requirements for cold chain resolutions. The growth of retail chains via global companies, ease up of the business activities; along with the efforts taken by the administration to decrease wastage of food items are the factors, furthermore, anticipated to increase the expansion of the cold chain industry, during the forecast period.

As a result of the increasing customer alertness, caused the move from carbohydrate-rich eating habits to protein-rich foodstuff. This shift in habits impels the market for refrigerated storage space, in rising nations.

Owing to the end user-driven changeover in the financial system, the nations like China are estimated to reveal a major development speed in the near future. By way of increasing technical progressions in the shipping of the frozen materials, along with the storehouse administration, the market is expected to spread out in rising markets.

In 2020, the storage equipment sector retained the principal, more than 75% revenue share of the global cold chain market. Storage space apparatuses are important in the frozen storeroom business since they guarantee the excellence of the goods and boost their shelf life. The utilized equipment comprises vaccine carriers, refrigerators, deep freezers plus others. Storage equipment is more separated into off-grid and on-grid.

The requirement for off-grid storage equipment is accredited to the rising necessity to avert the losses of food items after producing and processing, in emergent nations. The rising hard work done by the governments in the emergent nations to encourage off-grid cold chains are likely to inspire the requirement for solar energy sourced off-grid storage equipment.

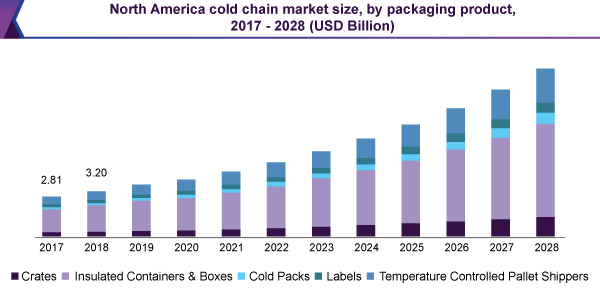

In 2020, the product packaging sector was accounted for the major, above 73% revenue share of the cold chain market. The product division comprises thorough scrutiny of the temperature-controlled pallet shippers, cold packs, crates, labels, and insulated boxes as well as the containers.

Mainly the Temperature-controlled Packaging (TCP) is the component, utilized in the market for refrigerated storage space. It is build-up, in line with a variety of standards, to preserve the products at a precise temperature for a specific time.

Since, compare with Styrofoam the PUR material turn out to be heavier, in addition to, is not recyclable; the demand for PUR is getting reduced. Temperature-sensitive materials utilized for the delivery of non-bulk covering comprises, insulated pallet shippers, EPS foam, VIPs, cryogenic tanks, and PUR foam.

The frequently used refrigerants are of three types. Those include PCM, dry ice, and gel packs. Physical performance, thermal performance, pack-out simplicity as well as the price of the system, are the important aspects to be measured, whilst estimating the temperature-sensitive packaging resolution.

In 2020, the storage sector held the largest, above 58% revenue share of the cold chain market. Due to the globally rising inclination for the packaged foods, it is estimated to maintain its supremacy, during the forecast period. Altering nutritional patterns along with the standards of living of the customers is inspiring the demand for the frozen foods. This is anticipated to increase the requirement for storage space solutions.

Cold chain methods are essential for making delivery of healthcare products and food & beverages. The rising orders for insulated containers as well as vehicles, high-cube refrigerated trailers, and connected refrigerated trucks supporting cross-product shipping are anticipated to impel the transport division, during the forecast period.

Mainly, the exercise of supervising mechanisms in the cold chain is growing. This enlargement can be credited to the technical advancement along with the rising requirement to make sure the effectiveness, reliability, plus security of the consignment. Regularly, the developments are observable in frontend devices as well as the backend IT infrastructure, arranged for gathering and coverage of the concurrent information, regarding the consignment.

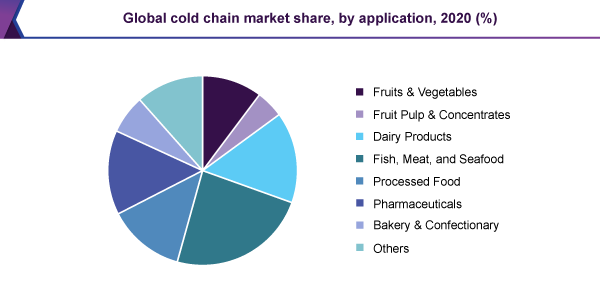

The fish, meat, and seafood sector held the major 24% revenue share and dominated the global cold chain industry, in 2020. It is estimated that the market will increase by stable CAGR and will preserve its top place, throughout the forecast period.

The technical advancement in the various stages like processing, storage, and packaging of the seafood items are the factors, likely to inspire the enlargement of this sector. An escalation in fish production is furthermore anticipated to increase the development of the sector.

On the other hand, due to the continuous improvement in wrapping material, processed food is estimated to be the speedily developing application sector, during the estimated years. Improvement in wrapping materials enhances the shelf life of food items. This has improved the business of processed foods, during the previous years.

The greater demand for the cold chain in the pharmaceuticals manufacturing sector can be credited to its significance in retaining the security and effectiveness of the pharmaceutical products. The strict regulatory standards, for example, Goods Distribution Practices (GDP) in the European Union (EU), are driving the cold chain in the pharmaceutical manufacturing sector.

Rising stages of the disposable income, along with the altering habits regarding the food items are the factors, generating the demand for the cold chain from the bakery & confectionary sector. The shippers are working in partnership with third-party logistics providers to furnish the increasing orders and to make sure that the goods are distributed in the best conditions on an appropriate timetable.

In 2020, North America was accounted for the major, above 35% revenue share of the global cold chain market. It is estimated to hold the leading position during the forecast period, since the region has considerable expansion openings for the companies, scheduling to spend for an extended drag. Rising infiltration of linked devices, as well as huge consumer support, is, furthermore, anticipated to stimulate the enlargement of the market throughout the forecast period.

On the other hand, Asia Pacific is expected to be the speedily developing local market for cold chains, during the anticipated time, due to the rising government reserves for the enlargement of logistics communications as well as infiltration of Warehouse Management Systems (WMS). Increasing modernization of the pharmaceutical division in China is, moreover estimated to enhance the requirement for cold chain resolution. One more key feature compelling the market comprises the fast development of BioPharma, within the province.

The key service-providing companies of the global market for cold chains are continually improving their technologies to continue to lead the competition and to guarantee competence, honesty, and security.

The companies have taken on Hazard Analysis and Critical Control Points (HACCP) plus RFID tools to perk up the good organization, by way of a reduced volume of the consignment. Additionally, they are growing their fleets of multi-compartment refrigerated automobiles, to give extra services to the clientele.

• Creopack (Canada)

• Cold chain Technologies, Inc. (U.S.)

• Nordic Logistics and Warehousing, LLC (U.S.)

• Cold Box Express, Inc. (U.S.)

• Cryopack Industries, Inc. (U.S.)

• Preferred Freezer Services, LLC (U.S.)

• Agro Merchant Group (U.S.)

|

Report Attribute |

Details |

|

The market size value in 2021 |

USD 238.4 billion |

|

The revenue forecast in 2028 |

USD 628.3 billion |

|

Growth rate |

CAGR of 14.8% from 2021 to 2028 |

|

The base year for estimation |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, packaging, equipment, application, region |

|

Regional scope |

North America; Asia Pacific; Europe; South America; Middle East; Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; India; Singapore; Japan; South Korea; Brazil; Saudi Arabia; UAE; Israel; South Africa; Nigeria; Egypt; Kenya |

|

Key companies profiled |

Agro Merchant Group; Nordic Logistics and Warehousing, LLC; Preferred Freezer Services, LLC; Cold Chain Technologies, Inc.; Cryopack Industries, Inc.; Creopack; Cold Box Express, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Million Insights has segmented the global cold chain market report on the basis of type, packaging, equipment, application, and region:

• Type Outlook (Revenue, USD Million, 2017 - 2028)

• Storage

• Warehouses

• On-grid

• Off-grid

• Reefer Containers

• Transportation

• Road

• Sea

• Rail

• Air

• Monitoring Components

• Hardware

• Sensors

• RFID Devices

• Telematics

• Networking Devices

• Software

• On-premise

• Cloud-based

• Packaging Outlook (Revenue, USD Million, 2017 - 2028)

• Product

• Crates

• Dairy

• Pharmaceuticals

• Fishery

• Horticulture

• Insulated Containers & Boxes

• Payload Size

• Large (32 to 66 liters)

• Medium (21 to 29 liters)

• Small (10 to 17 liters)

• X-small (3 to 8 liters)

• Petite (0.9 to 2.7 liters)

• Type

• Cold Chain Bags/Vaccine Bags

• Corrugated Boxes

• Others

• Cold Packs

• Labels

• Temperature-controlled Pallet Shippers

• Materials

• Insulating Materials

• EPS

• PUR

• VIP

• Cryogenic Tanks

• Others (Insulating Pouches, Hard Cased Thermal Boxes, and Active Thermal Systems)

• Refrigerants

• Fluorocarbons

• Inorganics

• Ammonia

• CO2

• Hydrocarbons

• Equipment Outlook (Revenue, USD Million, 2017 - 2028)

• Storage Equipment

• On-grid

• Walk-in Coolers

• Walk-in Freezers

• Ice-lined Refrigerators

• Deep Freezers

• Off-grid

• Solar Chillers

• Milk Coolers

• Solar-powered Cold Boxes

• Others (Solar Refrigerators and Products related to Solar Panels)

• Transportation Equipment

• Application Outlook (Revenue, USD Million, 2017 - 2028)

• Fruits & Vegetables

• Fruit Pulp & Concentrates

• Dairy Products

• Milk

• Butter

• Cheese

• Ice cream

• Fish, Meat, and Seafood

• Processed Food

• Pharmaceuticals

• Vaccines

• Blood Banking

• Bakery & Confectionary

• Others (Ready-to-Cook, Poultry)

• Regional Outlook (Revenue, USD Million, 2017 - 2028)

• North America

• U.S.

• Canada

• Mexico

• The Asia Pacific

• China

• India

• Japan

• Singapore

• South Korea

• Europe

• U.K.

• Germany

• France

• Italy

• Spain

• South America

• Brazil

• Middle East

• UAE

• Saudi Arabia

• Israel

• Africa

• South Africa

• Nigeria

• Egypt

• Kenya

Research Support Specialist, USA