- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global commercial drone market size was accounted for USD 5.80 billion in 2018. It is estimated to reach 274.6 thousand units were sold in the year and the market is projected to witness 56.5% CAGR from 2019 to 2025. The increasing application of drones in agriculture, energy sectors, and entertainment is attributing to their growth. Drones were used for military applications, in the beginning; however, it has found numerous commercial applications of late.

These unmanned aerial vehicles (UAV) are capable of performing different hazardous tasks including inspection of utility pipelines with precision. In addition, favorable initiatives and regulations by governments have paved the way for increasing participation by start-ups owing to a lower entry barrier. Moreover, the emergence of drone delivery services in the e-commerce sector is anticipated to be the major boost for the market. Drones are capable of carrying emergency medicine and temperature critical commodities.

UAV manufacturers are focusing on developing a customer-centric solution to address specific business needs. Technical advancements have enabled drone manufacturers to introduce drones in various sizes, shapes, and weights. These drones are capable of performing varieties of applications.

Various other factors such as increasing investment in UAV start-ups and increasing commercial applications such as 3D mapping are projected to further bolster the growth of the market. However, factors such as lack of trained pilots, security and privacy concerns, and traffic management are estimated to hinder the market growth.

The construction and real-estate sectors have been witnessing an increasing demand for commercial drones for surveying applications. Drones reduce the cost and time in such applications as compared to conventional methods, thereby, gaining traction.

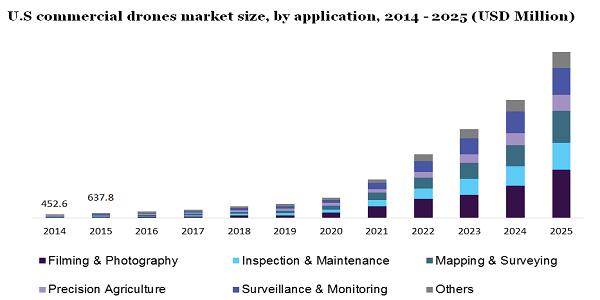

Among different applications, filming & photography are projected to account for the largest share in the commercial drone market over the next six years. In 2018, this segment was worth USD 1.86 billion and estimated to register considerable growth over the next few years. The use of drones for filmmaking, recording events, and aerial photography has increased in the recent past. Further, the use of drones in journalism is gaining traction as it allows media persons to cover in places where people's entry is not allowed.

On the other hand, the inspection & maintenance category is likely to witness significant growth over the forecast duration. The Federal Aviation Administration (FAA) has introduced new regulations (Part 107), which, in turn, has opened a new opportunity in the oil & gas sector. Further, the increasing adoption of commercial drones by utility companies is driving their demand.

The precision agriculture category is estimated to grow significantly owing to the increasing application of drones in critical farm applications. Drones help the farmer in various applications such as field monitoring and crop plantation.

Drones have significantly altered conventional business operations in the construction and real estate sector. This segment is estimated to register robust growth from 2019 to 2025. The rise in drone application in offering constant updates, surveying lands, and avoiding hazardous conditions are attributing to the growth of the segment.

Technical advancements in the farming sector are likely to lead to a rise in the adoption of drones in the agriculture sector. The awareness regarding drone use in agricultural activities is gaining traction. Moreover, drones help in crop monitoring under harsh environmental conditions and provide precise input. These benefits are projected to make drones a popular choice for farmers.

The security & law enforcement agencies are estimated to witness increased adoption of drones in the next few years. Drones are capable of transferring surveillance data like videos and images to base locations in real-time. UAVs can be equipped with night-vision cameras and thermal sensors along with moving in confined space. Such abilities are expected to make drones a vital component in a security application.

The delivery & logistics segment is likely to be the fastest-growing from 2019 to 2025. UAVs can be a cost-effective way of goods delivery. Further, it reduces the time taken for delivery. Owing to cost-effective delivery, e-commerce companies are anticipated to offer free delivery services, which, in turn, would attract a huge number of customers.

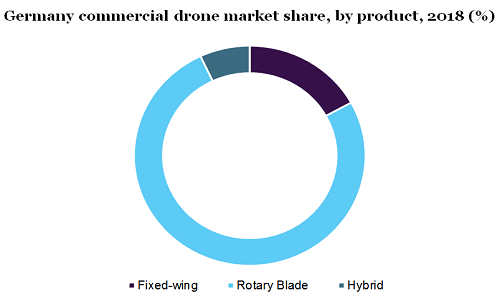

Fixed-wing UAVs are projected to expand at more than 60% CAGR over the forecast duration. They are most commonly used in terrain modeling, aerial mapping and topographic surveys owing to drones’ ability to operate at high altitudes for a longer time. On the other hand, the hybrid drones category is likely to grow at the fastest pace over the forecast duration. Hybrid drones are capable of offering increased power, payload size, and range as compared to those who are battery-operated.

In 2018, the rotary blade category accounted for the highest share in the market. Further, the segment is anticipated to continue its dominance over the forecast duration. These drones can land and take off vertically, thus, eliminate the need for extra space. The increasing need for precise maneuvering and the ability of such drones to locate their target with precision is driving the growth of the market.

In 2018, North America held the largest share in the market and projected to maintain its dominance over the forecast duration. The introduction of favorable government initiatives in the region coupled with the rise in drone-powered business is driving the growth of the region. In the U.S, the Federal Aviation Administration (FAA) has introduced guidelines regarding the safe and legal operation of drones for commercial purposes.

APAC is projected to be the fastest-growing segment during the forecast duration. Increasing adoption of drones in various application in countries such as Japan and China are attributing to the growth of the region. Drones are known to offer higher productivity as compared to conventional methods, especially in the agriculture sector that is facing a labor shortage. Europe, on the other hand, is witnessing considerable growth owing to the favorable regulations framed by the European Union government.

MEA is estimated to witness significant growth owing to the well-established oil & gas sector in the region. The use of drones in pipeline maintenance and inspection is gaining traction in the region. African countries are also increasingly adopting drones in the medicine and agriculture industries. For example, the government of Tanzania has partnered with Zipline to deliver medical supplies as well as blood in rural areas.

The COVID-19 outbreak has positively affected the commercial drones market. The pandemic has forced people to maintain social distance, where the use of drones has surged to combat the pandemics. The epicenter of the pandemic, Wuhan, drones was used in order to deliver medical essentials, which reduced the direct exposure to medical staff. Further, drones were used to check the temperature in a bid to slow the spread of coronavirus. In addition, drones adoption in various other applications such as surveillance, surveying, broadcasting, and delivering necessary items including food has increased to avoid people to people contact.

Leading market participants are Xiaomi, 3D Robotics, DJI, AeroVironment Inc., EHANG, and INSITU among others. Favorable government initiatives and increasing investment by venture capitalists are projected to create a lucrative opportunity for the market players. Market players, to gain larger market share, are adopting various strategic initiatives such as merger & acquisition, partnerships, and introduction of new products. Technology licensing is the other major strategic initiative where market players are focusing on. Owing to favorable regulations, the market is projected to witness the entry of new players.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million, Demand in Thousand Units and CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA) |

|

Country scope |

U.S., Canada, Germany, U.K., France, Italy, China, Australia, Japan, South Korea, Brazil, Mexico, UAE, Israel, and South Africa |

|

Report coverage |

Revenue forecasts, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the global commercial drone market report on the basis of application, product, end-use and region:

• Application Outlook (Revenue, USD Million, 2014 - 2025)

• Filming & Photography

• Inspection & Maintenance

• Mapping & Surveying

• Precision Agriculture

• Surveillance & Monitoring

• Others

• Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2014 - 2025)

• Fixed-Wing

• Rotary Blade

• Hybrid

• End-Use Outlook (Revenue, USD Million, 2014 - 2025)

• Agriculture

• Delivery & Logistics

• Energy

• Media & Entertainment

• Real Estate & Construction

• Security & Law Enforcement

• Others

• Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2014 - 2025)

• North America

• The U.S.

• Canada

• Europe

• Germany

• The U.K.

• France

• Italy

• The Asia Pacific

• China

• Australia

• Japan

• South Korea

• Latin America

• Brazil

• Mexico

• Middle East & Africa

• UAE

• Israel

• South Africa

Research Support Specialist, USA