- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global fraud detection & prevention market size was accounted for USD 17.33 billion in 2018. It is expected to witness growth with an 18.9% CAGR over the forecasted period, 2019 to 2025. This can be associated with the shifting trend towards digitalization coupled with the rising need for cyber-security to carry out online transactions on account of rising data leakage, hacking, and privacy issues.

Further, rapid technological advances being carried out across the globe like the emergence of AR (Augmented Reality), IoT (Internet of Things), cloud computing, and AI (Artificial Intelligence) have paved the way for an increase in virtual platforms for customers. Moreover, the surging number of financial crimes, cyber-attacks, identity thefts, and data breaches are hindering the growth of several organizations. These factors are driving the demand for fraud detection and prevention solutions.

Several sophisticated tactics are being used by hackers to exploit and identify vulnerabilities. These losses account for nearly 5% of the organization’s revenue. Owing to the increasing data volume through various transactions, several enterprises have started taking measures for curbing cyber threats and fraud.

Several sophisticated tactics are being used by hackers to exploit and identify vulnerabilities. These losses account for nearly 5% of the organization’s revenue. Owing to the increasing data volume through various transactions, several enterprises have started taking measures for curbing cyber threats and fraud.

Thus, the adoption of techniques for fraud prevention is becoming a top priority across several organizations. This is expected to reduce the gap between enhanced payment experience and security. For example, voice recognition technology is being adopted by a majority of financial institutions for verification of the client’s voice. Further, the invention of technologies like device fingerprinting and geolocation is anticipated to enhance the process of consumer verification.

In 2018, the segment of solutions dominated the global fraud detection and prevention market with a share of around 65%. This growth can be attributed to their feature of allowing the organizations to find patterns and anomalies in the fraudulent activities at the primary stage and helping to eliminate them. It also enhances the process by reducing the detection time and in the processing of data at a faster pace thereby driving the demand across the globe.

The segment of services is expected to witness the highest CAGR from 2019 to 2025. This growth can be attributed to the rising need for integration, consulting, support, and third-party services across several major organizations. Also, the need for the implementation of several marketing strategies in emerging economies is expected to drive the demand for such solutions in the upcoming years.

The solution segment of authentication held the largest share across the global market, in 2018 and generated USD 5.01 Billion in terms of revenue. This can be associated with the rising adoption of authentication solutions across several companies for securing passwords and logins which would help to gain more consumer trust. Several solutions like single factors, multifactor, and voice biometrics have enhanced customer authentication and thereby boosting the fraud detection capabilities.

The fraud analytics segment is projected to witness the highest CAGR during the forecasted years. It uses technologies like machine learning, AI, business intelligence, and data science for enabling fraud detection at an early stage. As a majority of the organizations analyze a huge amount of customer information, the need for fraud analytics is expected to boost examine of fraud patterns.

The segment of professional services held the largest share across the global market, in 2018. These professional services include training, support services, and consulting for the prevention of fraud. The majority of the players offering such services are also assigning consultants having higher technical expertise. Also, the support and training program being implemented by these players is helping in reducing the security gaps for enhancing the overall security thereby driving the market growth.

In 2018, the segment of managed services held a share of around 28% across the global market. It is also expected to register the highest CAGR in the upcoming years. It comprises a team of consultants and experts who manage all business activities like monitoring of business transactions for responding and detecting emerging threats. As these factors are being taken care of by the third-party managed services, their demand is anticipated to surge up in the upcoming years.

In 2018, the application segment of payment fraud dominated the global market with a share of around 40%. This can be attributed to the rising usage of e-wallets and cashless payments prevailing among the millennial population. As this digital transformation has enhanced access to the banks at the fingertip of customers, it has also created a major concern about digital fraud.

Thus, a majority of retailers and financial institutions have started adopting measures like consumer analytics, governance policies, and multifactor authentication. They are also focusing to prioritize fraud detection using updated systems with statistical models, fraud detection knowledge, and new rules. The emerging technology of advanced analytics has enabled organizations in recognizing fraudulent transaction patterns which are anticipated to drive the market growth for such solutions in the upcoming years.

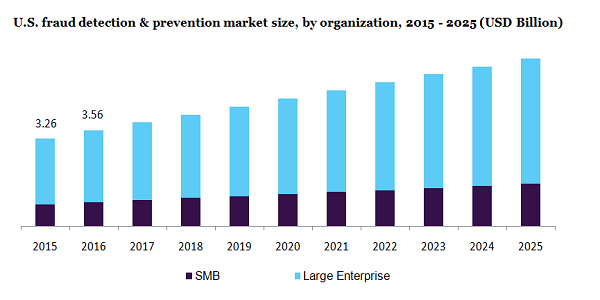

The segment of large enterprises held the largest share exceeding 75.0% across the global market. This can be attributed to their ability to spend more and technical expertise for the detection and prevention of fraud. But, these organizations are more prone to attacks like phishing, botnets, and irregular denial-of-service which make them compulsion for adopting fraud prevention and detection strategies.

Several cybercriminals have also started targeting SMBs (Small and Medium Businesses) owing to a lack of sufficient safety and security measures. Thus, threats and frauds are anticipated to challenge SMB’s IT infrastructure. Thus, on account of stringent governing policies and mounting losses, these SMBs are expected to adopt such solutions.

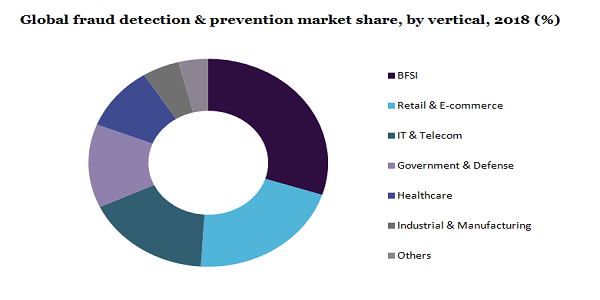

In 2018, the segment of BFSI held the largest share across the global market. This growth can be attributed to rising operations like mutual funds, insurance, and stockbroking across the banking sector. Further, the rising usage of digitalization has paved the way for heists and frauds in the BFSI sector. Thus, many financial institutions have started adopting several hybrid models like rule-based fraud prevention and detection techniques and advanced analytics.

The segment of retail and e-commerce is projected to witness the highest CAGR from 2019 to 2025. This can be attributed to the rising usage of electronic payment options that has created the demand for fraud detection & prevention solutions. These e-commerce companies store data related to debit and credit card information, login IDs, and passwords. Thus, the need for storing customer information is the topmost property of these companies which are anticipated to drive market growth in the upcoming years.

In 2018, North America dominated the market for fraud detection & prevention in terms of revenue. This can be associated with the rising presence of key players like Dell Inc.; BAE Systems; Fiserv, Inc., and ACI Worldwide, Inc. Also, huge investments being made by several companies for developing solutions to detect and prevent frauds for complying with government standards like PCI DSS are expected to drive the market growth in the upcoming years.

The Asia Pacific is anticipated to witness the highest growth during the forecasted years, 2019 to 2025. This can be associated with surging fraud cases across developing countries like India and China. Further, the rising infrastructure development by the adoption of technology across this region has enforced several governing authorities to enhance their data security. These factors are expected to compel many enterprises for adopting these solutions thereby driving their market growth.

The fraud detection & prevention market is fragmented on account of the presence of several solution providers across the globe. This market includes key players like Software AG, SAP SE, Total System Services, Inc., Software AG, Fiserv, Inc., IBM, ACI Worldwide, Inc., Oracle, BAE Systems, Equifax, Inc., and Experian plc.

The emergence of many solution providers that offer third-party security by enhancing their robust risk management is also expected to generate strong competition for these players. Such players are engaged in offering a wide range of fraud detection & prevention solutions to many industries for reducing fraud risks. Several players are developing innovative methods for assessing fraud risks which would allow them to launch customized solutions.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD million and CAGR from 2019 to 2025 |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2015 to 2025 in each of the sub-segments. For the purpose of this study, Million Insights has segmented the global fraud detection & prevention market report based on component, solutions, services, application, organization, vertical, and region:

• Component Outlook (Revenue, USD Million, 2015 - 2025)

• Solutions

• Services

• Solutions Outlook (Revenue, USD Million, 2015 - 2025)

• Fraud Analytics

• Authentication

• Governance, Risk, and Compliance

• Services Outlook (Revenue, USD Million, 2015 - 2025)

• Professional Services

• Managed Services

• Application Outlook (Revenue, USD Million, 2015 - 2025)

• Insurance Claims

• Money Laundering

• Payment Fraud

• Others

• Organization Outlook (Revenue, USD Million, 2015 - 2025)

• SMB

• Large Enterprise

• Vertical Outlook (Revenue, USD Million, 2015 - 2025)

• BFSI

• Government & Defense

• Healthcare

• IT & Telecom

• Industrial & Manufacturing

• Retail & E-commerce

• Others

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• the Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• MEA

Research Support Specialist, USA