- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global automotive cyber security market size was accounted for USD 1.44 billion in 2018 and projected to grow at a CAGR of 21.4% over the forecast period, from 2019 to 2025. The rising focus of OEMs on developing connected cars and autonomous driving systems has generated the risk of data theft, which is expected to drive the market demand over the forecast period. In addition, increasing the application of e-mobility globally is anticipated to drive market growth over the forecast period.

The advent of new technologies and trends such as 3D printing, robust connectivity social networks of things, and machine learning is gaining traction. Substantial developments in the automotive industry are driving the demand for sensors and battery management systems which are expected to enable more reliable cyber security solutions. Therefore, technological advancement in semi-autonomous and autonomous vehicles is expected to generate the need for automotive cyber security due to the increasing volume of data and the development of network capacities.

The advent of cloud computing technology has opened new avenues for market growth. Development of mobile cross-platform, automotive data taxonomy, cloud software infrastructure, and open car standard interface will create new opportunities for market growth across the globe. The industry is constantly striving to enable smartphone connectivity with car systems for automated vehicles. This initiative will help to implement intelligent transport systems.

Moreover, the growing incidence of malicious attacks owing to the rising adoption of connected cars will propel market growth. However, financial impacts, commonly accepted standards, and safety issues will hamper the market growth to some extent.

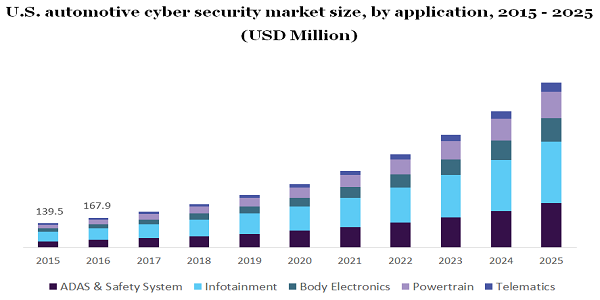

Application-wise, the market is segmented into ADAS & safety systems, body electronics, infotainment, telematics, and powertrain. The infotainment application segment is projected to dominate the automotive cyber security market over the forecast period. The segment is expected to have healthy growth due to the advent of autonomous driving technologies and increasing demand for seamless connectivity from the vehicle’s ECU to several cloud services in order to enhance the subsequent vehicle maneuvering and sensor processing.

By security, the market is bifurcated into the wireless network, application, and endpoint security. In 2018, wireless network security held the largest market share. Due to the increasing number of connected cars, the risk of cyber-attacks in the automotive sector is also increased, thereby the need for network security is expected to gain traction in the next few years.

The application segment is projected to grow with a CAGR of more than 23.0% over the forecast period. Society of Automotive Engineers (SAE) and ISO have recently worked together for the formation of automotive cyber security measures. In addition, IPA a vehicle information security guide has introduced the complete life cycle of vehicles to suppliers and third parties towards security.

On the basis of vehicle type, the automotive cybersecurity market is segmented into passenger cars, commercial vehicles, and electric vehicles (EV). In 2018, passenger cars accounted for the largest market share in terms of revenue. On the other hand, electric vehicles are projected to grow with the fastest CAGR over the forecast period, from 2019 to 2025. This growth is attributed to rising sales of electric vehicles in developed regions such as North America and Europe. Apart from sports and luxury cars, the demand for electric vehicles is increasing which is expected to propel the segment growth in the next few years. For instance, Tesla has developed Tesla Model 3 and witnessed high demand in the U.S. In addition, cost reduction in battery-operated vehicles is estimated to further boost the demand for electric vehicles, which will positively impact market growth.

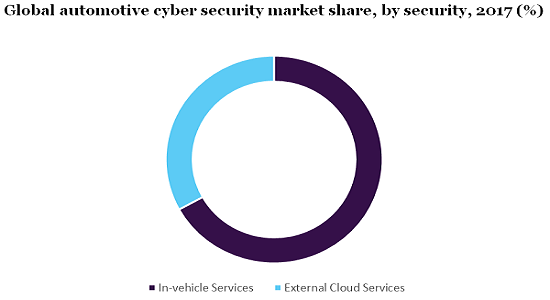

On the basis of services, the market is fragmented into in-vehicle services and external cloud services. In-vehicle services are projected to lead the market over the forecast period. This is due to the growing usage of endpoint applications like mobile, radio, and smart antennas.

The external cloud services segment is expected to emerge as the fastest growing owing to the adoption of cloud infrastructure. These services comprise highly reliable technology for the automobile sector, as autonomous cars generate a huge amount of data. Moreover, the growing number of cloud-enabled vehicles will boost a higher rate of information sharing.

The cloud services include features like open API that has the capability to connect with vehicles allowing seamless data across mobility systems, load balancing, data security, and life cycle management. It also enables monitoring, service logging, programming, and remote diagnostic.

North America is expected to hold the largest market share over the forecast period due to the increasing demand for automobiles. Asia Pacific market is expected to account for the second-largest market share during the forecast period. This is due to the rising investment and critical measures implemented by the regional government to tackle data breaches in the automotive sector. In addition, rising purchasing power and rapidly increasing urbanization are other factors expected to drive regional market growth. In 2018, Germany accounted for the largest market share in Europe. This high market share is attributed to the presence of prominent market players such as Mercedes-Benz, Opel, Audi, BMW, and Porsche Volkswagen.

The key players include in the automotive cyber security market are as follows:

• Argus Cyber Security Ltd.

• Arilou Technologies

• Vector Informatik GmbH

• NXP Semiconductors N.V.

• HARMAN International

• Symantec Corporation

• Denso Corporation

• Honeywell International, Inc.

• Guardknox Cyber-Technologies Ltd.

|

Attribute |

Details |

|

The market size value in 2020 |

USD 2.1 billion |

|

The revenue forecast in 2025 |

USD 5.6 billion |

|

Growth Rate |

CAGR of 21.4% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Security, vehicle type, application, service, region |

|

Regional scope |

North America; Europe; Asia Pacific; Rest of World |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Russia; Turkey; Italy; China; India; Japan; South Korea; Thailand; Brazil; South Africa; Iran |

|

Key companies profiled |

Argus Cyber Security Ltd.; Arilou Technologies; Vector Informatik GmbH; NXP Semiconductors N.V.; HARMAN International; Symantec Corporation; Denso Corporation; Honeywell International, Inc.; Guardknox Cyber Technologies Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global automotive cyber security market report based on security, vehicle type, application, service, and region:

• Security Outlook (Revenue, USD Million, 2015 - 2025)

• Endpoint

• Application

• Wireless Network

• Vehicle Type Outlook (Revenue, USD Million, 2015 - 2025)

• Passenger Car

• Commercial Vehicle

• Electrical Vehicle

• Application Outlook (Revenue, USD Million, 2015 - 2025)

• ADAS & Safety System

• Infotainment

• Body Electronics

• Powertrain

• Telematics

• Service Outlook (Revenue, USD Million, 2015 - 2025)

• In-vehicle Services

• External Cloud Services

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• Italy

• Spain

• Russia

• The Asia Pacific

• China

• India

• Japan

• South Korea

• Thailand

• Rest of World

• Brazil

• South Africa

• Iran

Research Support Specialist, USA