- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global aviation connectors market size was valued at USD 4.5 billion in 2019. It is estimated to expand at a 6.3% CAGR from 2020 to 2027. Factors such as the rise in the number of aircraft carriers, emphasizing air safety, and advancement in avionics systems are attributing to the growth of the market. In addition, increasing demand for vibration-free and reliable connectors is further driving the market growth.

Aviation connector finds its application in the various system such as using power systems, aircraft lighting, and seat actuator among others. These systems are required to work under rigorous working conditions. Considering this, key players provide rugged connectors. For example, DEUTSCH DMC-M Series connectors offered by TE Connectivity is a reliable connector with high-speed Ethernet. These connectors are capable of operating under a temperature range of -55°c to 175°c along with offering high resistance to vibration, smoke, and fire as per ARINC 809, EN4165, and BACC65.

The rise in the number of aircraft for military & defense purposes has further bolstered the market growth. Connectors that are resistant to vibration help in establishing an electrical connection in military aircraft. In addition, in military aircraft, the avionics system requires to tackle security and data processing challenges, thus, an advanced internal architectural design is needed. These connectivity and design are reinforced by USB, RF, PCB, and various other aviation connectors.

The rising focus on flight safety and growing use of the upgraded infotainment system has resulted in an increasing need for aviation connectors in aircraft of all kinds. In commercial flights, the business class offers an in-flight infotainment system to entertain their passengers during long flight journeys. Thus, such flights are required to be equipped with more connectors. Connectors help in the integration of airframe, engines, sensors, control panels, landing gears, and galley application, thereby, ensuring flight safety and functionality.

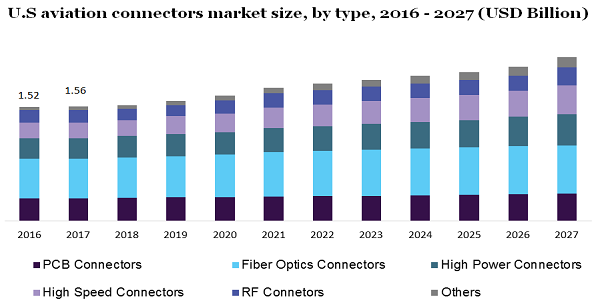

Based on type, the aviation connector market is categorized into Radio Frequency (RF), fiber optic, high-speed, high-power, PCB, and others. Of them, the fiber optic segment accounted for the largest share in 2019. Further, the segment is predicted to maintain its dominance over the forecast duration. The growing use of fiber optics in high-speed data transmission and its increasing use in FTTx applications are attributing to its growth. Moreover, it helps in addressing distance and bandwidth challenges.

On the other hand, the RF connector is projected to witness considerable growth over the forecast duration. Need for the communication between pilots and air traffic controllers is driving the device demand. It helps in transferring crucial information such as weather conditions, landing assistance, altitude, and direction, thereby, ensures flight safety. Thus, the device's usefulness in establishing an electrical connection to transmit signal is estimated to augment its growth.

Mostly, the aviation connectors are available in the form of circles and rectangles. In 2019, the circular category held the largest share in the market. The increasing use of circular connectors in communication devices, electronics, and computers in aircraft is attributing to its growth. In addition, the growing need for effective connectivity systems and the incorporation of advanced navigation technologies are further estimated to supplement the segment growth.

On the other hand, the rectangular category is projected to witness the highest CAGR of 6.6% over the forecast duration. The rectangular shape is preferred as it can be fitted without wasting any space between connectors. Some of the rectangular-shaped connectors are USB, electrical, coaxial, and multi-coaxial. Depending on their connection capability and application, connectors are made in either rectangular or circular share.

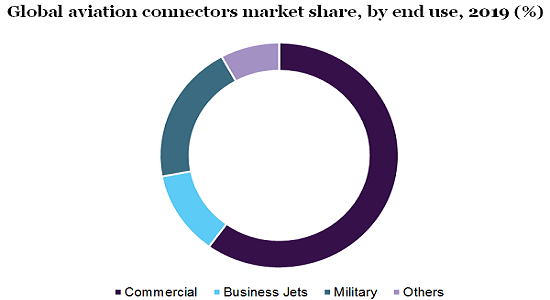

Depending on the end-user, the market is bifurcated into military, business jets, commercial, and others. Of them, the commercial category held the largest share in the market in 2019. Further, the segment is projected to register a 6.0% growth from 2020 to 2027. Emerging countries including India are witnessing high demand for commercial aircraft. Major aircraft manufacturers’ countries such as Germany, France, and the U.S are emphasizing the development of the advanced and reliable system, thus, spurring market growth.

On the other hand, in 2019, the military category accounted for USD 1.2 billion. The demand for military aircraft equipped with modern technologies is gaining traction among the world’s leading countries. For example, from 2025, Switzerland is aiming to replace Boeing F/A-18C/D Hornets with fleets of new combat aircraft. In addition, India is also aiming to replace its old combat aircraft and the country has signed a deal worth USD 15 billion to procure 114 combat aircraft. Therefore, increasing demand for new aircraft from the military sector is anticipated to drive market growth over the next few years.

It is predicted that North America would account for the largest share in the market over the forecast duration, primarily because of the presence of the leading players in the region. Some of the prominent players in the market are Gulfstream Aerospace, United Technologies, Sikorsky Aircraft, GE Aviation. Boeing and Lockheed Martin among others. Further, Europe is anticipated to register a 5.5% CAGR over the forecast duration. Growing focus on the replacement of old aircraft with new ones in the military is the major factor driving the European market. In addition, Europe is the home of some of the leading manufacturers such as Dassault Aviation, Thales Group, Leonardo Helicopters, Snecma, BAE Systems, and Airbus among others.

The Asia Pacific is predicted to register the fastest growth rate over the next seven years. Increasing demand for commercial, military, experimental, and business jets from countries such as Japan, India, and China is driving regional growth. In addition, China, in July 2019, reduced the prices of aviation fuels, which, in turn, positively affected the growth of the aviation industry. Further, India is also witnessing significant demand owing to the rise in the number of domestic manufacturers such as Raj Hamsa Ultralights, Indian Rotorcraft manufacturer, Mahindra Aerospace, and HAL.

The outbreak of COVID-19 has adversely affected the aviation connectors market. Owing to the pandemic outbreak, air traffic was disrupted significantly. Several countries imposed lockdowns and restricted air travel. Sudden decline in air traffic, adversely affected the revenue of commercial airlines. In addition, military operations were also put on hold, as social distancing become the new norm. The pandemic outbreak was followed by an economic crisis with world major economies losing a significant part of their gross domestic product (GDP). Declining GDP has resulted in low spending on procurement of new commercial as well as military aircraft, thus, plummeting the industry growth.

Leading companies operating in the market are Bel Fuse Inc., Eaton Corporation, Conesys Inc., Rosenberger Group¸ Amphenol Corporation, TE Connectivity, Esterline Corporation, Conesys Inc., and ITT Corporation among others. Owing to the presence of leading manufacturers, the market is competitive in nature. Key companies are focusing on an organic growth strategy to stay ahead in the market. For example, Elektron Technology, in April 2018, unveiled aviation connectors made of fiber optics. These connectors are well suited to work under extreme environmental conditions.

|

Attribute |

Details |

|

The market size value in 2020 |

USD 4.7 billion |

|

The revenue forecast in 2027 |

USD 7.2 billion |

|

Growth Rate |

CAGR of 6.3% from 2020 to 2027 |

|

The base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2020 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, shape, end-user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico |

|

Key companies profiled |

Amphenol Corporation; Bel Fuse Inc.; Carlisle Companies Inc.; Eaton Corporation; Esterline Corporation; Fischer Connectors SA; Conesys Inc.; ITT Corporation; CONEC Elektronische Bauelemente GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insights has segmented the global aviation connector market report on the basis of type, shape, end-user, and region:

• Type Outlook (Revenue, USD Million, 2016 - 2027)

• PCB Connectors

• Fiber Optic Connectors

• High Power Connectors

• High-Speed Connectors

• RF Connectors

• Others

• Shape Outlook (Revenue, USD Million, 2016 - 2027)

• Circular

• Rectangular

• End-user Outlook (Revenue, USD Million, 2016 - 2027)

• Commercial

• Business Jets

• Military

• Others

• Regional Outlook (Revenue, USD Million, 2016 - 2027)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• France

• The Asia Pacific

• China

• Japan

• India

• Latin America

• Brazil

• Mexico

• Middle East & Africa

Research Support Specialist, USA