- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global cloud services brokerage (CSB) market size was accounted for USD 4.96 billion in 2018 and projected to grow with a CAGR of 17.3% over the forecast period, from 2019 to 2025. Cloud Service Brokerage (CSB) is referred to as an intermediator between consumers and Cloud Service Providers (CSP) that help and support consumers in orchestration, integration, and implementation across multiple platforms and assist them for the best solutions and services for their businesses.

Enterprises are offering several solutions due to the rising adoption of a multi-cloud platform. Many organizations are depending upon third parties for choosing the best solution to increase their operational efficiency, productivity, and agility. This is projected to drive market growth over the forecast period.

Cloud-based service vendors are developing agile and modern business models for IT infrastructures by providing advanced service. Market players assist users in leveraging and simplifying services that can customize, aggregate, and improve access to business information in multi-cloud platforms.

Various organizations are shifting their business processes towards the cloud to reduce operational costs and easy data accessibility from any location. Moreover, the growing penetration of Platform-as-a-Service (PaaS) in several enterprises to test and develop applications is expected to boost the demand for CSB solutions.

Integration of cloud services with on-premise business operations improves the flexibility and scalability of organizations. However, the complexity to manage multiple cloud platforms can hinder the organization’s productivity. Therefore, organizations are demanding services that can help to reduce these complexities and execute business processes efficiently. This scenario is projected to increase the demand for CSB solutions in the next few years. Further, growing investment for advanced telecom network infrastructure and increasing adoption of hybrid IT solutions are projected to drive the market growth during the projected period.

However, the growing concern of cybersecurity and lack of awareness about the benefits of CSB among SMEs are factors expected to restraint the market growth during the forecast period.

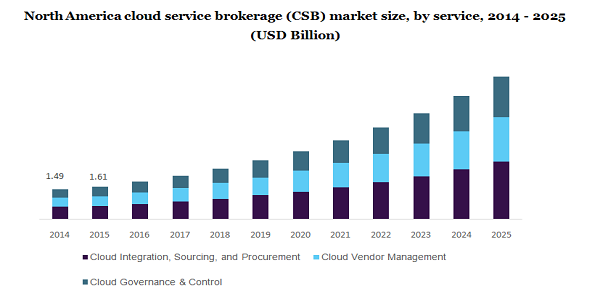

The cloud service brokerage market, based on services, is segmented into integration, sourcing, and procurement; governance &control, and vendor management. Among these services, the cloud integration, sourcing, and procurement segment held over 40.0% market share, in 2018. Increasing demand for these services in a large enterprise to integrate their business with third-party vendors, technology partners, and clients that provide agility is a major factor for segment growth.

Moreover, the vendor management segment is projected to grow with a significant CAGR over the forecast period. To manage billings, orders, and other demand from several vendors, companies are extensively adopting a cloud-based vendor management solution which is expected to boost the segment growth during the forecast period.

Based on the deployment model, the market is classified into public, private, and hybrid. In 2018, the public cloud segment dominated the market with a market share of over 45.0%. Growing demand for Infrastructure as a Service (IaaS), PaaS, and Software as a Service (SaaS)-based services is a major factor to drive this segment growth.

The hybrid cloud segment is expected to grow with the highest CAGR over the forecast period. This growth is attributed to the growing demand for agile, cost-efficient, and scalable computing coupled with an increasing need for interoperability between legacy systems and cloud services.

Based on the platform, the market is fragmented into internal brokerage enablement and external brokerage enablement. In 2018, the internal brokerage enablement segment held the largest market share of nearly 50.0% in terms of revenue. Growing demand for internal brokerage enablement to support services for existing employees of the organization, spend management, compliance security and to provide integrated multi-cloud/SaaS governance is a major factor driving the segment growth.

The external brokerage enablement is projected to grow with a significant growth rate over the forecast period. This is due to the growing demand for CSB solutions for incorporating and managing several vendors, CSPs, and resellers on a single platform coupled with support to multiple data formats, currencies, languages, and time zones.

Based on organization size, the market is segmented into small & medium enterprises, and large enterprises. Large enterprise segments accounted for the larger market share of over 60.0%, in 2018. This high revenue market share is obtained due to the increasing demand for CSB solutions to reduce complexity and increase productivity along with the high adoption of multi-cloud platforms.

SMEs segment is projected to grow with a significant growth rate during the forecast period. As SMEs have limited resources than large resources, the demand for CSB is expected to manage better utilization of human resources.

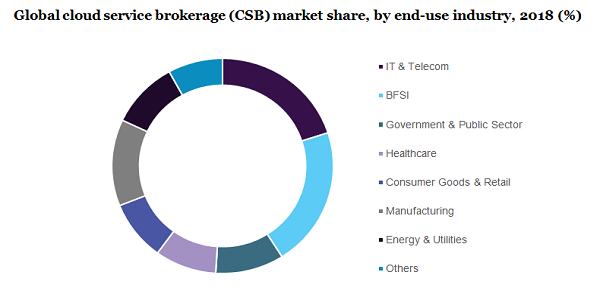

Based on end-use, the market is segmented into IT & Telecom, government & public sector, BFSI, healthcare, manufacturing, consumer goods & retail, energy & utilities, and others. In 2018, IT & telecom held a significant market share of nearly 20.0% due to the growing demand for CSB to manage PaaS, IaaS, and SaaS across several organizations.

Moreover, factors like the growing need for data harmonization, provisioning, and predictive analytics to reduce the operational cost of IT infrastructure are expected to drive the segment growth during the forecast period.

The BFSI end-use segment is projected to grow with a significant CAGR during the forecast period. This growth is attributed to favorable government initiatives to promote digital banking coupled with the increasing digital payment landscape across the globe, especially in developing regions.

In 2018, North America dominated the market and accounted for the largest market share of around 40.0% in terms of revenue. This is due to the presence of IT and telecom vendors coupled with the high adoption of cloud-based services in countries like the U.S. and Canada.

Asia Pacific CSB market is projected to grow with a significant growth rate during the forecast period. This growth is attributed to the rapidly increasing number of IT-based startups in several countries such as India and China. Moreover, growing investment for upgrading telecom infrastructure coupled with offering higher bandwidth to consumers is driving the market growth in the Asia Pacific.

Owing to the outbreak of COVID-19, the cloud service brokerage market is expected to gain traction, as most of the employees are working from home due to government restrictions. This pandemic has accelerated the adoption of cloud-based platforms among organizations. Therefore, to manage complexities and for efficient operations, the demand for cloud service brokerage is expected to increase, as CSB helps to manage performance as well as delivery of cloud services efficiently. Despite the pandemic situation, the implementation of CSB will help large organizations and SMEs to execute their operations efficiently.

The key players are focusing on expanding their services offer to fulfill customers’ needs and to offer high security. For example, in 2018, Atos SE launched a new cloud security brokerage solution along with high data security in hybrid cloud environments. Further, companies are also engaged in establishing partnerships to expand their geographical presence. The prominent players operating in this market are as follows:

|

Attribute |

Details |

|

The market size value in 2020 |

USD 6,481.8 million |

|

The revenue forecast in 2025 |

USD 17,198.0 million |

|

Growth Rate |

CAGR of 17.3% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, deployment model, platform, organization size, end-use industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; France; China; Japan; India; Mexico; Brazil |

|

Key companies profiled |

Accenture PLC; IBM Corp.; Atos SE; Capgemini SE; Jamcracker, Inc.; Cognizant Technology Solutions Corporation; DXC Technology Company; Infosys Limited; Hewlett Packard Enterprise Development LP; Fujitsu Ltd.; NTT DATA, Inc.; Tech Mahindra Limited; Wipro Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Million Insights has segmented the global cloud service brokerage market report based on service, deployment model, platform, organization size, end-use industry, and region:

• Service Outlook (Revenue, USD Million, 2014 - 2025)

• Integration, Sourcing, and Procurement

• Vendor Management

• Governance & Control

• Deployment Model Outlook (Revenue, USD Million, 2014 - 2025)

• Private

• Public

• Hybrid

• Platform Outlook (Revenue, USD Million, 2014 - 2025)

• Internal Brokerage Enablement

• External Brokerage Enablement

• Organization Size Outlook (Revenue, USD Million, 2014 - 2025)

• Large Enterprises

• Small & Medium Enterprises

• End-use Industry Outlook (Revenue, USD Million, 2014 - 2025)

• IT & Telecom

• BFSI

• Government & Public Sector

• Healthcare

• Consumer Goods & Retail

• Manufacturing

• Energy & Utilities

• Others

• Regional Outlook (Revenue, USD Million, 2014 - 2025)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• France

• The Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• Middle East & Africa

Research Support Specialist, USA