- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global digital lending platform market was prized by USD 4.87 billion in 2020. It is estimated to witness 24.0% CAGR from 2021 to 2028.

The plans, aggressively followed by financial organizations to improve the experience for clients are anticipated to steer the enlargement of the market, during the forecast period.

The increasing speed of the internet infiltration along with the propagation of smart phones, furthermore, pushes the expansion of the market. The benefits presented by digital lending platforms for example, rapid decision-making, trouble-free accessibility using smart phones, and e-signing are likely to add to the development of the market.

The progression in the most recent technologies, for example advanced analytics, block chain, machine learning, and Artificial Intelligence (AI), together with planned deployment of the most modern procedures, for example e-signatures, e-mandates and biometric facilitated verification to lessen cheat, are likely to perform an important function in propelling the expansion of the digital lending platform market.

But, the contests, like concerns about the safety of information and security of privacy, are likely to limit the increase of the market. Numerous government organizations, globally, by now have taken efforts to deal with these concerns.

Additional challenges, like greater inclination for usual procedures of lending plus lesser digital literacy levels in weak nations, are furthermore anticipated to hold back the development of the market, to a definite level.

The eruption of the Covid-19 pandemic had an optimistic influence on the market for digital lending platform. Mainly, banks and credit unions are increasing their digital banking contributions, to encounter the requirements of their clients in the wake of pandemic. Moreover, in Covid-19, the banks have gradually started utilizing digital outlets for providing loans beneath the Paycheck Protection plan.

In 2020, the on-premise section held above 68.0% revenue share and dominated the global digital lending platform market. Financial organizations are choosing for on-premise digital lending platforms like a portion of the efforts to call off cyber threats, following the increasing figure of the occasions relating to the information violation as well as cyber-attacks. Furthermore, the on-premise deployment decreases the entire expenditure of possession since there is barely any monthly or yearly contribution charges occupied. On the other hand, the reality that as contrast to the cloud solutions, execution of on-premise solutions needs additional period, which can possibly delay the expansion of the section.

The cloud section is increasing grip due to the sustained acceptance of inventive practices, in addition to an increasing inclination for cloud sourced platforms. Fin tech companies are concentrating on deploying cloud sourced digital lending platforms and following the pay as per usage fee pattern, that permits companies to reduce the general operational overheads.

The design & implementation section held above 34.0% revenue share and dominated the global digital lending platform market, in 2020. To encourage the acceptance of digital platforms, financial organizations necessitate a design & implementation structure.

The consulting section is anticipated to observe the highest development, during the forecast period. Consultancy services permit credit unions to plan training curriculum for particular requirements. Furthermore, consulting services are able to assist in enhancing the manner the technology teams, workforce and customers function.

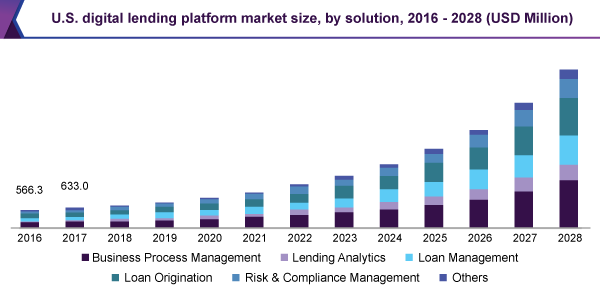

The business process management section held above 30.0% revenue share and dominated the global digital lending platform market, in 2020. Due to its ability to reduce operational expenses as well as considerably boost efficiency, business process management has increased fame.

The lending analytics section is likely to observe the highest development, during the forecast period. Lending analytics permit lenders to carry out client segmentation scrutiny and enhance customer attainment. Furthermore, it helps lenders in increasing productivity, dropping expenses and improving performance.

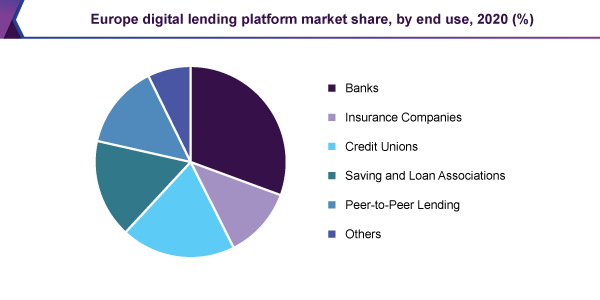

The banks sector held, above 30.0% share and dominated the global digital lending platform market, in 2020. Banks are forcefully concentrating on digitalizing their fiscal services. Strict policies and optimistic proposals followed by governments of together developing as well as developed nations are, furthermore, pushing banks to implement digital lending platforms and improve client experience. Normally, digital lending platforms permit banks to guarantee clearness in their loan procedure.

The credit unions section is likely to observe the highest development, during the forecast period. The development can be credited to the reality that digital lending platforms are able to assist credit unions in raising the client transfer speed.

In 2020, North America region held, above 33.0% revenue share and dominated the global digital lending platform market. For a number of important companies, North America is the homeland. The region is the initial acceptor of the sophisticated and newest technologies. Therefore, in North America, the demand for continuous and digital fiscal solution, at all times is on the upper part.

Mainly, a huge movable labor force is encouraging the financial establishments, within the region, to digitalize their services and improve client experience. The financial establishments, within the region, are struggling to discriminate themselves from their contestants, by way of initiating new digital assistances like a piece of efforts, to get a considerable viable benefit.

The Asia Pacific section is expected to observe major enlargement, during the forecast period. The development can be credited to the rising figure of fin tech companies, within the region. The features like increasing infiltration speed of internet along with the smart phones are moreover anticipated to stimulate the expansion of the local market.

Additionally, positive plans followed by the administrations of budding economies, together with India, China and others, are promoting the application of highly developed banking gadgets, by this means powering the enlargement of the local market.

Most important market players are taking up the policies like product upgrading, presentation of new products and joint contracts, like a piece of the efforts, to strengthen their place in the market. Besides, they are concentrating on joint ventures with banks to improve client experience.

• Tavant

• Roostify

• Nucleus Software

• Fiserv, Inc.

• Ellie Mae, Inc.

• Wizni, Inc.

• Sigma Infosolutions

• Pegasystems Inc.

• Newgen Software

• FIS

|

Report Attribute |

Details |

|

Market size value in 2021 |

USD 5.80 billion |

|

Revenue forecast in 2028 |

USD 26.08 billion |

|

Growth rate |

CAGR of 24.0% from 2021 to 2028 |

|

Base year of estimation |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, service, deployment, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil |

|

Key companies profiled |

Ellie Mae, Inc.; FIS; Fiserv, Inc.; Newgen Software; Nucleus Software; Pegasystems Inc.; Roostify; Sigma Infosolutions; Tavant; Wizni, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Million Insights has segmented the global digital lending platform market report based on solution, service, deployment, end use, and region:

• Solution Outlook (Revenue, USD Million, 2016 - 2028)

• Business Process Management

• Lending Analytics

• Loan Management

• Loan Origination

• Risk & Compliance Management

• Others

• Service Outlook (Revenue, USD Million, 2016 - 2028)

• Design & Implementation

• Training & Education

• Risk Assessment

• Consulting

• Support & Maintenance

• Deployment Outlook (Revenue, USD Million, 2016 - 2028)

• On-premise

• Cloud

• End-use Outlook (Revenue, USD Million, 2016 - 2028)

• Banks

• Insurance Companies

• Credit Unions

• Savings &Loan Associations

• Peer-to-Peer Lending

• Others

• Regional Outlook (Revenue, USD Million, 2016 - 2028)

• North America

• Canada

• U.S.

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa

Research Support Specialist, USA