- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global electric vehicle supply equipment (EVSE) market size was accounted for USD 14.1 billion in 2018. It is estimated to grow at a CAGR of 33.1% over the forecasted period 2019 to 2025. EV supply equipment is used for charging applications across commercial and residential places such as highways, parks, hotels, corporate offices, and homes. Furthermore, encouraging initiatives by the government authorities regarding the use of electric vehicles is projected to surge the market growth.

China and the U.S. are the largest producer & consumers of energy & utilities which is mainly supporting the market growth. Moreover, encouraging government initiatives for developing charging infrastructure is projected to spur the demand for EVSE. Companies such as General Motors and Coca-Cola Company are focusing on developing charging solutions. Additionally, electricity provider companies like Electric Company and Pacific Gas collaborating with EV supply equipment companies. These initiatives are anticipated to boost the demand for electric vehicle supply equipment.

Public transportation agencies such as GVB Netherlands, Warsaw public transports are partnering with companies such as AB Volvo, Mercedes Benz, and VDL coach & bus to develop charging solutions. Moreover, supportive government investments are also fostering market growth. For example, the City of Warsaw has provided funding into projects across Warsaw city for developing 20 fast-charging systems.

In addition, in 2016, the U.S. government has invested over USD 4.5 billion to boost the charging solution for electric vehicles. Similarly, the South Korean government has funded over USD 180.3 million to develop an EVSE solution. Moreover, hotel manufacturers are cooperating with EVSE companies to install charging stations. For example, Tesla, Inc, has installed over 3,000 EV charging stations at hotel Marriott International.

However, the high cost linked with installation is expected to restrain the growth of the market. Moreover, the development of hydrogen storage solutions and next-generation systems is projected to negatively impact market growth. On the other hand, onboard pantographs, and wireless charging options are anticipated to bolster the demand for the EVSE market.

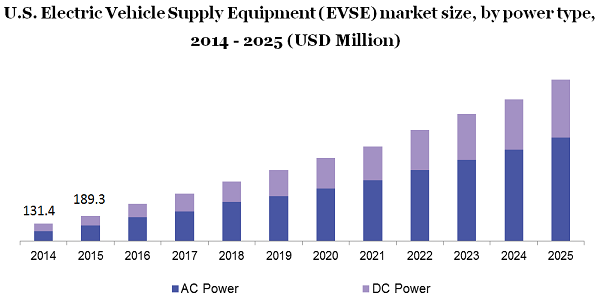

Power type includes two categories as DC power and AC power. DC power type contributed to the highest market share, in 2018. This segment is projected to lead the market by the end of 2025. A growing number of public partnerships for developing Level 1, 2 charging stations especially across the commercial sector is boosting the segmental growth. The rising adoption of DC level-1 charger in North America and Europe market is propelling the market growth.

AC Power type is projected to grow at a substantial rate during the forecasted period. Automotive companies such as General Motors, Tesla, BMW focus on offering AC-powered chargers in EVs. Moreover, contractors like Joju Solar focus on providing maintenance and installation service to charging stations. Level-1 AC-powered chargers have significantly huge demand from companies such as General Motors, and Coca-Cola Company, which is expected to bolster the growth of the electric vehicle supply equipment market.

Depending on the product, the market is split into EV charging kiosks, portable chargers onboarding charging stations, and others. In 2018, the EV charging kiosks segment held the largest share in the overall market. Technological development such as near field communication (NFC), and RFID, and fast digital payment options are influencing consumers to utilize EVSE solutions. Additionally, fewer workforces in Germany, U.K., and the U.S. have represented a challenge for EV charging station operators in heavy traffic situations. This is anticipated to bolster the need for charging kiosks solutions.

The onboard charging station is projected to propel at the fastest CAGR during the forecasted period, 2019 to 2025. Government authorities are agreeing with a long-term contract for the development & maintenance of charging stations. Onboard charging solution reduces vehicle downtime and offers an expedited charging process, especially for large trucks.

The EV supply equipment market is divided into supercharging, inductive charging, and normal charging depending on the charging station type. In 2018, the normal charging station type segment led the market with the highest share. This growth is attributed to supportive government initiatives across cities like Melbourne, Beijing, and Amsterdam. These initiatives are also boosting the demand for onboard charging solutions with AC power.

An inductive charging solution is anticipated to register the fastest CAGR from 2019 to 2025. Furthermore, wireless charging solution developments and the rising trend of ridesharing, driverless vehicles is projected to boost the demand for inductive charging solution in the next few years.

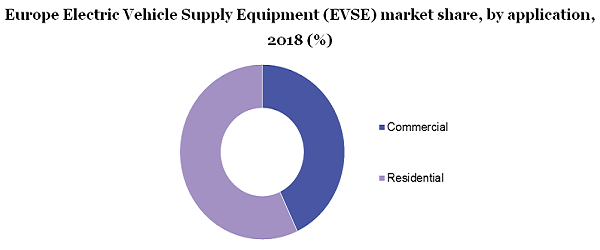

In 2018, commercial application has led the market with the highest share in the overall market. Various initiatives including Electric highway between Italy and Norway, Trans-Canada highway are mainly contributing to market growth. In addition, EVSE manufacturers are focusing on building charging infrastructure at shopping malls, resorts, and hotels. Moreover, increasing emphasis by the top hospitality players such as Marriott International, and Hyatt Corporation are developing EV charging stations at parking lots.

The residential application segment is projected to grow at a significant rate during the forecasted period. The rising number of tax credits and subsidies provided by the government is mainly driving the growth of EVSE in the residential sector. Moreover, automotive companies offer chargers for electric cars. Factors such as high convenience and cost-effectiveness are projected to surge the market in the coming few years.

In 2018, Asia Pacific contributed to the largest market share in the overall market. It is anticipated to propel at the highest CAGR during the forecasted period. Favorable government initiatives to develop charging infrastructure for electric vehicles is mainly boosting the market growth. The government of Japan & South Korea is focusing on developing charging stations along with funding from government agencies. For example, the Beijing administration is planning to install over 1,628 charging station parks, malls, and hotels.

Europe is anticipated to grow at a significant rate of CAGR from 2019 to 2025. This is due to the growing number of partnerships between Volkswagen Group, BMW, and Daimler AG for developing fast-charging solutions. Additionally, private & public partnership (PPP) in the development of EV supply equipment highway is projected to bolster the demand for this market.

COVID-19 pandemic has impacted the global EVSE market along with economic slowdown, and disruption in automobile manufacturing. Due to lockdown, several companies have faced challenges as the production of electric vehicle equipment has stopped. Key electric vehicle (EVs) manufacturers including Tesla Motors, Kia Motors, BYD have witnessed a decline in their sales. Moreover, the supply chain disruption in raw materials such as electronic components is hampering the market growth.

However, various Original Equipment Manufacturers (OEMs) have partnered with its group of companies for installing charging stations and developing charging infrastructure. These initiatives are projected to positively impact market growth.

Leading players in the market include ABB Ltd.; AeroVironment Inc.; ClipperCreek, Inc.; Chargemaster PLC; ChargePoint, Inc.; Leviton Manufacturing Co., Inc.; Siemens; and Eaton Corporation. Key players focus on strategic acquisitions and investment in R & D activities. For example, in 2018, AeroVironment Inc. has introduced TurboDX EV supply equipment with smart charging features. ChargePoint Inc. has acquired a General Electric charging network of vehicles.

Manufacturers engage in partnerships with government agencies to increase their presence across the globe. For example, in 2016, Heliox has contracted with Oslo Government in Norway to build fast-charging stations.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million, Volume in Units & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America & Middle East & Africa |

|

Country scope |

U.S., Canada, Netherlands, U.K., France, Norway, Germany, China, Japan, South Korea, Brazil, Mexico. |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For this study, Million Insights has segmented the global electric vehicle supply equipment market report based on power type, product, charging station type, application, and region:

• Power Type Outlook (Volume, Units; Revenue, USD Million, 2014 - 2025)

• AC Power

• Level 1

• Level 2

• Level 3

• DC Power

• Level 1

• Level 2

• Level 3

• Product Outlook (Volume, Units; Revenue, USD Million, 2014 - 2025)

• Portable Charger

• EV Charging Kiosk

• Onboarding Charging Station

• Others

• Charging Station Type Outlook (Volume, Units; Revenue, USD Million, 2014 - 2025)

• Normal Charging

• Super Charging

• Inductive Charging

• Application Outlook (Volume, Units; Revenue, USD Million, 2014 - 2025)

• Commercial

• Destination Charging Station

• Highway Charging Station

• Bus Charging Station

• Fleet Charging Station

• Others

• Residential

• Regional Outlook (Revenue, USD Million, 2014 -2025)

• North America

• U.S.

• Canada

• Europe

• Netherlands

• U.K.

• France

• Norway

• Germany

• the Asia Pacific

• China

• Japan

• South Korea

• Latin America

• Brazil

• Mexico

• Middle East & Africa (MEA)

Research Support Specialist, USA