- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global geospatial analytics market size was worth USD 51,700.7 million in 2018. The market is estimated to expand at 15.0% CAGR over the forecast duration, 2019 to 2025. This technology uses Geographic Information Systems (GIS), remote sensing, Global Positioning Systems (GPS), and geo-referencing in order to provide precise trend analysis, predictions, and modeling. Additionally, this analytics filters out useful and relevant data from the set of the clustered dataset.

The rising penetration of IoT, big data analytics, and Artificial Intelligence (AI) is projected to provide growth opportunities for the market. These technologies have enabled geospatial analytics service providers to offer analytics for complex and large data set on demand. Additionally, these advancements have led to the integration of a hybrid cloud system with information systems.

Geospatial analytics uses different analytical techniques including statistical analysis in order to analyze spatial and geographical data. Further, it utilizes software-based solutions to process spatial data. Moreover, geospatial information can be readily integrated into existing information systems in an organization. Thus, these aforementioned benefits are expected to drive market growth over the next few years.

Geospatial analytics uses different analytical techniques including statistical analysis in order to analyze spatial and geographical data. Further, it utilizes software-based solutions to process spatial data. Moreover, geospatial information can be readily integrated into existing information systems in an organization. Thus, these aforementioned benefits are expected to drive market growth over the next few years.

However, factors such as high cost-incurred in acquisition and dearth of skilled workforce are expected to limit the market growth over the next few years. Despite the significant reduction in overall cost required for the geospatial solution, the accessibility of open source software and decreasing hardware cost make it challenging for small and medium enterprises.

In the beginning, geospatial analytic systems were used in the life science and environmental industry, primarily focusing on geology, epidemiology, and ecology. However, with recent technological advancements, this analytics technique is being used in several industries such as healthcare, government & defense, natural resources, public safety, and utilities. Additionally, this analytics technique is used in Disaster Risk Reduction and Management (DRRM) and Climate Change Adaptation (CCA).

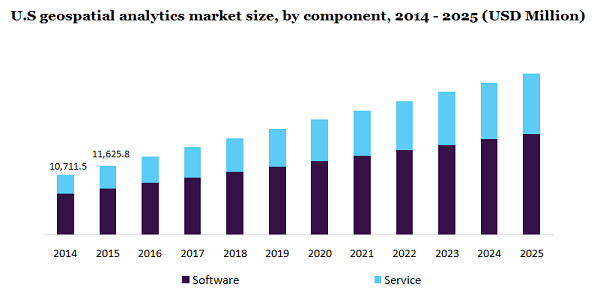

On the basis of components, the geospatial analytics market is segregated into service and software. In 2018, the software category held the largest share in the market. The growth of this segment is attributed to the rising use of the software-based solution in obtaining business intelligent information based on location. Such information helps the organization in making an informed decision. Additionally, analytics software adoption for various applications such as forest management, traffic monitoring, and environment management has increased significantly over the last few years. Technical advancement paved the way for the development of 4-D GIS software, which, in turn, is projected to drive the demand for geospatial analytics.

On the other hand, the service category is projected to register the highest CAGR over the forecast duration. The rising need for training, support, and installation services is attributing to the growth of this segment. Various government bodies deploy this analytics technique in order to monitor their infrastructure projects, cross-border movement, and natural resources apart from offering safety to vehicles. Additionally, companies are providing Geospatial Analytics-as-a-Service, which, in turn, is anticipated to drive its demand. For example, Cloud geospatial analytics service offered by IBM helps in monitoring the location of a vehicle's movement in real-time.

By type, the market is segmented into visualization, network and location analytics, surface and field analytics, and others. Of them, surface and field analytics accounted for the largest share in the market in 2018. The wide application of this segment in both private and government sectors is attributing to its growth. Surface and field analytics is used to determine water flow along with designing and constructing drainage systems. Additionally, this system is used to analyze the erosion of topsoil in the agriculture sector.

On the other hand, the network and location analytics category are estimated to register the highest CAGR over the forecast duration. The growing need to deliver customized content and optimization of marketing strategy is driving the growth of this segment. Additionally, this segment helps in organizing and analyzing a large volume of data, which helps the business in decision making. Network and location analytics allows visualization and interpretation of data in various ways such as charts, reports, globe, and maps. This plays a vital role for companies looking to expand their operations and explore the untapped market.

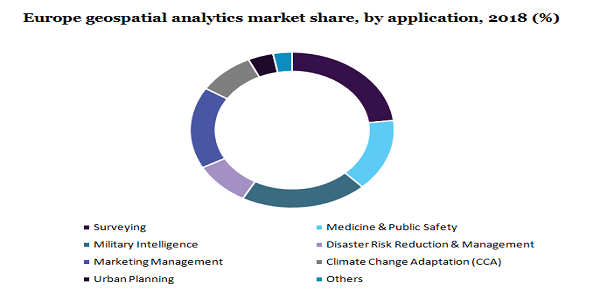

On the basis of application, the geospatial analytics market is segmented into medicine and public safety, marketing management, urban planning, disaster risk reduction and management, surveying, Climate Change Adaptation (CCA), military intelligence, and others. In 2018, the surveying category held the largest market due to the wide adoption of this segment in monitoring natural resources and agriculture. On the other hand, the military intelligence category is anticipated to account for the highest growth rate over the forecast duration. The rising use of remote sensing satellites for patrolling the border is driving this segment growth.

Remote sensing finds its application in land surveying along with various earth science branches such as oceanography, geology, glaciology, ecology, hydrology, and meteorology. Along with economic, humanitarian, planning, and commercial applications, the remote sensing system is also used in military applications. Further, an organization like the National Emergency Management Agency (NEMA) utilizes geospatial analytics in disaster management.

Remote sensing finds its application in land surveying along with various earth science branches such as oceanography, geology, glaciology, ecology, hydrology, and meteorology. Along with economic, humanitarian, planning, and commercial applications, the remote sensing system is also used in military applications. Further, an organization like the National Emergency Management Agency (NEMA) utilizes geospatial analytics in disaster management.

In 2018, North America held the largest share in the market, primarily because of the presence of major market players such as Harris Corporation, Pitney Bowes, Google LLC, Trimble Navigation, Alteryx, Inc., Digital Globe, and ESRI among others. The growing adoption of leading technologies such as IoT, cloud computing, big data analytics, and others in North America is a major factor driving regional growth. Additionally, the availability of the number of remote sensing satellites, high-speed network connectivity, and increased UAV adoption that help in capturing geospatial data is driving regional growth.

Increasing demand from China, Japan, and India is estimated to augment the growth in the Asia Pacific and the region is likely to be the fastest-growing over the forecast duration. China is witnessing high demand owing to rapid industrialization and growing logistics and infrastructural projects. Leading Asia Pacific countries are using geospatial analytics for forest management, environment monitoring, and disaster control. Further, private and government sectors are witnessing considerable growth in the adoption of geospatial analytics techniques.

The recent outbreak of COVID-19 is expected to positively drive the geospatial analytics market. In order to better detect and respond to any infectious diseases, geographical understanding plays a crucial role. Geospatial analytics helps epidemiologists in order to map the occurrence of disease against various parameters such as geographies, environment, spread patterns, and surveillance measures. Public health organizations use GIS to better understand patterns of the outbreak in real-time to increase their healthcare facilities. Thus, the aforementioned advantages associated with geospatial analytics are expected to drive market growth in the near future.

Leading players functioning in the market are Digital Globe, Trimble Inc., MapLarge, ESRI, Oracle Corporation, Google LLC, RMSI, Alteryx, Inc., SAP SE, and General Electric Company among others. These players are focusing on strategic initiatives such as partnerships, collaborations, new product launches, and others. For example, IBM Watson, in 2016, collaborated with MAPBOX to provide analytics services for business users. Additionally, this partnership helped IBM in offering useful insights to various customers in retail, defense, natural resources, and insurance.

Similarly, a leading insurance service provider Munich Re uses simulation, spatial data, and predictive analytics from SAP HANA. Additionally, the company has deployed a cloud-based Earth Observation Analysis Service (EOAS) from SAP HANA to analyze the impact of natural disasters that helps the company in assessing risk in insurance.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million and CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, APAC, Latin America, and MEA |

|

Country scope |

U.S., Canada, U.K., Germany, India, Japan, China, and Brazil |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the global geospatial analytics market report based on component, type, application, and region:

• Component Outlook (Revenue, USD Million, 2014 - 2025)

• Software

• Service

• Type Outlook (Revenue, USD Million, 2014 - 2025)

• Surface & Field Analytics

• Network & Location Analytics

• Geovisualization

• Others

• Application Outlook (Revenue, USD Million, 2014 - 2025)

• Surveying

• Medicine & Public Safety

• Military Intelligence

• Disaster Risk Reduction & Management

• Marketing Management

• Climate Change Adaptation (CCA)

• Urban Planning

• Others

• Regional Outlook (Revenue, USD Million, 2014 - 2025)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• The Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa

Research Support Specialist, USA