- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global insurance fraud detection market size was USD 4.1 billion in 2018. The market is projected to expand at 13.7% CAGR over the forecast duration, 2019 to 2025. The adoption of innovative technologies such as IoT, artificial intelligence, machine learning, and big data has transformed business operations. With growing digitalization, organizations are facing challenges such as money laundering, theft, extortion, embezzlement, and conspiracy. Similarly, insurance fraud has become a key challenge resulting in the loss of huge money for service providers. This has resulted in the use of advanced technologies and proactive measures by insurance providers to mitigate the risks.

Claimants have become smart and they are using innovative ways to defraud insurance companies. Businesses with traditional fraud detection systems would face a stiff challenge in securing their existing system. Thus, to counter the sophisticated fraud requires an advanced detection solution. Machine learning, model-based tools, and fraud detection analytics are capable of countering fraud activities in the insurance sector.

Digitalization has improved the day-to-day functioning of organizations. However, organizations that lack the ability to counter the challenges posed by the omnichannel environment are at the risk of fraudulent activities. Insurance companies have increased their offering through digital platforms to enhance consumer experiences. Owing to this, the adoption of advanced fraud detection solutions has become a topmost priority for them. With fraud detection software, access and control can be strengthened, making it difficult for claimants to bypass the security systems.

Over the past few years, there has been a rise in the number of insurance fraud activities. Multiple insurance providers have suffered the damage and still, they are facing dissension. After the fraud, there is a low possibility that service providers would be able to recover the losses. Thus, preventing fraud is the primary requirement.

Although the fraud detection system cannot prevent all the fraudsters, enterprises are focusing on deploying a system that can highlight real-time fraudulent activities. Thus, addressing them in the early stage has become the need of the hour. Major fraud detection systems such as risk assessment, trend analysis, reporting, and data mining can make enterprises aware of fraudulent activities in real-time.

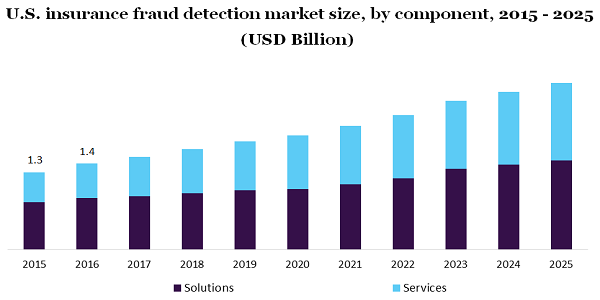

By component, in 2018, the solution category held the largest share of over 65% in the insurance fraud detection market. The increased adoption of fraud detection systems has helped in reducing false claims and responding to suspected activities, thereby, supplemented the growth of the market. Advanced detection solutions allow uncovering hidden relationships and finding subtle patterns during each stage of the claim process. Thus, it helps the organization with a comprehensive picture of the risks.

On the other hand, the services division is likely to witness the fastest growth with a 14.7% CAGR from 2019 to 2025. Perpetrators have found new ways to falsify the information and open insurance schemes for fictitious beneficiaries. With the emergence of new fraud techniques, insurance companies are relying on advanced solutions to address the problem.

On the basis of solution, the market is bifurcated into authentication, fraud analytics, and government, risk, and compliance. In 2018, the authentication segment accounted for USD 1.2 billion and emerged as the largest segment. Owing to the advent of advanced technologies, manual methods are losing their popularity. The use of technologies such as data analytics has become imperative in order to address increasing fraud activities. Analytics help in the integration of data internal sources to the third party.

Amid increasing competition, market players are offering self-service and online services to strengthen their position in the market. Apart from various fraud detection techniques, consumers’ authentication has become of vital importance. Authentication is projected to offer an enhanced security layer to verify payments.

The professional services, which include support & maintenance, training services, and consulting, help consumers to mitigate the risk of fraud. Vendors offer consultants with sound knowledge about varieties of frauds. These consultants make organizations aware of the loopholes in the existing systems and the precaution measures required. In addition, consultants also identify if the fraudulent activities are being committed externally or internally. On the other hand, support & maintenance service providers help users with software updates.

The managed services category is projected to register the fastest CAGR from 2019 to 2025. Vendors are focusing on developing innovation centers and centers of excellence to help insurers with enhanced detection techniques. These innovation centers help ensures advanced technologies, expertise, tools, and skills. In addition, vendors also offer pilot projects to address vulnerabilities.

On the basis of deployment, the on-premise segment held the largest share in 2018. On-premise solution assists organizations in uncovering potential fraudulent activities on real-basis. To identify the threat pattern, vendors are providing both rule-based and behavioral scoring models. However, despite automation, some specific reports require manual intervention; thus, enterprises are relying upon on-premise solutions.

On the other hand, cloud adoption is projected to witness the highest growth over the forecast duration. The popularity of software-as-a-service models has surged in the recent past. Benefits such as scalability and flexibility offered by cloud services are supplementing the segment growth. In addition, cloud deployment is easy to install and is cost-effective. The advent of the innovative security solution is further anticipated to increase cloud popularity.

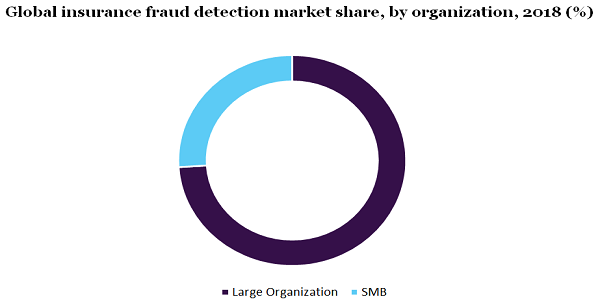

By enterprise, the large enterprise category is likely to hold the largest share in the insurance fraud detection market. Leading insurance providers spend a huge amount of money on advertising to attract consumers. With the help of discounts, the organization strengthened its customer base. Owing to the huge consumer base, large enterprises have a large number of claims on a daily basis. It has been found that claimants often exaggerate to obtain the various benefits of insurance services, even if they are not entitled to. Thus, various fraudulent activities such as properties damage, stolen cars, and fraudulent medical expenses have prompted insurance providers to opt for advanced detection technologies.

The SMB category is projected to register the fastest growth over 14% CAGR from 2019 to 2025. These companies offer basic policies along with a wide range of other coverage that is suitable for smaller business owners. For localized or specialty insurance, SMB is ideal. In addition, clients with poor records of accomplishment in terms of claims may get approval from such organizations. However, such organizations lack the necessary infrastructure to deal with potential fraudulent activities. Thus, the increasing number of fraudulent activities is projected to drive the demand for detection solutions.

In 2018, North America accounted for the largest share in the insurance fraud detection market with over 49%. The region is the home of several key players such as BAE Systems, Fiserv, Inc., and ACI Worldwide. In the United States, the insurance sector is divided into a life annuity, property, and casualty. Moreover, the government of the U.S. has mandated the citizen to adopt life and health insurance, thereby, boosting the growth of the market. The increasing number of people opting for insurance services has led to a rise in fraudulent activities. As estimated by the Federal Bureau of Investigation (FBI), the overall insurance fraud accounts for USD 40 billion each year in the country. Thus, the increasing number of insurance frauds is likely to supplement the market growth.

On the other hand, APAC is projected to register the fastest CAGR of 17.0% from 2019 to 2025. A large number of companies are focusing on precautionary measures to mitigate the risk of fraudulent activities. Further, the awareness about fraud detection techniques has gained popularity in the region, which, in turn, attributing to the growth of the market.

The outbreak of COVID-19 has affected most of the business and the insurance sector is no exception. The sector has been hit hard owing to the rise in the number of claims due to health emergencies in various countries. In addition, firms are expected to increase the premium in the upcoming years. With the increasing number of causalities due to COVID-19, life, and disability, insurance is further projected to increase.

The pandemic has led to a rise in the adoption of various digital technologies by insurance providers in settling claims and avoiding fraudulent activities. Despite the heavy burden on the insurance sector, the demand for fraud detection solutions is estimated to increase as people are opting for health insurance reimbursement.

Owing to the presence of several local as well as international players, the market is highly fragmented in nature. The competition has further increased owing to the entry of the growing number of small and medium solution providers. Several companies are offering fraud-detection-as-a-service to gain a competitive advantage in the market. In addition, vendors are offering customized solutions to strengthen their market presence.

Leading players operating in the market are ACI Worldwide, Experian Plc, BAE Systems, IBM Corporation, and Accenture among others. Considering the growing complexity of the fraudulent activities, vendors have upped their investment to develop robust detection solutions.

|

Report Attribute |

Details |

|

The market size value in 2020 |

USD 5.0 billion |

|

The revenue forecast in 2025 |

USD 9.7 billion |

|

Growth Rate |

CAGR of 13.7% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solutions, services, deployment, organization, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico |

|

Key companies profiled |

Accenture; ACI Worldwide, Inc.; SAS Institute Inc.; IBM Corporation; Fiserv, Inc.; SAP SE; Experian Plc; BAE Systems |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global insurance fraud detection market report on the basis of component, solutions, services, deployment, organization, and region:

• Component Outlook (Revenue, USD Million, 2015 - 2025)

• Solutions

• Services

• Solutions Outlook (Revenue, USD Million, 2015 - 2025)

• Fraud Analytics

• Authentication

• Governance, Risk, and Compliance (GRC)

• Services Outlook (Revenue, USD Million, 2015 - 2025)

• Professional Services

• Managed Services

• Deployment Outlook (Revenue, USD Million, 2015 - 2025)

• Cloud

• On-Premise

• Organization Outlook (Revenue, USD Million, 2015 - 2025)

• Small & Medium Business (SMB)

• Large Enterprise

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• The U.S.

• Canada

• Europe

• The U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Mexico

• MEA

Research Support Specialist, USA