- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global kid's footwear market size was worth USD 34.1 billion in 2018. The market is projected to grow at a CAGR of 8.2% over the forecast period. Growing physical growth among children, parents' interest in buying dress color matching footwear, and the introduction of a variety of footwear products are attributing to the growth of the market. Further, smart footwear is gaining traction among kids owing to its lightweight and attractive features.

The introduction of innovative and affordable footwear is the key trend in the market. Demand for aesthetically appealing footwear is growing as parents seek attractive footwear than durable ones. Owing to their physical growth, children require a pair of shoes and other footwear every 4-6 months. Further, the growing promotion of footwear through various social media platforms is expected to supplement the growth of the market over the forecast duration.

Children often require different kinds of shoes for different occasions. Growing westernization in emerging countries has positively attributed to the growth of the market. Additionally, parents are majorly opting for footwear made up of sturdy materials in order to protect their children from injuries. Further, increasing demand for footwear along with other kid's wear among celebrity kids has positively affected the market growth.

Growing promotion of products by child actor has created a buzz among kids, as fashion has become the center stage that influence purchasing decision. For example, Boots Mini Club introduced a new series of children's footwear in collaboration with Britain TV celebrities. Further, growing investment by parents in their children's attire is propelling the market growth.

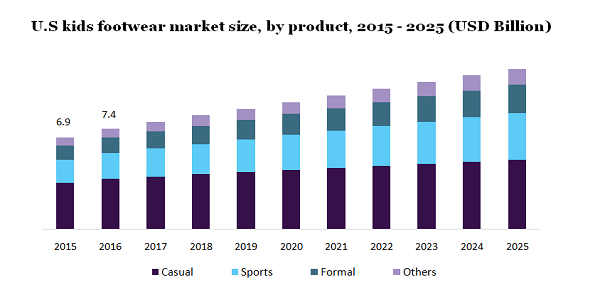

Among different products, the casual product segment held the largest market share with 46% in 2018. Changing consumers’ preferences and growing inclination for trendy footwear are driving the growth of this segment. Manufacturers are introducing a variety of innovative footwear like printed shoes and brogues to stay competitive in the market. Additionally, to cater to the growing demand, companies are introducing custom-made products for children. Some of the major customized brands are Explicit Shoes Inc., Simply Feet, and Bright Idea Design Studio, Inc.

On the other hand, the sports segment is likely to grow at a CAGR of 9.1% over the forecast period. Growing health concern among parents owing to the changing lifestyle of children has led to a rise in demand for this segment. Kids' participation in different outdoor and indoor games is increasing, which, in turn, positively affecting the growth of the children’s footwear market.

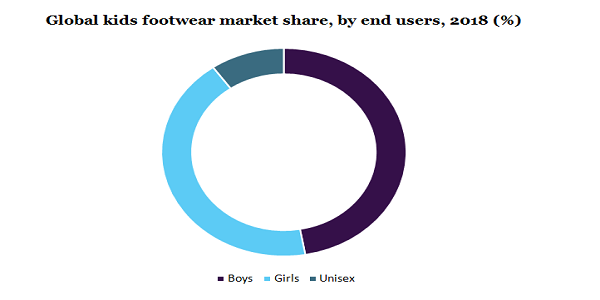

Among end-users, the boy segment held the largest market share with 47.2% in 2018. Changing the lifestyle of consumers and growing boys’ participation in various sports are the major factors affecting the market growth. Additionally, the rising demand for formal and casual footwear among boys is supplementing the segment growth. Further, rising customers’ purchasing power has led to increasing demand for trendy and stylish footwear products.

On the other hand, the girl's segment is anticipated to grow fastest with a CAGR of 8.7% over the forecast duration. The rise in the number of women athletes on global platforms has resulted in increasing girls’ participation in various sports. In addition, in developed countries, the awareness regarding sports is increasingly high, which, in turn, bolstering the demand for this segment.

In 2018, North America dominated sales with 34.4% of the market share. Growing consumers’ awareness about sportswear in the United States and Canada is attributing to the growth of the region. Additionally, consumers’ spending on fitness has increased considerably which is fueling the market demand. The U.S is the home of the largest fitness and sports club. In addition, changing consumer lifestyle owing to hectic work-schedule is prompting people to choose sports and other fitness activities with children also being part of it. These factors are projected to supplement market growth over the forecast period.

Asia Pacific is anticipated to grow at a CAGR of 9.5% throughout the forecast duration. Increasing consumers spending on personal apparel in emerging countries such as India and China is augmenting the growth of the market. Developing countries have experienced a rapid rise in income that has led to a rise in spending on children's wear products. Further, the introduction of the new product by major brands such as Nike, Adidas, and Puma are attracting a huge customer base.

Kids footwear market has been adversely affected owing to the COVID-19 outbreak. Footwear companies closed their operations and online sales were disrupted significantly following the outbreak of COVID-19. Owing to the lockdown, there has been a delay in the introduction of new products, thereby, negatively affecting the market growth. In addition, raw materials import has come to standstill, thereby, leading to low production.

On the other hand, consumer spending on footwear products has declined as the pandemic has significantly reduced the purchasing power capacity. Despite the reopening of various economic activities, the market is estimated to take more than a quarter to revive. Industry players should emphasize the development of cost-effective footwear for kids to increase their market share.

Increasing demand for kids’ apparel in emerging countries resulted in companies innovating on new product development, thus, driving the market growth. Strategic initiatives such as mergers & acquisitions, innovative campaigns, and product innovations are key in gaining competitive advantages. Key players operating in the market are The Children's Place, New Balance, Puma SE, SKECHERS USA, Adidas AG, New Balance, Crocs Retail, LLC, and Stride Rite among others. The rise in trendy and premium products is driving the sales of kids’ footwear.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Billion & CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S., Germany, U.K., China, India, Brazil, South Africa |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global kid's footwear market report on the basis of product, end-user, and region:

• Product Outlook (Revenue, USD Billion, 2015 - 2025)

• Casual

• Sports

• Formal

• Others

• End User Outlook (Revenue, USD Billion, 2015 - 2025)

• Boys

• Girls

• Unisex

• Regional Outlook (Revenue, USD Billion, 2015 - 2025)

• North America

• U.S.

• Europe

• Germany

• U.K.

• the Asia Pacific

• China

• India

• Central & South America

• Brazil

• Middle East & Africa

• South Africa

Research Support Specialist, USA