- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The payment security market size across the globe was valued at USD 15.79 billion in the year 2017. It is anticipated to witness a CAGR of 12.3% during the forecasted period, 2018 to 2025. This can be attributed to the rising retail and e-commerce industry which is creating demand for online payments. Also, the usage of technologies like artificial intelligence and machine learning for predicting and diagnosing security breaches is projected to drive the demand for payment security solutions.

The adoption of cashless and electronic transactions is increasing due to the surging usage of smartphones and online payments. Many providers have started developing mobile applications like Apple pay, Android pay, and Google wallets. Many wearable and connected devices are being developed with inbuilt technologies like IoT (Internet of Things) having payment capabilities.

For example, MasterCard has developed a platform to transform several consumer products like key fobs, jewelry, and wristbands into payment devices. Moreover, Visa Inc. is also working on a solution named connected cars that will enable consumers to pay for amenities like eateries, parking, and fuel from vehicles.

Several providers of payment security are investing hugely in R&Ds to develop advanced solutions. For example, the development of chatbots has helped in significantly reducing online fraud. Thus, several players have started adopting technological approaches like Deep Learning and Artificial Intelligence to reduce the risk of threats.

In 2017, the fraud detection and prevention segment held the largest share across the global market and was valued at USD 8.07 Billion. This can be attributed to the implementation of several fraud analytics solutions like customer analytics, behavioral analytics, big data analytics, governance, and predictive analytics by prominent players. Such factors are anticipated to enhance the usage of electronic payments in the upcoming years.

The encryption solution segment is projected to register the highest growth with a 12.8% CAGR from 2018 to 2025. With the help of P2PE (Point to point encryption), the data of the card can be encrypted into a number series. Also, as the cost for setting up fraud detection & prevention systems is high, SMEs are choosing encryption and tokenization solutions as a preferred alternative for payment security.

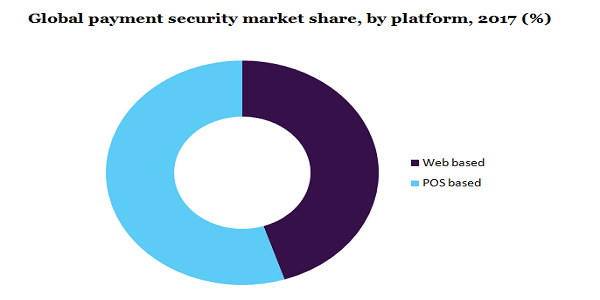

In 2017, the POS-based platform segment held the largest share across the global market. This can be associated with the rising consumer interest in online payments, convenience, and ease of online shopping. Also, features like low transaction fees, faster settlement, and secured transactions are projected to propel market growth in the upcoming years.

The providers of payment security are using many tools that are AI-based for purposes like customer interaction and fraud detection. Such tools also help in analysis, prediction, processing of frauds, and treats. They also help in accurately diagnosing the data breaches and threats which is driving the demand for payment security.

In 2017, the segment of large enterprises dominated the global payment security market. High-value transactions are being carried out across large enterprises are driving the need for payment security solutions. Thus, many enterprises have also started developing independent security solutions to safeguard their payments and transactions.

In 2017, the small & medium enterprises segment was valued at USD 4.79 billion across the global market. It is also projected to witness the highest CAGR from 2018 to 2025. This can be attributed to the adoption of solutions like tokenization and encryption. Also, threats related to cyber security and data leakage are promoting SMEs to adopt such solutions.

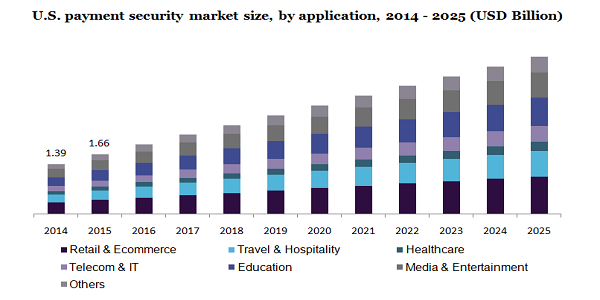

In 2017, the retail & e-commerce application segment held a share of around 28.0% across the global market. It is also anticipated to continue to show significant growth during the forecasted years. Further, the surging usage of mobile phones and the internet coupled with the increasing disposable income is projected to drive market growth for payment security.

The application segment of travel and hospitality is expected to register substantial growth during the forecasted years, 2018 to 2025. This can be attributed to increased consumer spending across the globe. Also, the emergence of concepts like mobile payments and e-wallets prevailing among the millennial population is projected to contribute majorly to the market growth for payment security.

North America dominated the global payment security market in 2017. This can be attributed to the rising presence of prominent players like Braintree, PayPal, Elavon, and Bluefin across countries like the U.S. and Canada. Further, the shifting trend towards online payments and net banking across this region is projected to propel the need for payment security in the upcoming years.

Asia Pacific is projected to register the highest CAGR in the upcoming years. This can be associated with the surging number of consumer goods and retail startups in countries like India and China. As they have started accepting mobile payments from consumers, the need for payment security is surging up across this region.

The key players in the market are Bluefin, Ingenico, MasterCard, Braintree, Elavon, Visa Inc., and Index. These providers of payment security have started adopting the latest technologies like artificial intelligence and machine learning to gain a competitive advantage. For example, PayPal has started providing security solutions that are AI-based.

These players are continuously engaged in implementing several marketing strategies like product launches, acquisitions, mergers, and partnerships to widen their global reach. For example, MasterCard had partnered along with a World Bank Group member named IFC in 2018 for implementing the facility of risk-sharing and for boosting electronic payment access across the emerging markets.

|

Attribute |

Details |

|

The base year for estimation |

2017 |

|

Actual estimates/Historical data |

2014 - 2016 |

|

Forecast period |

2018 to 2025 |

|

Market representation |

Revenue in USD Million and CAGR from 2018 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, South America, Middle East & Africa |

|

Country Scope |

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Poland, Sweden, Turkey, China, India, Japan, South Korea, Singapore, Taiwan, Malaysia, Thailand, Indonesia, Australia, Brazil, Argentina, U.A.E., Saudi Arabia, Egypt |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2014 to 2025 in each of the sub-segments. For the purpose of this study, Million Insights has segmented the global payment security market on the basis of solution, platform, organization, application, and region:

• Solution Outlook (Revenue, USD Million, 2014 - 2025)

• Encryption

• Tokenization

• Fraud Detection & Prevention

• Platform Outlook (Revenue, USD Million, 2014 - 2025)

• Web-based

• POS-based

• Organization Outlook (Revenue, USD Million, 2014 - 2025)

• Small and Medium Enterprises

• Large Enterprises

• Application Outlook (Revenue, USD Million, 2014 - 2025)

• Retail & E-commerce

• Travel and Hospitality

• Healthcare

• Telecom & IT

• Education

• Media & Entertainment

• Others

• Regional Outlook (Revenue, USD Million, 2014 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• Italy

• Turkey

• Sweden

• Spain

• Poland

• the Asia Pacific

• China

• India

• Japan

• South Korea

• Taiwan

• Thailand

• Malaysia

• Singapore

• Indonesia

• Australia

• South America

• Brazil

• Argentina

• MEA

• U.A.E.

• Saudi Arabia

• Egypt

Research Support Specialist, USA