- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

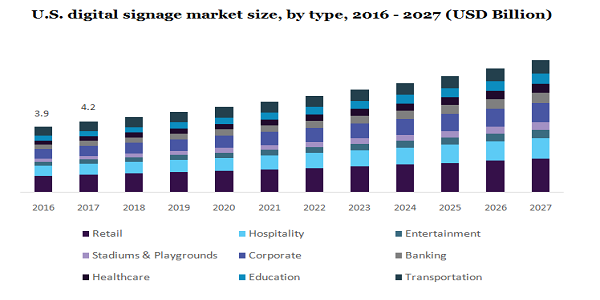

The U.S. digital signage market size was accounted for USD 4.7 billion in 2019 and projected to grow with a 6.4% CAGR over the forecast period, from 2020 to 2027. Digital signage is widely used for displaying informative and promotional information in the form of creative advertisements, design collaterals, graphics, and images. Creative advertisements attract the viewers and customers, display attractive content which plays an important role in influencing the buyers purchasing decisions. Thus, several benefits associated with digital signage are increasing its adoption across various end-use industries like corporate, transportation, hospitality, education, and others.

Moreover, the rising demand for comprehensive and concise information of products by consumers is fueling the implementation of digital signage. The growing implementation of advanced technology like gesture-recognize displays, single or multi-touch displays are expected to surge the market growth.

The emergence of innovative displays like LCD, LED, Super AMOLED display, an OLED has allowed the advertiser to display content with improved quality and clarity of the information being presented. This factor is encouraging digital signage manufacturers to provide content that is compatible with multiple displays. The information offered by digitalized display allows motions and pictures in digital format in order to attract a large number of customers.

The U.S. is a prominent country for manufacturers as promotional and marketing techniques are evolving continuously and most of the advertisers prefer to promote products and services with advanced trends over convectional marketing. Several benefits associated with digital signage such as reduction of paper usage, better spectators engagement, and low-cost advertising are gaining popularity in this country. In addition, the growing adoption of 3D digital signage for promotion and effective branding is projected to offer a lucrative platform for market growth.

However, high investment to install digital signage initially is hampering the growth of the market. Thus, the adoption of digital signage is low by mid and small-sized enterprises. In addition, a lack of awareness regarding the benefits of digital signage is hindering the market growth.

On the basis of components, the market is bifurcated into software, hardware, and services. In 2019, the hardware segment has dominated the market and is expected to retain its position throughout the forecast period, as the hardware component plays an important role in displaying content. However, the software segment is expected to grow with the highest CAGR of more than 7.0% over the forecast period. This growth is attributed to the advancement of content management software that is used to manage and create digital web content displays on the screens.

The services segment is projected to have significant growth which is lower than the software and hardware component segments. This segment helps to generate revenue by providing services associated with digital signage. Furthermore, there are several service provider who offers customized services at a low cost. Rising demand for regular maintenance and servicing is the major factor to augment the growth of this segment in the near future.

In the digital signage market, the hardware segment is fragmented into media players and extenders, displays, and others. Other segment includes mounting devices and components. In 2019, the display segment accounted for the largest revenue market share and was estimated to retain its position throughout the forecast period. Advancement in display technology is encouraging advertisers to upgrade with the latest trend. Moreover, digital signage is widely used for public places and transport. Digital displays play an important role, as it attracts the targeted audience for displaying contents or signs, thereby, helps to enhance the people experience. High resolution and brighter displays are more capable to attract a large number of audiences as compared to pixelated and unclear displays.

The media player is anticipated to grow with the highest CAGR from 2019 to 2027. The media player plays a vital role to show informative data on digital signage. In addition, media players also introduced apps to expand their functionality. It is also gaining traction in the commercial sector as it helps to attract more targeted people and to install a media player is a one-time investment and requires low maintenance. The growing demand for interactive digitized signs and video walls in the retail and hospitality industries is expected to drive the growth of this segment over the forecast period.

Based on the display type, the market for digital signage is segregated into video screens, kiosks, video walls, digital posters, transparent LED screens, and others. In 2019, the video walls led to the U.S. digital signage market due to its ability to display high-quality pixels and uniform brightness for each picture. On the other hand, the kiosk held the second largest market share, in 2019 and the digital poster display type has generated significant revenue in the same year. The kiosk is majorly used for displaying information and advertisement in shopping complexes, auditoriums, metro stations and buses, shopping malls, and others.

The transparent LED screen segment is projected to register the highest CAGR over the forecast period due to its attractive designs and spatial constraint related to the installation of other digital signage screens. Moreover, a transparent LED screen is the most advanced technology which offers transparency of more than 80% with high and improved resolution. In addition, these screens are energy efficient that helps to reduce energy utilization, thereby, supporting an advertiser to reduce operational cost.

Digital signage offers various display sizes. In 2019, below 32 inches dominated the market, as most of the incumbents incorporate, BFSI, and retail industries prefer this size. Small sizes displays are majorly preferred in confined spaces. Hence, the adoption of small display size signage is increasing in the retail sector. These above-mentioned factors are expected to maintain the dominance of this segment throughout the forecast period.

The 32 to 52 inches display size is estimated to grow with the fastest CAGR from 2020 to 2027, as incumbents of transportation, healthcare, entertainment, and hospitality are extensively adopting this size of digital signage. The above 52 inches segment is expected to have steady growth during the forecast duration. Rapidly changing demand for digital signage size specification among incumbents in the transportation and advertisement industries is fostering the growth of this segment to show their contents.

On the basis of software, the market is classified into analytics and engagement software and display software. In 2019, display software has been preferred across various industries, as it helps to manage and create content to be shown on digital signage. Content management software is expected to have robust growth in the near future due to its ability to manage and create content. However, usage of this software is sometimes found to be challenging due to the difficulty associated with uploading and updating the content on the cloud to display information across multiple locations and screens.

Audience analytics & engagement software is projected to have strong growth and is expected to grow with a CAGR of more than 8.0% over the forecast period. This growth is attributed to increasing concentration on competitive intelligence offering better viewer experience and evaluating viewer statistics by gathering information.

Application-wise, the market is segmented into stadiums, playgrounds, banking, retail, education, transportation, and others. In 2019, the retail application has led the market due to the rising adoption of digital signage by incumbents to extensively promote their services and products. Owing to rising competition in the retail industry, retailers are adopting various strategies to increase awareness about products among customers. Hence, retailers are increasingly adopting digital signage to sustain in a competitive market and to gain a maximum customer base.

The healthcare application is projected to have extensive growth from 2020 to 2027. The digital signage helps to display patient information, notify visitors and staff in the hospitals, and also manage inventory. The rising adoption of digital signage in the transportation industry coupled with increasing urbanization is estimated to generate significant revenue in the next few years. Digital signage is installed at the railway station, airports, metro stations, and bus stand to display promotional content, informative content, and digitalized posters. It is also used to install cabs, metros, buses, and trains to promote products & services.

On the basis of location, the market is fragmented into out-store and in-store. The in-store location segment includes the installation of signage in shopping malls, retail stores, offices, hotels, banks, educational institutes, the healthcare sector, and others. In 2019, the in-store segment dominated the market and is expected to retain its position over the forecast period on account of the rising adoption of digital signage by the retail sector in their premises.

The out-store location segment is expected to grow with a higher CAGR from 2020 to 2027. This growth is characterized by the increasing adoption of digital signage across various industries such as BFSI, transportation, and healthcare sectors coupled with a rising number of playgrounds and stadiums in developing countries. Furthermore, the rising adoption of digital signage for promotional products and new trends like live concerts and shows, various offers on goods and services, and election campaigns are expected to enhance the awareness regarding the adoption of digital signage in open grounds or spaces, thereby, increasing the adoption of out-store.

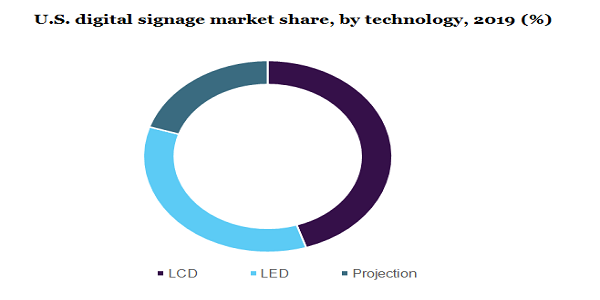

By display technology, the digital signage market is fragmented into LED, LCD, and projection. In 2019, the LCD segment has dominated the U.S. market and accounted for the largest market share of over 40.0% in terms of revenue. This LCD technology is widely adopted by the advertising and marketing industries, as it is easy to produce and it has lower manufacturing costs. The LCD is projected to see with higher resolution display and transformation is expected to occur from sRGB to BT.2020.

The LED display technology is projected to have the highest growth rate during the forecast period. Larger, slimmer display, flat-paneled, and brighter display technologies are gaining momentum among viewers. The acceptance of LED technology is expected to rise in the near future due to the increasing demand for OLED displays and the continuous evolution in technology. However, a complicated manufacturing structure, shorter lifespan, and high production cost are some factors that are expected to hamper the growth of this segment.

The growth of U.S. states including California, New York, Illinois, Florida, and Texas is majorly driven by growing investment in manufacturing facilities as well as infrastructure development by the government for displaying informative content.

In 2019, West U.S. has dominated the U.S. digital signage market in terms of revenue. This growth is attributed to the presence of hardware component manufacturers, software developers, and electronic display products and systems players. The Midwest region is expected to register the fastest CAGR over the forecast period due to increasing sales in Illinois, Nebraska, Ohio, and Minnesota across various industries such as retail, hospitality, transportation, and healthcare.

Some industries such as digital signage have been benefited due to the COVID-19 pandemic. However, the major challenge for this industry during this outbreak is that most of the companies faced supply problems that are halted by production in China. At the same time, manufacturers in this industry have begun to recover their business at a normal level. Hence, they have started to develop new solutions to combat recent challenges. To prevent the spread of coronavirus, digital signage plays a vital role to increase awareness among people by providing guidelines updated by the government. With the help of digital signage, schools, colleges, offices and retail shops are able to get an update about COVID-19 guidelines. In addition, U.S. companies operating in this industry have developed hand sanitizer with advertising displays. Moreover, the retail industry is widely adopting hand sanitizer digital kiosks which helps to reach their audience with targeted messages. In addition, this hand sanitizer digital kiosk has several benefits such as it supports Wi-Fi, 3G/4G connection to the web, and an automatic internal dispenser system. Thus, the rising usage of digital signage in this critical situation will drive market growth in the U.S. in the near future.

The major manufacturers in this market are Intel Corporation; BrightSign LLC; Planar System Inc.; Keywest Technology, Inc.; Visix, Inc.; Panasonic Corporation of North America; Microsoft Corporation; Cisco Systems, Inc.; NEC Display Solutions of America, Inc.; Hughes Network Systems LLC; and Scala, Inc.

Key players have adopted some common strategies like technological advancement in software, product development, enhancement in after-sales services and support, innovative display technologies, licensing of technologies.

|

Attribute |

Details |

|

The base year for estimation |

2019 |

|

Actual estimates/Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Market representation |

Revenue in USD Million and CAGR from 2020 to 2027 |

|

Regional scope |

Northeast, Southeast, West, Midwest, and Southwest |

|

Country scope |

The U.S. |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Million Insight has segmented the U.S. digital signage market report based on component, hardware components, display type, display technology, display hardware component, software, application, location, and region:

• Component Outlook (Revenue, USD Million, 2016 - 2027)

• Hardware

• Software

• Services

• Hardware Component Outlook (Revenue, USD Million, 2016 - 2027)

• Displays

• Media Players & Extenders

• Others (Mounting Devices & Components)

• Display Type Outlook (Revenue, USD Million, 2016 - 2027)

• Video Walls

• Video Screens

• Transparent LED Screens

• Digital Posters

• Kiosks

• Others

• Display Technology Outlook (Revenue, USD Million, 2016 - 2027)

• LCD

• LED

• Projection

• Display Size Outlook (Revenue, USD Million, 2016 - 2027)

• Below 32 Inches

• 32 to 52 Inches

• More than 52 Inches

• Software Outlook (Revenue, USD Million, 2016 - 2027)

• Display Software

• Audience Analytics & Engagement Software

• Application Outlook (Revenue, USD Million, 2016 - 2027)

• Retail

• Hospitality

• Entertainment

• Stadiums & Playgrounds

• Corporate

• Banking

• Healthcare

• Education

• Transportation

• Location Outlook (Revenue, USD Million, 2016 - 2027)

• In-store

• Out-store

• Regional Outlook (Revenue, USD Million, 2016 - 2027)

• Northeast

• New York

• Maryland

• Pennsylvania

• Southeast

• Florida

• North Carolina

• West

• California

• Idaho

• Nevada

• Midwest

• Illinois

• Ohio

• Nebraska

• Minnesota

• Southwest

• Texas

Research Support Specialist, USA