- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

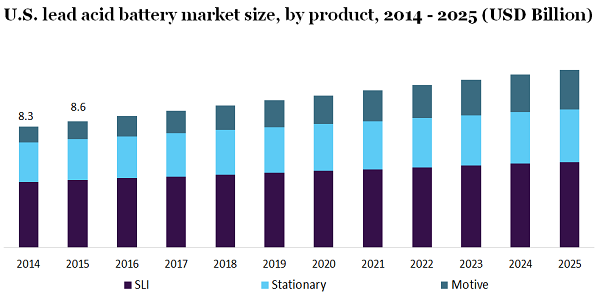

The U.S. lead-acid battery market size was accounted for USD 9.98 billion in 2018. Further, it is projected to witness a 5.3% CAGR from 2019 to 2025. Growing demand from the automotive industry, energy storage systems, and the uninterrupted power supply system are driving the demand for lead-acid batteries. Over the years, the demand for UPS systems has increased from industries such as chemical, healthcare, oil & gas, and manufacturing units.

In addition, reliability and low-cost associated with these batteries are projected to supplement the demand for these batteries. The rise in demand from energy storage and electrical storage has driven the need for innovation, which, in turn, has led to the manufacturing of advanced batteries.

Lead-acid batteries are witnessing significant demand from both aftermarket and OEMs. The emergence of electric vehicles has led to an increase in demand for vehicle charging infrastructure as the U.S. is among the leading countries in terms of the adoption of electric vehicles. In addition, the demand for lead-acid batteries is also gaining traction from telecom towers. Government favorable regulation and subsidies are further supplementing the market growth. Moreover, the decline in the cost of equipment in the U.S. states, particularly in California is projected to positively affect market growth.

Lead-acid batteries can be recycled without adversely affecting the environment. It saves energy and reduces the emissions of carbon. Thus, these factors are projected to positively affect market growth. Owing to their reliability, low cost, high capacity, and safety, lead-acid batteries are one of the most used across the globe. More than 95% of lead-acid batteries are recyclable.

Among several products, SLI accounted for the largest share in the U.S. lead-acid battery market and the segment held more than 50% share in the market. Increasing demand for these batteries in commercial and passengers cars is driving their demand. The stationary category held the second-largest share in 2018 and is estimated to be the fastest-growing segment over the forecast duration. Rising demand for this segment in oil & gas, energy, UPS, and railway sectors are attributing to its growth.

The motive product category is the emerging one in the U.S. It was worth USD 2.1 billion in 2018 and is projected to witness considerable growth over the forecast years. Increasing demand for electric cars and golf carts are estimated to be the major drivers for this segment. In addition, these batteries are used in industrial applications such as railroads, mining, golf cart, forklifts, and others.

In case of large backup power requirements, flooded lead-acid batteries are widely used. These batteries are used in computer centers, electric vehicles, golf carts, and others. In addition, they find their application in the diesel-electric submarine as well as a nuclear submarine.

The demand for flooded batteries is gaining traction in marine applications. The U.S. marine industry is witnessing significant growth owing to the rise in marine trading and leisure activities. Marine trade account for nearly 90% of total trade worldwide and considered the cheapest among all form of trade.

On the other hand, valve-regulated batteries can easily be installed with different orientations as they are resistant to temperature. Moreover, they are designed to firm to prevent electrolyte leakage. In addition, they recombine hydrogen and oxygen, thus, require less maintenance and are easy to transport.

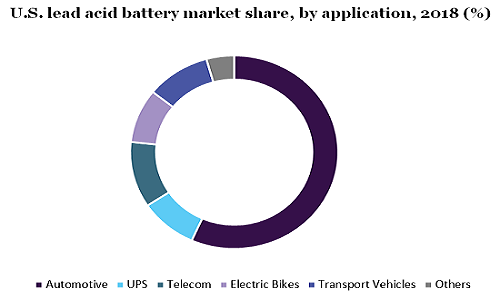

Among different applications, in 2018, the automotive segment held the largest share in the U.S. lead-acid battery market. The segment held over 56.0% shares in the market. The increasing adoption of electric vehicles in the U.S. is attributing to the growth of this segment. On the other hand, in 2018, the telecom sector was the second leading segment. Further, it is anticipated to witness a 4.6% CAGR over the forecast duration.

The United States is the home of several leading firms in the industries such as hospitality, healthcare, manufacturing, financial services, insurance, and others. For the uninterrupted power supply, these industries are estimated to use lead-acid batteries extensively. Especially in healthcare, where critical equipment requires a constant power supply, thus, driving the growth of the UPS system.

Key industries like mining, chemical, cement, and manufacturing require a huge investment of capital. Thus, the use of lead-acid batteries is widespread as they offer a cost-effective solution. In addition, the telecommunication sector also uses lead-acid batteries owing to their longer life, easy installation, and performance. Thus, increasing demand from the telecom industry and rising technical advancement in the field are projected to bolster the market growth over the next few years.

The COVID-19 outbreak has adversely affected the growth of the market. The United States is one of the worst-hit countries by the coronavirus. The pandemic has forced industries to either close their operations or operate with less workforce. This, in turn, has resulted in a decline in demand for power consumption, thereby, significantly reducing the market growth. In addition, lead-acid batteries are widely used in electric cars. Owing to the pandemic, the sales of electric cars were severely hit as customers reduced their spending in the wake of the financial crisis.

Leading players in the market are NorthStar, B.B. Battery, Exide Technologies, Panasonic Corporation, Crown Battery, and others. These companies are aiming to introduce a new product to strengthen their market position. Exide is one of the companies with an increased distribution network and global footprint. East Penn Manufacturing, in 2019, launched batteries designed on thermal shielding technology. These batteries are capable of withstanding heavy electrical loads and can operate under extreme working conditions. Merger and acquisition also remain the attractive strategic initiatives adopted by key players.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Volume in MW, Revenue in USD Million, & CAGR from 2019 to 2025 |

|

Report coverage |

Capacity forecast, company share, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the U.S. lead-acid battery market based on the product, construction, and application:

• Product Outlook (Revenue, USD Million, 2014 - 2025)

• Stationary

• Motive/Traction

• Starting, Lighting, and Ignition (SLI)

• Construction Outlook (Revenue, USD Million, 2014 - 2025)

• Flooded

• Valve Regulated (VRLA)

• Application Outlook (Revenue, USD Million, 2014 - 2025)

• Automotive

• Telecom

• UPS

• Electric Bikes

• Transport Vehicles

• Others

Research Support Specialist, USA