- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

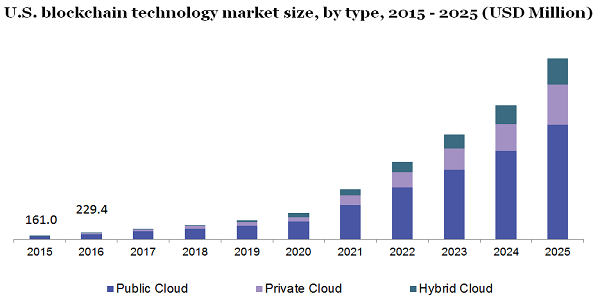

The global blockchain technology market size was accounted for USD 1,590.9 million in 2018. It is estimated to grow at a CAGR of 69.4% over the forecasted period, 2019 to 2025. Blockchain technology is an upcoming technology anticipated to be widely adopted across industry verticals, especially in the IT domain. This technology enables a ledger that can be accessed by the different parties for transactions involved and also act as an irrefutable depository for all transactions between various parties.

Several benefits associated with the adoption of this technology is attracting companies from the finance & technology sector. Technological solution not only disrupts the financial sector but also help in the development of various industries such as media & telecom, consumer goods, and others.

Blockchain technology is also used for bitcoin transactions. This technology is also incorporated in various cryptocurrencies like Mintchip, Ripple, and Litecoin. Several banks and financial institutions are interested in adopting this technology owing to its innovative structure with regulatory boards including the Bank of England, and the International Monetary Fund (IMF).

Thus, various players in the finance sector are focusing on investing in this technology to develop their services. However, the market is projected to struggle with regulatory & security concerns in the next few years.

Besides the finance sector, blockchain technology is projected to offer ample opportunities for the public sector and the healthcare industry. Earlier the technical knowledge was limited with the BFSI domain, but with advanced technology development, blockchain technology is now used across different applications.

The blockchain technology market is fragmented into the hybrid cloud, private cloud, and public cloud depending on the type. The public network cloud is projected to dominate owing to the growing adoption of these solutions in governmental institutions for efficient transactions. For example, Australian Securities Exchange (ASX) is planning to introduce the blockchain platform in the settlement of their transactions, & clearing systems.

The private cloud segment helps companies to reverse transactions and rules modification at affordable transaction rates. Private networks also help in fixing faults by manual interventions. Thus, the private cloud segment is anticipated to grow at a significant rate in the next few years.

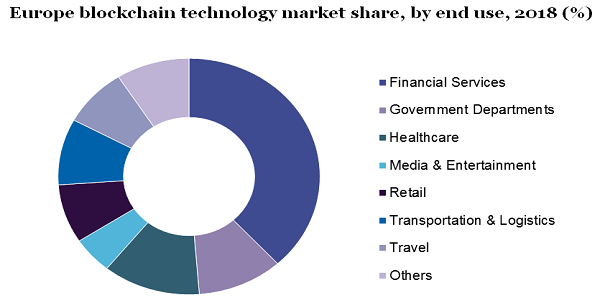

The end-user segments include government, media & entertainment, healthcare, retail, financial services, travel, transportation & logistics, and others. Blockchain technology offers various benefits to the financial industry by enabling integration with the internet and mobile devices. The financial services sector is expected to dominate the market over the forecast duration. For example, in 2019, Bank of America has partnered with Marco Polo Network for digitizing its finance solutions.

In the financial services sector, the transactional & regulatory offerings of expertise are aligned with the BFSI sector for efficient financial management. Thus, several industries like healthcare, transportation, media & telecom, and consumer goods are expected to get benefits from this technology.

Protocols & infrastructure providers develop software blocks that are required for the blockchain networks. Growing demand for protocols including Hyperledger, BigChainDB, Openchain, and Ethereum are mainly supporting market growth. These protocols help application developers constructing customized distributed ledger networks.

The development of open source-based distributed ledger technology offers greater data transparency, high throughput, low latency, and support to private and public ledgers. In addition, increasing demand for blockchain protocol for developing games like EtherWarfare, Spells of Genesis, CryptoKitties, and others is projected to bolster the market growth.

In 2018, the payment application segment accounted for USD 723.3 million in the overall market. Blockchain technology’s ability to offer transparency reduced operational cost, and enhanced payment system efficiency is boosting the segment growth. Additionally, the growing adoption of this technology in the company’s payment processes is projected to drive market growth.

Financial services utilize blockchain solutions to provide cross-border payment transactions at lower costs. For example, in 2017, SWIFT has introduced a proof of concept for exploring distributed ledger technologies for efficient monitoring in banks. Several banks including the ANZ banking group, RBC Royal Bank, DBS Bank, Deutsche Bank have joined SWIFT’s payment solutions.

The small & medium enterprise type segment is anticipated to grow at the highest CAGR during the forecast period. Moreover, SMEs are using solutions driven by artificial intelligence and machine learning that help to access high-quality information at lower costs. These key benefits are expected to positively impact the market growth.

The rising adoption of blockchain solutions by SMEs for enabling digital services is projected to spur the growth of the segment. Moreover, these solutions help in automating financial transactions and provide data security to SMEs.

In 2018, North America accounted for USD 612.3 million in the overall market. This growth is contributed to the rapid adoption of innovative solutions in the countries such as Canada, and the U.S. Blockchain technology is widely used in the government, retail, and the BFSI sector for payment transactions, smart contracts, and digital identity detection solutions.

The Asia Pacific is projected to grow at a significant rate owing to the rising financial sector across countries like India, and China. In banks, for managing the Know Your Customer (KYC) documents, blockchain technology is utilized. Furthermore, growing research initiatives for developing blockchain solution is predicted to support market growth. For example, in 2018, the Chinese academy of sciences has announced the development of a new lab in the country.

The outbreak of COVID-19 has negatively impacted the global blockchain technology market. COVID-19 crisis has disrupted the supply chains network of all industries and their commerce business. Blockchain technology is expected to be critical for the potential rebuilding of the disrupted networks. This technology provides transparent and secured data on transactions and goods services.

Amid COVID-19 blockchain in the finance sector is expected to grow at a faster pace than other industries. Data storage, goods authentication, and food tracking applications involve financial transactions, which are projected to contribute to market growth.

Furthermore, the online gaming trend is on rising during the coronavirus pandemic, as people are staying at home. These online gaming applications are expected to proliferate digital currency usage, which, in turn, is boosting the need for blockchain technologies.

Leading players in the market include Microsoft Corporation; Linux Foundation; IBM Corporation; Deloitte; BTL Group; R3; Chain Inc.; Global Arena Holding, Inc. (GAHI); Circle Internet Financial Limited; Eric Industries; Ripple; and Post-Trade Distributed Ledger.

Companies are engaged in investment for new technology development and collaborations to increase their presence across the world. For instance, in 2019, Icertis has collaborated with Microsoft Corporation to develop an enhanced blockchain framework to deliver high efficiency.

|

Attribute |

Details |

|

The market size value in 2020 |

USD 3.84 million |

|

The revenue forecast in 2025 |

USD 57.64 billion |

|

Growth Rate |

CAGR of 69.4% from 2019 to 2025 |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2015 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Quantitative Units |

Revenue in USD Billions, & CAGR from 2019 to 2025 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, component, application, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. |

|

Country scope |

U.S., Canada, Germany, U.K., China, Japan, India, and Brazil. |

|

Key companies profiled |

IBM Corporation; Microsoft Corporation; Linux Foundation; and R3. Some other key players in the market include BTL Group; Chain Inc.; Deloitte; Circle Internet Financial Limited; Global Arena Holding, Inc. (GAHI); Post-Trade Distributed Ledger; Ripple; and Eric Industries. |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For this study, Million Insights has segmented the global blockchain technology market report based on type, component, application, enterprise size, end-use, and region:

• Type Outlook (Revenue, USD Million, 2015 - 2025)

• Public

• Private

• Hybrid

• Component Outlook (Revenue, USD Million, 2015 - 2025)

• Application & Solution

• Infrastructure & Protocols

• Middleware

• Application Outlook (Revenue, USD Million, 2015 - 2025)

• Digital Identity

• Exchanges

• Payments

• Smart Contracts

• Supply Chain Management

• Others

• Enterprise Size Outlook (Revenue, USD Million, 2015 - 2025)

• Large Enterprises

• Small & Medium Enterprises

• End-Use Outlook (Revenue, USD Million, 2015 - 2025)

• Financial Services

• Government

• Healthcare

• Media & Entertainment

• Retail

• Transportation & Logistics

• Travel

• Others

• Regional Outlook (Revenue, USD Million, 2015 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• The Asia Pacific

• China

• India

• Japan

• Australia

• South America

• Brazil

• Middle East & Africa (MEA)

• Saudi Arabia

• UAE

Research Support Specialist, USA