- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

With reference to the report published, the global COVID-19 detection kits market size was accounted for USD 3.28 billion in 2020. It is estimated to witness a 5.05% CAGR from 2021 to 2027.

A number of nations are busy in the improvement of the apps as well as kits, together with tracking plans, for bulk testing. The smartphone app for the COVID-19, recognized by Britain, makes use of Bluetooth signals, to recognize COVID-19 affected persons. This type of national method, furthermore, makes available complete information regarding the warning signs, along with the possibility of the disease. These types of initiatives speed up the discovery of infected patients that more influence the escalation of revenue, along with the expansion of the market. Physical tests, difficulty in delivery timing, and visual coverage bring about unsure results, in contrast to the automatic tests. Considering this, in August 2020, QIAGEN has developed a user-friendly digital test, which is recognized as Access Anti-SARS-CoV-2 Total.

The serology test is performed on a transportable digital appliance, to present trustworthy outcomes in 10 minutes and diminish the threats. The accessibility of an intelligent testing resolution is estimated to increase the enlargement of the COVID-19 detection kits market, in the nearby future.

The arrival of new-fangled advanced testing machinery, to tone down the unpleasant effects of the present pandemic, is expected to stimulate the natural revenue enlargement of the companies, busy in delivering the COVID-19 detection kits. Such as, a significant next-generation sequencing (NGS) machinery shows the prospective to accumulate 100,000 collective samples in a solo apparatus in 8 to 12 hours; this heightens the capability of the testing. Even though this equipment is in the exploration stage, yet, they offer a productive opening for the development of this market, in the near future.

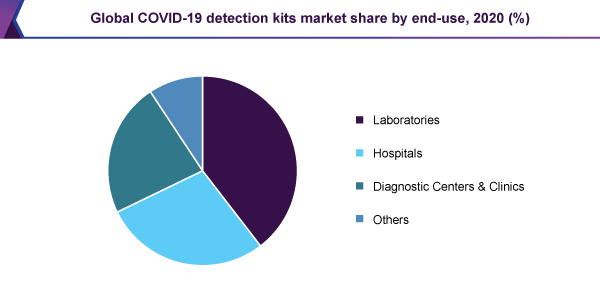

Detection kits for the laboratory otherwise centralized testing were ruling the COVID-19 detection kits market, by way of holding approximately 68% share of the revenue, in 2020. Using automatic large throughput laboratory programs, facilitated the laboratories to professionally deal with a lofty quantity of samples, at the same time upholding a superior level of excellence, as well as reliability of the result. These factors have donated to create central testing, a significant aspect in a flourishing COVID-19-response policy, to restrain the spread of the disease.

Due to their smaller sensitivity, POC testing, for instance, fast antigen tests, is comparatively not as trustworthy, in terms of the accurateness of the result. On the other hand, the continuous rise in death rate is expected to catalyze the decentralized testing method, mainly in the budding markets, amid the underfunded and most delicate healthcare arrangements. This is anticipated to considerably stimulate the utilization of antibody testing strips along with fast antigen testing kits. Hence, both testing modes perform a fundamental part in diminishing the unfavorable effects of the pandemic.

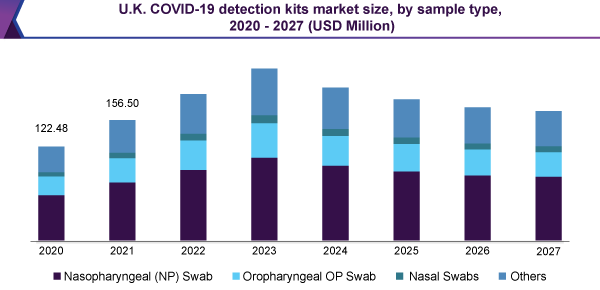

As a result of the greater utilization of nasopharyngeal swabs, used for molecular testing, nasopharyngeal swabs (NP) were anticipated to lead the COVID-19 detection kits market, by holding above 45% revenue share; in 2020. The service givers are increasing their testing capacities, through signing an accord with swab manufacturers, for mass delivery of the swabs. For example, with the intention to assist high-priority testing of coronavirus the Commonwealth of Virginia joins forces with the UVA School of Engineering, to acquire 60,000 nasopharyngeal swabs for every week, in August 2020. The improvement of novel serology tests, which rely on blood sampling, is expected to stimulate the utilization of COVID-19 detection kits.

In 2020, RT-PCR assay kits were expected to form the highest share of the revenue. The majority of the commercially offered COVID-19 detection kits depend on the reverse transcription-PCR method, due to its high-pitched sensitivity as well as specificity. Rutgers Clinical Genomics Laboratory improved the TaqPath COVID-19 Combo kit, in May 2020, which makes possible the RT PCR testing by means of saliva sampling, at a residential home. It proposes not as much of a painful discovery plus the greater capacity of testing.

Immunoassays test strips are the capable tools for the initial analysis of COVID-19, for the duration of the increasing phase of the pandemic and are expected to record the highest speed of the development. This is credited to a number of paybacks of these products, for example, costly apparatuses, chemicals, and skilled experts are not required. This is creating them a reasonably priced and is effortlessly available, like point of care (POC) tests. Quicker outcomes, in addition to, scalability is the extra factors, powering the progress of the sector.

In 2020, the laboratories sector was expected to make up a 40% revenue share, resulting in its domination above further equivalent sectors. A steady rise in laboratory capability, by means of the growth in the range of testing in existing centers, in addition to the organization of new-fangled, high-powered laboratories, increases the acceptance of COVID-19 detection kits. The tactical coalition between the governments, manufacturing companies of the equipment, private laboratories as well as public health institutions, are able to step up such types of efforts.

North America is projected to observe the highest rate of enlargement, throughout the forecast period. Globally, the U.S. is the most terribly affected nation-state, by means of the maximum number of COVID-19 cases, accounting for above 6 million cases, during the initial week of September 2020. As a result of this, regulatory organizations, like Health Canada and the U.S. FDA, are constantly giving way for the Emergency Use Authorizations (EUA) to coronavirus test kits, to increase the testing capability. This powers the development of the regional COVID-19 detection kits market.

In 2020, by way of a 36.88% revenue share, Asia Pacific is anticipated to dictate the market. This is credited to the incessant rise in the cases of coronavirus in Asian nations like India, growth in the figure of diagnostic services, in addition to the achievement of mass testing programs, within the region. Chinese region Wuhan concluded the bulk testing of its 11 million persons and finished up with 206 sure asymptomatic cases of COVID-19, within the region, since June 2020.

The contestants of the market are continually developing numerous categories of kits, used for the discovery of SARS-CoV-2 infection, throughout the world. Such types of initiatives are taken for the development of innovative products, additionally, the companies are also adopting various policies, globally, such as merger & acquisition, business growth, agreements, joint ventures & partnership, as a reaction to the increasing requirement for the COVID-19 testability.

Some of the companies for the COVID-19 detection kits market are:

• Becton, Dickinson and Company

• Luminex Corporation

• My lab Discovery Solutions Pvt Ltd.

• DiaSorin

• Thermo Fisher Scientific, Inc.

• F. Hoffmann-La Roche AG

• Quidel Corporation

• Abbott

• Altona Diagnostics GmbH

• Veredus Laboratories

• Perkin Elmer, Inc.

|

Report Attribute |

Details |

|

The market size value in 2020 |

3.28 billion |

|

The revenue forecast in 2027 |

4.63 billion |

|

Growth Rate |

CAGR of 5.05% from 2020 to 2027 |

|

The base year for estimation |

2020 |

|

Historical data |

2020 |

|

Forecast period |

2021 - 2027 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2027 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, sample type, mode, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

The U.S.; Canada; Germany; The U.K.; France; Spain; Italy; Russia; Austria; Portugal; Sweden; Norway; Denmark; Poland; Switzerland; Turkey; Belgium; Netherlands; Japan; China; India; South Korea; Australia; Malaysia; Philippines; Indonesia; Thailand; Singapore; Brazil; Mexico; Peru; Chile; South Africa; Iran; Israel; UAE; Iraq; Qatar |

|

Key companies profiled |

F. Hoffmann-La Roche AG; Perkin Elmer, Inc.; Thermo Fisher Scientific, Inc.; Veredus Laboratories; DiaSorin; Altona Diagnostics GmbH; Mylab Discovery Solutions Pvt Ltd.; Abbott; Luminex Corporation; Quidel Corporation; Becton, Dickinson, and Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. |

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2027. For the purpose of this study, Million Insights has segmented the global COVID-19 detection kits market report on the basis of product, sample type, mode, end-use, and region:

• Product & Service Outlook (Revenue, USD Million, 2020 - 2027)

• RT-PCR Assay Kits

• Immunoassay Test Strips/ Cassettes

• Sample Type Outlook (Revenue, USD Million, 2020 - 2027)

• Nasopharyngeal (NP) Swab

• Oropharyngeal (OP) Swab

• Nasal Swab

• Others

• Sample Type Outlook (Revenue, USD Million, 2020 - 2027)

• Nasopharyngeal (NP) Swab

• Oropharyngeal (OP) Swab

• Nasal Swab

• Others

• Mode Outlook (Revenue, USD Million, 2020 - 2027)

• Decentralized or Point-of-Care (PoC) Testing

• Centralized Testing (Non-PoC)

• End-use Outlook (Revenue, USD Million, 2020 - 2027)

• Laboratories

• Hospitals

• Diagnostic Centers and Clinics

• Others

• Regional Outlook (Revenue, USD Million, 2020 - 2027)

• North America

• The U.S.

• Canada

• Europe

• Germany

• The U.K.

• France

• Italy

• Spain

• Austria

• Portugal

• Sweden

• Norway

• Russia

• Denmark

• Poland

• Switzerland

• Turkey

• Belgium

• Netherlands

• The Asia Pacific

• Japan

• China

• India

• Australia

• South Korea

• Malaysia

• Philippines

• Indonesia

• Thailand

• Singapore

• Latin America

• Brazil

• Chile

• Peru

• Mexico

• The Middle East & Africa (MEA)

• South Africa

• Iran

• Israel

• UAE

• Qatar

• Iraq

Research Support Specialist, USA