- US: +1-408-610-2300

- Toll Free: +1-866-831-4085

- Become a Client

The global artificial intelligence (AI) chipset market size was accounted for USD 7.4 billion in 2018 and projected to grow with a CAGR of 33.6% over the forecast period, 2019 to 2025. The rising penetration of social media and e-commerce generates a huge amount of data. The rapidly increasing volume of data and the necessity for high-speed processors are expected to drive market growth. Consumer’s shift towards machine learning and computer vision devices is influencing the tech giants to raise funds for the development of high-speed processors. In addition, the rising number of smart devices and smartphone users is expected to drive the market growth for artificial intelligence chipsets.

In recent years, AI technology has integrated with most applied technologies and is expected to gain traction in upcoming smart devices. It helps to facilitate the intelligence of products & services and implement them across several industries such as transportation, education, finance, logistics, and healthcare. Chipsets play an important role in integration while developing AI applications, as it provides a physical base for the development of AI-enabled applications.

AI technology is widely used for various applications such as smart healthcare, smart home, smart finance, self-service store, intelligent hardware, intelligent security, intelligent education, and autonomous vehicles. This technology is complex, as it runs through several chipset types, computing technology, application, and algorithm mechanism. The primary applications run through artificial intelligence are sound and speech, device control, high-volume compute, image/video, and natural language processing, wherein chips help to run these applications.

Various key players are striving to develop AI chipsets with high-speed processors to support applications and bulk data simultaneously. For example, Intel Corp. introduced Nervana Neural Network Processors for interface and training workload domain. These processors are dedicated accelerators that concentrate on artificial intelligence to provide the right intelligence at the right time. This advancement has raised the adoption of AI chipsets in automotive, manufacturing, consumer electronics, healthcare, and other industries.

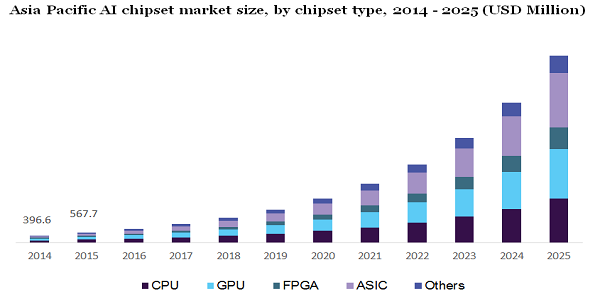

By chipset type, the artificial intelligence chipsets market is segmented into CPU, ASIC, GPU, FPGA, and others. Market players such as Advanced Micro Devices, Inc.; Apple Inc.; Qualcomm Technologies, Inc.; Samsung Electronics Co., Ltd., and Arm Limited have developed their own chipsets on GPUs integrated with core CPUs. Besides this, GPU alone is used to increase the computing performance and speed of the chipsets. However, most companies are using CPU as the auxiliary processor and GPU as the main processor while designing AI chipsets. For example, NVIDIA Corporation develops both GPU and CPU, wherein only GPUs are used for inference and training workload domains, namely Jetson AGX and DGX respectively.

ASIC segment is expected to contribute to grow significantly during the forecast period, as it is used for high-speed performance processors. For example, Google developed Cloud TPU and Edge TPU on ASIC architecture. Amazon is focusing on developing an ASIC-based AI chipset for its Alexa home assistant. FPGA is another major accelerator type as it is adopted by major key players such as Xilinx Inc., Intel Corporation; and Baidu, Inc.

There are various accelerator types like Neural Processing Unit (NPU), Reduced Instruction Set Computer (RISC), Neural Network Processors (NNP), and Intelligent Processing Unit (IPU). These are also used by several tech giants.

In the AI chipsets market, the workload domain is segmented into inference and training. The training segment is projected to dominate the global market and is expected to hold a major market share over the forecast period. In 2018, several market players such as Intel Corporation; Xilinx Inc.; Google Inc.; Advanced Micro Devices, Inc.; and NVIDIA Corporation focused on the development of training chipset.

On the other hand, interference chipsets are operated by over 40 firms, including around 20 startups which are expected to gain traction over the forecast period due to the growing need for edge computing for safety. Currently, mostly training is used for cloud computing while interference is deployed on both at the edge and cloud. The training workload domain is widely used for various Google-enabled applications such as organizational datasets, maps, and surveillance cameras, autonomous vehicles, intelligent machines, drones, and mobile devices.

Based on computing technology, the market is segmented into edge AI computing and cloud AI computing. The Cloud computing segment held the largest market share, in 2018 owing to the rising adoption of AI technology in training workload-based chipsets. In addition, the growing adoption of cloud computing in data centers for reducing operational costs, improving the management of infrastructure, and enhancing productivity is expected to drive the segment growth in the near future. Companies like NVIDIA Corporation; Advanced Micro Devices, Inc., Google Inc.; Intel Corporation offer AI chipsets based on edge computing, and cloud computing, wherein the cloud computing segment is accounting for higher revenue for these companies.

However, rising application of edge computing for several products like smartphones, Cloud AI Computing, chip deployment, and autonomous vehicles, chip deployment is shifting towards edge computing. Most of the AI chipsets are deployed with an edge for interference wherein the edge-based AI chipsets are still in the phase of development. Various companies such as Graphcore, Baidu Inc., and Google Inc. offer both edge and cloud computing technology. These companies offer AI chipsets deployed on edge for inference purposes and cloud for training purposes.

On the basis of vertical, the market is segmented into retail and e-commerce, healthcare, BFSI, automotive, marketing, manufacturing, and others. In 2018, consumer electronics gained a significant market share in the global market. This is due to the increasing adoption of AI chipsets in smart devices. For example, Apple Inc. introduced its A11, A12, and A13 Bionic Chips for high-speed processors which incorporated with GPUs as an accelerator. In addition, Samsung has introduced neural processing units for developing its future AI applications.

The market is expected to witness significant growth in the automotive sector due to the rising deployment of these chips in autonomous cars for interface purposes. For example, NVIDIA Corporation offers Jetson AGX and DGX for autonomous vehicles. Moreover, the rising demand for AI chipsets in robotics, smartphones, and other devices is expected to witness a positive impact on market growth owing to the proliferation of the Internet of Things (IoT) and cloud computing technology. Constant development in existing and new technologies like artificial intelligence and 5G networks along with the growth of automotive and industrial electronics sectors are majorly driving the market growth.

In 2018, North America held the largest market share of over 39.0% in terms of revenue. This high revenue market share is attributed to the presence of a large number of tech giants for AI chipsets in the U.S. In addition, high purchasing power, growing demand for advanced featured smart devices along with high investment for developing infrastructure by the government, and rising number of smart home projects are key factors estimated to drive the regional market growth. For example, as per the National AI R&D Strategic Plan, the federal government has invested in AI R&D. This plan will help to enhance cyberinfrastructure and access to high-quality data.

Many key players operating in this market are present in the U.S. including Intel Corporation, Microsoft Corporation, Micron Technology, IBM Corporation, NVIDIA Corporation, Google Inc., Amazon Web Services, Inc., EPIC, and Xilinx Inc. In addition, there are many emerging players developing new chipsets for artificial intelligence such as a U.S.-based start-up Cerebras has developed a large computer chip for data centers. AI technology in North America is expected to witness significant growth during the forecast period due to the increasing usage of this technology across various industries like retail, healthcare, manufacturing, automotive, and others. Hence, the rapid adoption of AI technology will surge the AI chipset market growth in this region.

The outbreak of COVID-19 has rapidly become a global pandemic. The increasing number of infected cases has posed a serious risk to public health. Therefore, the healthcare industry is adopting technologically advanced devices to diagnose and reduce the spread of virus infections. AI-enabled devices are playing an important role in detecting the early stages of virus infection. For instance, Intel Corporation has developed a solution that helps doctors to diagnose virus infection by CT chest scan accurately to stop infected patients from spreading the infection to others and provide treatment to the ill at the same time. In addition, market players are striving to reach such solutions to health professionals and various countries across the globe. Thus, several initiatives for developing AI-based solutions by market players are expected to witness robust growth of the market for AI chipset in a pandemic situation.

Moreover, Due to the COVID-19 outbreak, the banking sector is facing some issues such as quick response to their customers. Implementation of AI catboats in the customer service vertical, the customers are able to access 24/7 support for their queries. This initiative is projected to drive the demand for AI chipsets in the banking sector. The COVID-19 pandemic has rapidly changed consumer’s shopping habits. People are preferring to buy essentials and other products from online stores. Therefore, many businesses are adopting technologically advanced setups to offer a better customer experience. For instance, Gucci created an artificial store for customers along with cameras and lights. In this artificial store, AI and machine learning technologies play an important role to enhance customer experience, thereby expected to drive the demand for AI chipset during and post-pandemic situations.

The key players in this market are Google Inc.; Graphcore; Apple Inc.; Huawei Technologies Co., Ltd.; Xilinx Inc., Baidu, Inc.; Micro Devices, Inc.; Huawei Technologies Co., Ltd.; Qualcomm Technologies, Inc.; and Intel Corporation. Vendors operating in this market are focusing on gaining a maximum customer base to sustain themselves in the competitive market. Therefore, vendors are partnerships and collaborating with several organizations. For example, in 2018, NVIDIA Corporation announced a partnership with Continental AG to introduce self-driving vehicle systems which are developed on NVIDIA’s Drive platform. This partnership allows to development and design of AI-based self-driving systems of automation levels 2 to 5.

In 2018, NVIDIA Corporation has done a partnership with Arm Limited to launch deep learning inferencing to the number of mobiles, consumer electronics, and Internet of Things devices. This partnership helps other companies integrating AI into their platforms to introduce affordable and intelligent products in the consumer electronics industry.

|

Attribute |

Details |

|

The base year for estimation |

2018 |

|

Actual estimates/Historical data |

2014 - 2017 |

|

Forecast period |

2019 - 2025 |

|

Market representation |

Revenue in USD Million and CAGR from 2019 to 2025 |

|

Regional scope |

North America, Europe, Asia Pacific, South America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, and Brazil |

|

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

|

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization |

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Million Insights has segmented the global artificial intelligence chipset market report based on chipset type, workload domain, computing technology, vertical, and region:

• Chipset Type Outlook (Revenue, USD Billion, 2014 - 2025)

• CPU

• GPU

• FPGA

• ASIC

• Others

• Workload Domain Outlook (Revenue, USD Billion, 2014 - 2025)

• Training

• Inference

• Computing Technology Outlook (Revenue, USD Billion, 2014 - 2025)

• Cloud AI Computing

• Edge AI Computing

• Vertical Outlook (Revenue, USD Billion, 2014 - 2025)

• Consumer Electronics

• Marketing

• Healthcare

• Manufacturing

• Automotive

• Retail & E-Commerce

• BFSI

• Others

• Regional Outlook (Revenue, USD Billion, 2014 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• U.K.

• Germany

• France

• The Asia Pacific

• China

• Japan

• India

• South America

• Brazil

• Middle East & Africa

Research Support Specialist, USA